In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

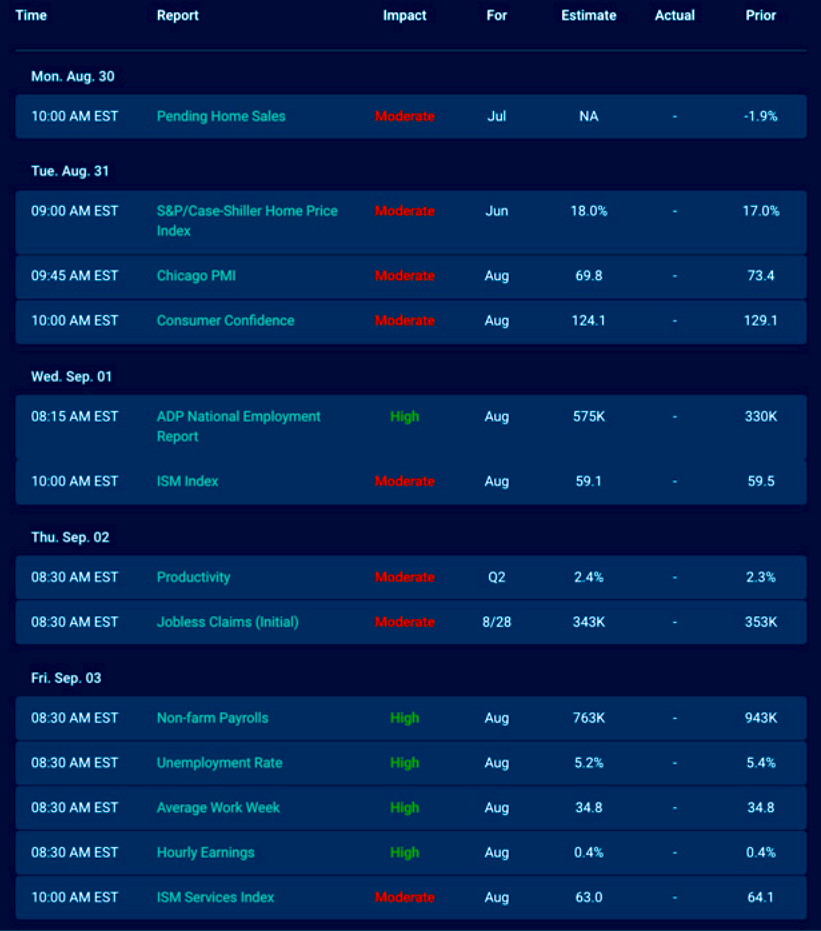

Economic Calendar for the Week of August 30 – September 3

A Look Into the Markets

Among the many stories happening this past week, the elephant in the room remains Afghanistan. There is so much uncertainty and it isn’t clear when, how and if it ends. In challenging times like these, bond prices and rates typically improve, but they didn’t. Rates crept higher week over week. Let’s break it all down and discuss what to look for next week.

Cranking up the Printing Press

Congress is preparing to vote on nearly $5T on spending next year. That is a serious amount of money, and it comes with a cost. First, the Treasury must sell bonds in weekly auctions in order to create the money to spend.

This means we need buyers, and a lot of them to purchase all this paper. These buyers must also be confident that the bonds don’t decline in value causing a capital loss sometime in the future.

What would cause bond prices to decline and rates to move higher? Here are a few things that could cause higher rates:

1. Persistently high inflation: At the moment, we are seeing very high year-over-year inflation, but the Fed says it will be mostly “transitory” or temporary in nature. If the Fed is incorrect and inflation remains persistently high, rates must creep higher. The Consumer Price Index, CPI, is currently 5.3% annually, more than three times higher than our 10-year yield, currently sitting at 1.35%. Inflation being higher than Treasury rates is an unsustainable trend but, there is a big reason why it exists today.

2. The Fed stops buying bonds: The Fed is currently purchasing at least $120B in Treasuries and Mortgage-backed securities every month. There are calls to taper and stop purchasing bonds. If and when the Fed exits, rates could move sharply higher, much like they did back in 2013 – hence the term “taper tantrum”.

3. U.S. Dollar decline: Should the enormous spending plan be passed; it could have a negative effect on the US Dollar. When the Dollar declines, it makes US dollar denominated commodities like Oil more expensive, thereby lifting prices and causing inflation.

Bottom line: There is a lot of uncertainty in Afghanistan, Washington DC and the Fed. We don’t know if these spending bills will even pass or if conditions warrant the Fed to taper anytime soon. However, if and when the Fed signals they are exiting their bond buying program, rates are likely headed higher and possibly in a hurry.

So, if you or someone you know or care about is looking for a mortgage, now is time. Rates have already backed up a touch and could revisit higher rates seen earlier this year.

Looking Ahead

It’s Jobs Week. One half of the Fed’s mandate is to promote maximum employment. At present, the labor market is underperforming and with COVID cases having risen across the US in August – will the ADP Report and Jobs Report be affected? The Fed and financial markets will be watching.

Mortgage Market Guide Candlestick Chart

Mortgage-backed securities (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBS prices have been in a clear “tug of war” with prices moving higher and lower the past week in response to the Afghanistan uncertainty and idea the Fed may pull the plug on bond purchases.

The 100-day Moving Average (the Orange Line) has kept MBS prices from falling and home loan rates moving higher. If that line holds, rates will remain at or better than current levels. If it doesn’t, we could see another spike higher in a hurry.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, August 27, 2021)

Economic Calendar for the Week of August 30 – September 3

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.