In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of September 13 – September 17

A Look Into the Markets

Home loan rates have bounced around the past couple of weeks in response to good, bad, and even some ugly news. Let’s break down this week’s big news and what it means to the housing market and economy. And let’s look at the pending breakout in mortgage rates in the chart section below.

The European Central Bank (ECB) Buying Fewer Bonds

Last Thursday, the ECB announced it is going to “modestly” reduce the pace of their pandemic emergency purchase program (PEPP) bond purchases.

The PEPP, which started in March 2020, will end next March with bond purchases totaling 1.87B euros.

“The Lady isn’t tapering” – ECB President Christine Lagarde 9/9/21

It is worth noting, the existing Asset Purchase Program (APP) that purchases 20B euros in bonds per month will continue and, this taper announcement does not signal an interest rate liftoff.

In response to the well-telegraphed ECB action, bond yields in Europe were mostly unchanged which helped U.S. interest rates remain near unchanged.

This big question: Will the Federal Reserve taper bond purchases here at home?

It is not uncommon for central banks to work in unison with monetary policy, meaning now that the ECB has dipped its toe in the water to slow bond purchases, maybe the Fed can do the same.

There have been many calls to taper the mortgage-backed security (MBS) side of the purchases due to the “froth” in the housing market.

However, we are seeing incredible slack in the labor market while consumer confidence and sentiment have declined as COVID remains a threat to economic progress.

The next Fed Meeting Monetary Policy Statement will be released on Wednesday, Sept 22nd at 2:00 p.m. ET. We will find out soon enough if the Fed is confident enough to scale back bond purchases and not trigger a taper tantrum reaction in the bond market as we saw back in 2013.

Bottom line: We do not know if the Fed will also announce a “modest” tapering in bond purchases or how the bond market will react. At some point, the Fed will have to scale back purchases and when it does, we should expect an increase in rates.

So, if you or someone you know or care about is looking for a mortgage, now is the time to make a move.

Looking Ahead

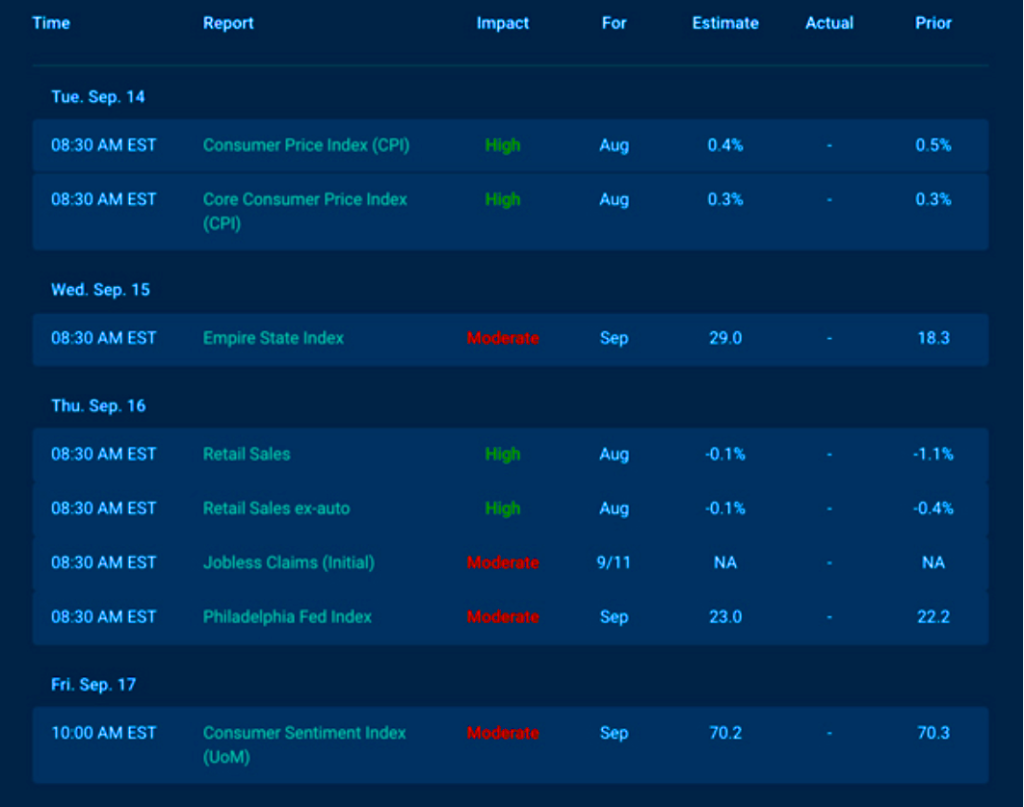

Next week brings several reports that will have the Feds attention and may likely add to the case on whether to taper or not. These include the Consumer Price Index (inflation), Retail Sales, and Consumer Sentiment. The Fed Members are also approaching the “quiet period” we see in advance of each meeting. Meaning, there are no prepared speeches that could move the markets.

Mortgage Market Guide Candlestick Chart

Mortgage-backed securities (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

A technical breakout is coming. The 100-day Moving Average (the Orange Line) has kept MBS prices from falling and home loan rates moving higher. The 200-day Moving Average (the Purple Line) has kept a lid on price advances and prevented rates from further improvement. MBSs are going to break out of this range soon and when it does, we could likely see an extended move in either direction.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, September 10, 2021)

Economic Calendar for the Week of September 13 – 17

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.