In This Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of September 14– September 18

A Look Into the Markets

The Good

This week, home loan rates hit all-time low levels despite progress and optimism on a vaccine, the economy, and the job market.

A continued tailwind for relatively low rates comes from the Eurozone, where their central bank, the ECB, left rates unchanged and refrained from adding more stimulus, despite very low inflation. This means rates in Europe, which are negative in most places, will remain lower for longer and that will help keep our rates relatively low as well.

The Bad

‘Too much of a good thing.’ The Treasury, in an effort to fund the government and pay for the enormous stimulus measures, had to sell $108 billion in Treasuries this past week. The buying demand for these new Bonds and notes was tepid. This applied upward rate pressure on the entire U.S. Bond market and limited the gains.

What will make the buying demand in auctions increase? Higher yields/rates or worse economic conditions, so that today’s low rates make for a relatively sound investment.

The Ugly

Volatility is back in Stocks. The NASDAQ lost over 10% in a 3-day span this week. Fortunately, Stocks were able to cover some of the losses before heading into the weekend.

The takeaway: Typically, when Stocks drop sharply, so do rates. That did not happen this week.

Bottom line: The backdrop for housing could not be better. If you or someone you know would like to talk about the incredible opportunity for housing, please contact me.

Looking Ahead

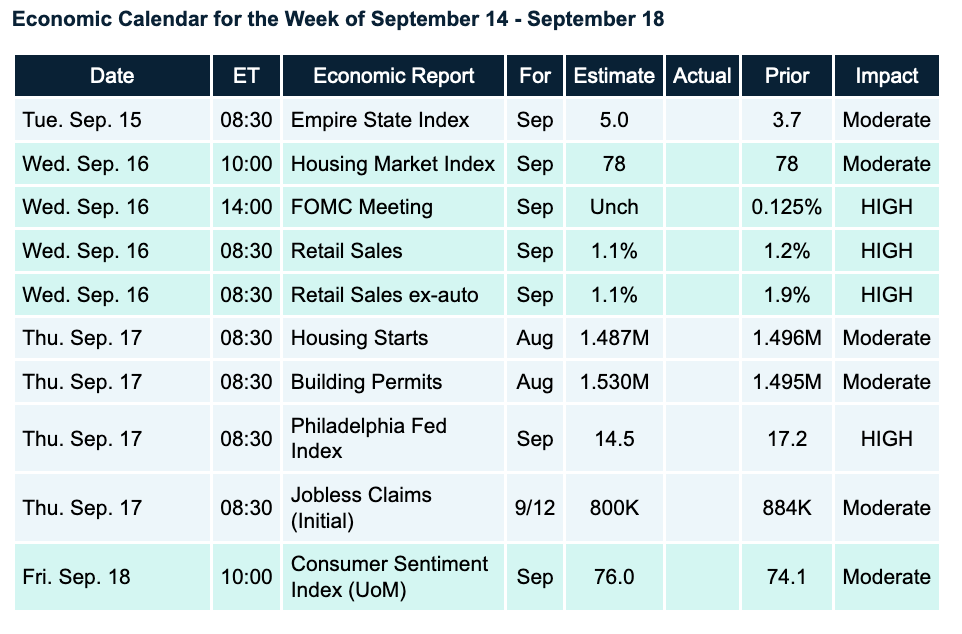

Next week is Fed Week. On Wednesday the 16th, the two-day Fed meeting wraps up with the all-important Monetary Policy Decision and Fed Statement. There is zero chance of a rate change. What will be important to hear is their take on the economy and inflation. The Fed’s new softer position on inflation could have an effect on long-term rates, like mortgages, somewhere in the not too distant future.

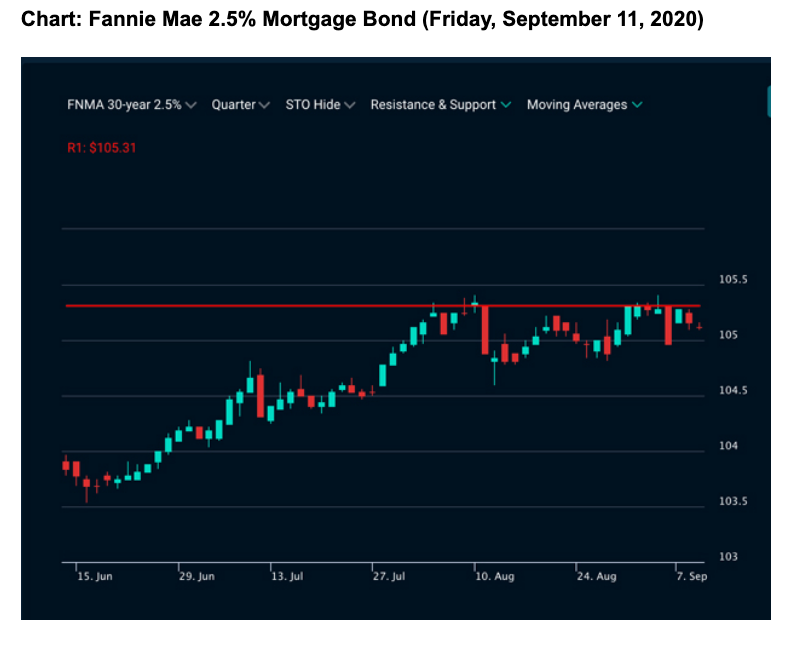

Mortgage Market Guide Candlestick Chart

Mortgage Bond prices are trading right near all-time highs, with rates at all-time lows. Should prices break above the red horizontal resistance line, home loan rates will move another leg lower. The opposite is also true.

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.