In This Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

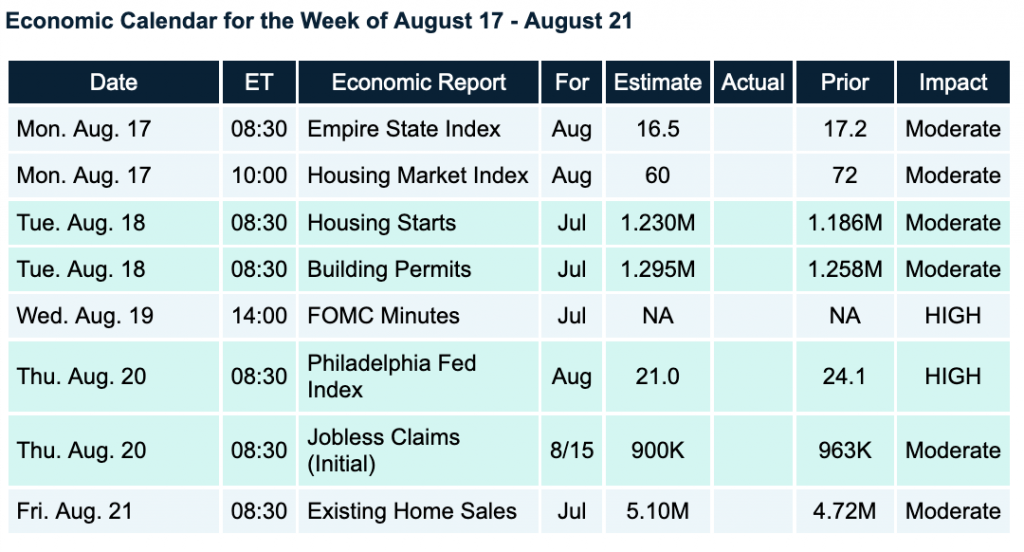

Economic Calendar for the Week of August 17 – August 21

A Look Into the Markets

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.”

— Sam Ewing

This past week, home loan rates ticked up from the best levels ever, and the 10-year Note yield moved sharply higher week-over-week from .50% to nearly .70%.

Why? One major reason: inflation may be on the rise.

Mortgage-backed securities are the drivers of home loan rates, and inflation largely determines whether their prices/rates go up and down.

This past Wednesday, the Core Consumer Price Index (CPI), a reading on consumer prices, rose 0.6% in July — the fastest monthly rate in nearly 30 years!

One number doesn’t make a trend, but if we see higher inflation readings in the months ahead then long-term interest rates, like mortgage rates, will also be higher than today.

Ultra-low interest rates, quantitative easing (where the Fed purchases Bonds daily), and a trillion dollars in stimulus can all serve to stoke higher inflation in the future.

The opportunity:

If, for all the reasons above, we see higher inflation in the future, one would want to be a homeowner rather than a renter. Why?

Inflation drives real asset prices, like homes, higher. It also drives wages and rent higher. This means new homeowners can lock in today’s low rates, and as prices and wages increase, they can pay down the mortgage with ever-increasing pay. At the same time, their home price will increase even further in price.

For renters, wages will rise with inflation, but so will rent, meaning the increase in wages may be required to keep up with the increase in rent.

What happens if inflation doesn’t rise?

If inflation doesn’t rise much, home prices will still rise over time as they have for centuries. Just this week, home prices hit an all-time median high of $311,000. Homeowners, on average, accumulate more wealth over time than renters.

Looking ahead:

Next week we will see more economic reports centered on housing, which has been a bright spot in the economy. Initial Jobless Claims, which determines the length of the unemployment line, will be reported next Thursday. This past week, we saw continued improvement in the labor market with Initial Claims falling beneath 1 million the first time in 20 weeks.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Mortgage Market Guide Candlestick Chart

The candles to the far right of the chart show the decline in prices and the move higher in rates in response to the hotter than expected consumer inflation reading.

Economic Calendar

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.