In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of July 12 – July 16

A Look Into the Markets

“And if you listen very hard / The tune will come to you at last” – “Stairway to Heaven” by Led Zeppelin

This past week long-term interest rates fell to their lowest levels since mid-February. Let us go through some reasons why rates declined and what it means for the second half of 2021.

From More to Less

The great reopening of the U.S. economy appears to be fizzling. There are still 9.3M open jobs available, which means the labor market is improving, but slowly. The effect of fewer employed means there will be softening economic growth and lower inflation. Bonds love low inflation, and seeing the 10-year note yield hit 1.25% this past week suggests that higher inflation will indeed be transitory.

Another thing we are getting less of is policy response, both from Congress and the Fed. On the former, the original proposal from the White House was another $4 trillion in economic stimulus through the American Infrastructure Plan and American Families Plan. Those proposals are being batted around Congress and will likely end up being a fraction of the original proposal.

On the latter, the Federal Reserve, who has been so accommodative during COVID, will be less so going forward. At the recent Fed meeting, they changed their forecast from initially hiking rates in 2024 to hiking as many as three times in 2023.

And on the bond-buying program, where the Fed has been purchasing at least $40 billion worth of mortgage bonds each month, they will be doing less in the future, and the pressure is on to start tapering. At the last Fed meeting, some Fed members cited a scorching hot housing market as a reason to stop buying mortgage-backed securities.

Return of Familiar Tailwinds

US bond yields are relatively attractive compared to other large bond markets around the globe like Germany and Japan where their 10-year yields are -0.31% and 0.02%, respectively. This helps the U.S. attract investments from around the globe, thereby pushing yields lower.

Bottom line: Markets tend to overshoot to both the upside and downside, meaning this revisit to rates in February could be fleeting. For anyone considering a mortgage, now is the time.

Looking Ahead

Next week brings plenty of news for the markets to ponder. On the economic front, consumer inflation will be front and center with the Consumer Price Index. This could be the second month in a row that consumer inflation will be higher than mortgage rates on a year-over-year basis. The last time it happened was 50 years ago. It is also the start of earnings season. We shall see if the decline in yield due to less economic growth will be justified. What corporations provide as future guidance may very well determine the next directional move in rates: either a continued decline or quick snap back higher.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

MBSs hit right at their 200-day moving average (purple line), which stopped prices from moving higher still. If prices remain beneath this purple line, home loan rates will remain at or lower than current levels. Should prices be able to break above the purple line, rates could move another leg lower from here.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, July 9, 2021)

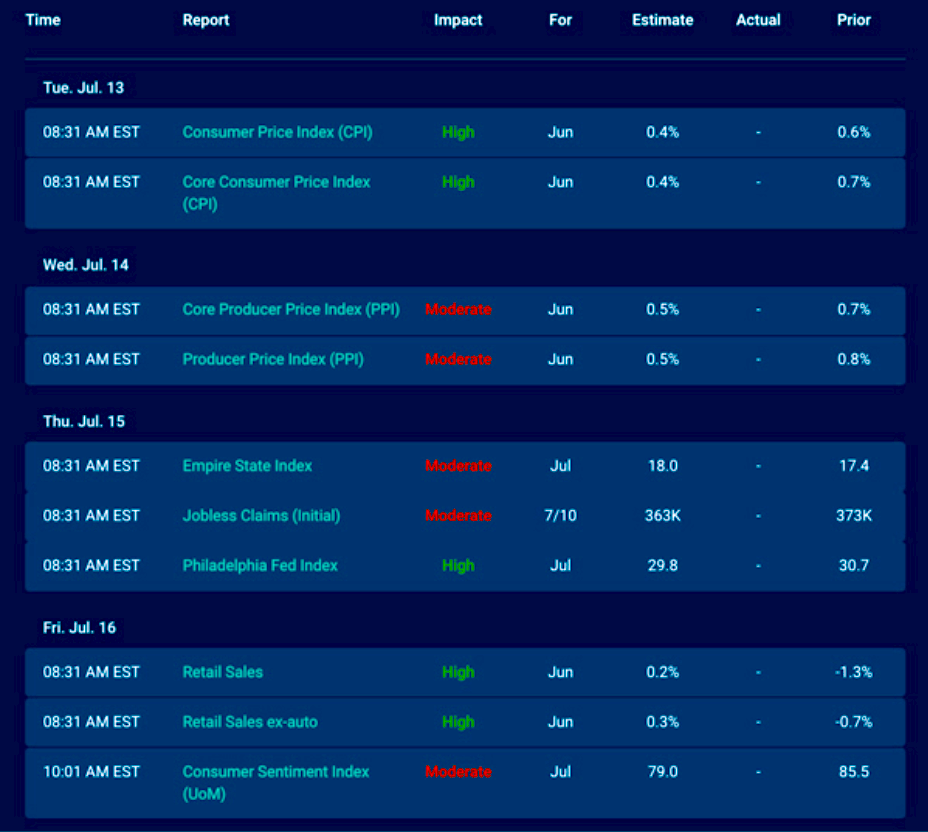

Economic Calendar for the Week of July 12 – July 16

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.