In This Issue…

A Look Into the Markets

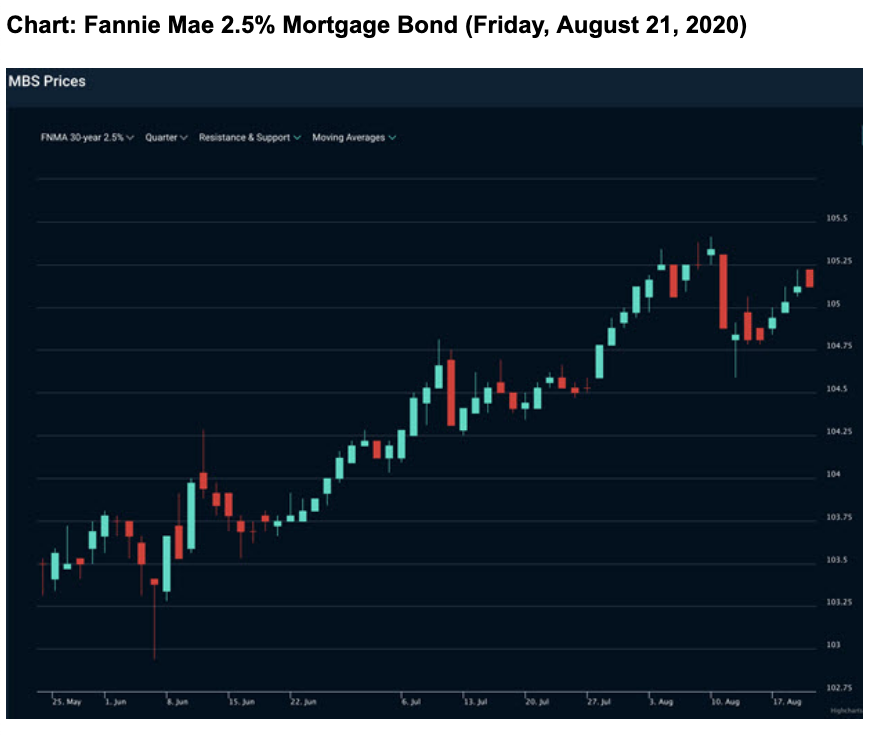

Mortgage Market Guide Candlestick Chart

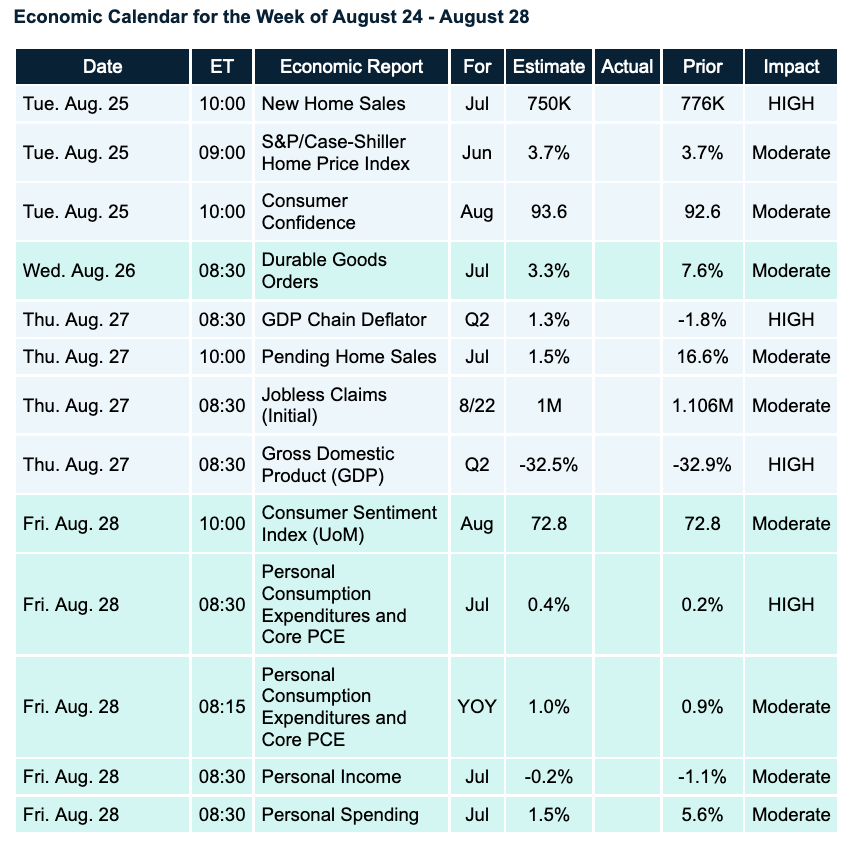

Economic Calendar for the Week of August 24– August 28

A Look Into the Markets

No Progress From Congress

This week we watched rates modestly improve as uncertainty climbed. The main culprit is the ongoing “debate” in Congress on what a fourth stimulus bill will look like. History has shown that Congress will likely get something done, things will just remain uncertain until they do.

Takeaway: Upon passage of a fresh stimulus plan, the removal of uncertainty could apply some pressure on rates.

Home Builders Are Feeling Good

The National Association of Home Builders reported Builder Confidence in single-family homes rose to 78. Anything above 50 is positive. This is the highest reading in the 35-year history of the index.

Buyer-traffic, people visiting new home developments, also hit the highest levels on record.

The tailwinds in housing — low interest rates, value of owning versus renting, continued economic improvement, household formation, migration from big cities, and work from home — should continue to propel the sector for some time.

New Home Prices Will Cost More This Fall

A perfect storm is likely to cause new home prices to climb this fall, and possibly beyond. The incredible housing demand just discussed has caused a surge in the need of lumber. At the same time, lumber mills were shut down in April and May, causing a shortage.

The law of supply and demand reminds us big demand and a shortage means higher prices.

What else causes higher prices? Inflation. On June 10, 2020, the Federal Reserve reaffirmed the financial markets that they will keep the Fed Funds Rate at the current level for a long time. This has caused virtually every asset to move higher: Stocks, precious metals like gold and silver, and finally — lumber.

Since that Fed meeting, lumber prices have more than doubled. This means for a 2,000 square foot new home, the cost of lumber went from $10,000 to over $20,000. With demand for new homes soaring, we should expect homebuyers to pay more this fall.

Looking Ahead

Next week, the economic calendar delivers a few potentially market-moving releases like New Home Sales, Q2 GDP, Consumer Confidence, Durable Goods, and the inflation reading Core PCE.

Also helping to shape market direction will be another round of Treasury auctions to pay for all of the economic stimulus. The recent uptick in 10-year Note yield came on the heels of weak buying demand in 20- and 30-year Bond auctions.

However, the big story to follow is what the next round of stimulus will look like and how the markets will react.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Mortgage Market Guide Candlestick Chart

Bond prices improved week-over-week yet remain just beneath resistance at 2020 price highs. Home loan rates can only improve further if Bond prices can climb further and above this resistance.

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.