In This Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of September 21– September 25

A Look Into the Markets

“This is what it sounds like when doves cry.”

— When Doves Cry, Prince

On Wednesday, the Federal Reserve issued its Monetary Policy Statement and held a press conference.

An unofficial mandate for the Fed is to maintain “market calm” and not say anything to roil either Stocks or Bonds. Overall, the Fed statement and press conference were extremely “dovish” — meaning they still want loose monetary policy to help stimulate the economy.

And of course, there was no change to rates. In fact, the Fed has forecasted no hikes to the overnight Fed Funds Rate until 2024 or later.

Normally, both Stocks and Bonds would like such a backdrop. However, since Fed day, both Stocks and rates have dropped. What happened?

Bonds Love Uncertainty — Stocks Hate it

Fed Chair Powell said, “More fiscal support is likely needed”, which means the Fed can’t support the “highly uncertain” economy by itself.

Translation: “Congress needs to come together quickly and agree on a fourth stimulus package to help the many people still in need.”

The markets took this as a real problem in the short-term, as Congress has been unwilling to agree on a new package up until now.

Stocks have enjoyed incredible gains since the early summer and are using this “uncertain” opportunity to sell off, with Bonds and rates being the beneficiary.

Bottom line: Rates are at all-time lows, this new uncertainty of a fourth stimulus package could be short-lived, and this modest improvement caused by the uncertainty could quickly evaporate. If you or someone you know would like to talk about the incredible opportunity for housing, please contact me.

Looking Ahead

Next week is light on economic data but a fresh round of Treasury supply to help fund the government could weigh on rates. The headline risk associated with a fresh stimulus package can’t be overstated. The markets can change directions quickly based on the headlines.

Mortgage Market Guide Candlestick Chart

Below is a 10-year view of Mortgage Bond prices. As prices go up, home loan rates decline. You can see current prices on the right side of the chart are trading right at all-time highs — meaning all-time low mortgage rates. Should Mortgage Bonds break above the red horizontal resistance line, home loan rates will move another leg lower. The opposite is also true.

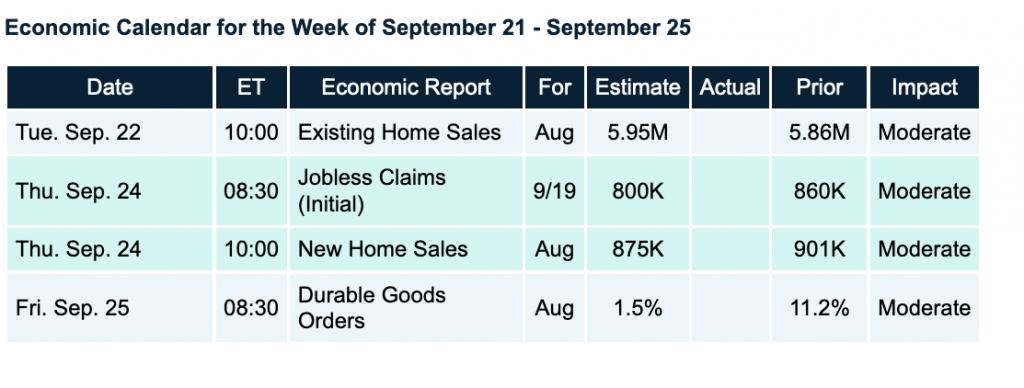

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.