In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of July 19 – July 23

A Look Into the Markets

“You didn’t have to love me like you did / But you did, but you did / And I thank you” – “I Thank You” by ZZ Top

This past week long-term interest rates spiked higher in response to a hotter-than-expected consumer inflation print only to come back down in response to soothing words from Federal Reserve Chairman Jerome Powell. Let us break down what happened and what to look for in the weeks ahead.

Consumer Prices Are Rising

The Consumer Price Index (CPI) for June showed inflation rising by 5.4% year-over-year, much hotter than expectations and the highest reading since 2008. Inflation is the arch-enemy to bonds and interest rates, so it was no surprise to see long-term Treasury and home loan rates spike higher.

This high reading came one day before Fed Chair Powell was set to speak in front of Congress in his semi-annual testimony on economic conditions and monetary policy.

Heading into the testimony, there was already growing pressure for the Fed to start tapering bond purchases, more specifically MBS purchases, because of inflation fears and froth in the housing market.

Before Mr. Powell took a seat in front of Congress, his prepared speech was released, and he made it very clear the Fed is not going to taper bond purchases just yet despite the higher inflation fears.

“There Is Still a Long Way to Go”

The Fed has a dual mandate of maintaining price stability (inflation) and to promote maximum employment. They are leaning on the employment side of the mandate when they are saying, “There is still a long way to go.” With over 9M job openings, the most ever in U.S. history, the Fed is correct. It will take some time to fill millions of jobs.

Mr. Powell also said the Fed is going to talk about tapering in the next couple of meetings. They meet again on July 27th and 28th with the next one in late September. This means the Fed is likely to hold the current course throughout the summer.

Bottom line: Interest rates are at the best levels seen since mid-February, making it a great opportunity to secure a home loan. For anyone considering a mortgage, now is the time.

Looking Ahead

Next week brings more corporate earnings. What these companies say about the economic future and their ability to pass along price increases to consumers is key. If companies share an uncertain or weaker outlook, bonds could benefit further. The opposite is also true.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

MBSs hit right at their 200-day moving average (purple line), which stopped prices from moving higher still. If prices remain beneath this purple line, home loan rates will remain at or lower than current levels. Should prices be able to break above the purple line, rates could move another leg lower from here.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, July 16, 2021)

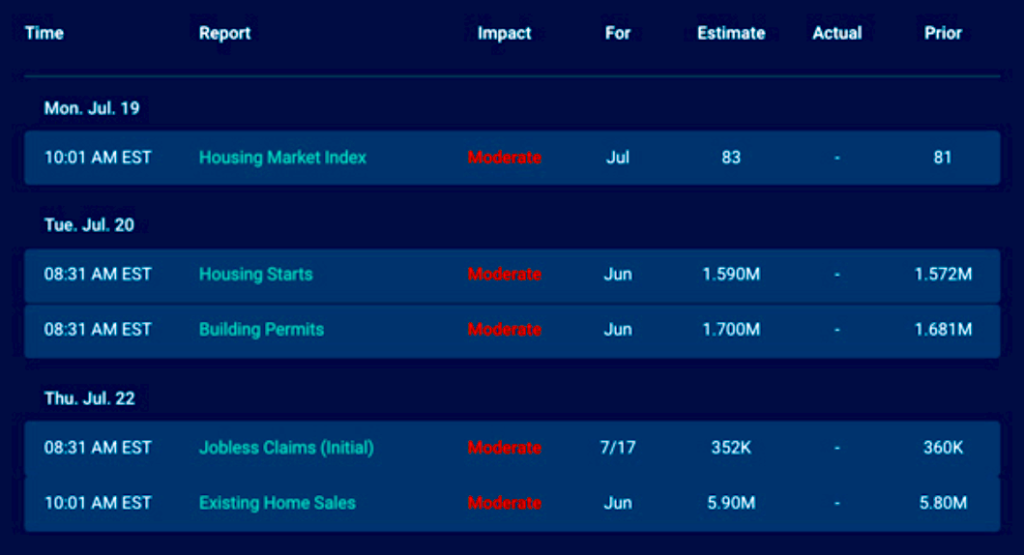

Economic Calendar for the Week of July 19 – 23

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.