In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of July 11, 2022

A Look Into the Markets

This past week was filled with “R” words, including the growing fears of a global recession as economic data around the globe points to a slowdown. Let’s discuss what happened and the big events to watch out for next week.

Recession

The dreaded “R” word has gained steam after the Atlanta Fed GDP Now forecasted a -2.1% for the 2nd Quarter GDP. A recession is defined as back-to-back quarters of negative growth, so if the official GDP readings show the 2nd quarter contracted, then we are in a recession today.

A few things happen during a recession:

- Long-term rates do not go higher

- The Fed can’t raise rates “expeditiously”

- Energy and commodity prices decline

- Home price gains stall

We are already seeing three of the four above take place. The worry is #2 as the Fed remains hawkish and is committed to a .75% rate hike at month’s end.

Restrictive

“Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.” FOMC Minute June Meeting.

The above quote from the Fed Minutes unnerved the bond market on Wednesday as it showed the Fed will continue to hike rates “expeditiously” if inflation doesn’t moderate.

It’s important to remember the Fed only controls the overnight Fed Funds Rate and the Treasury market essentially controls the Fed. So, the Fed may go ahead and raise rates further if inflation doesn’t moderate but long-term rates, like the 10-yr Note, will stop going up when it senses a recession or slower economic conditions on the horizon.

Retreat

The bond market is already talking to the Fed and saying you can’t raise rates much further. The 10-yr Note has retreated down to 2.95%, from 3.49% at the June Fed Meeting. The 2-yr Note has moved up to 3.00% so this 2/10yr Note yield inversion is yet another warning signal of slower economic conditions.

What has also retreated this week was oil prices, which have plunged from a recent closing high of $122, down to $97. Recession fears elevate lower demand fears, and this has pushed oil and other commodity prices sharply lower.

If oil prices remain at current levels or go lower, it would go a long way to lowering inflation, helping long-term rates remain low and giving consumer sentiment a boost.

Bottom line: Long-term rates have stabilized but we should not expect much more improvement until inflation moderates further. With that said, if you are interested in purchasing a home, it remains a great time with rates beneath the rate of inflation.

Looking Ahead

Next week brings the CPI Report for June. Last month’s surprisingly hot CPI caused a fast spike in interest rates. If this report shows prices cooling or at least stabilizing, the Fed may signal less rate hikes in the future at the July FOMC Meeting. But, if this reading is hot, we should expect more tough talk and more fears of a deeper recession on the notion the Fed will hike rates aggressively into a rapidly slowing economy.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 4.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

You can see on the right side of the chart, prices fell to new 2022 price lows…meaning 2022 rate highs but bounced sharply higher after the big Fed rate hike in mid-June. Time will tell whether that price bottom will be the rate peak for 2022.

Chart: Fannie Mae 30-Year 4.5% Coupon (Friday, July 8, 2022)

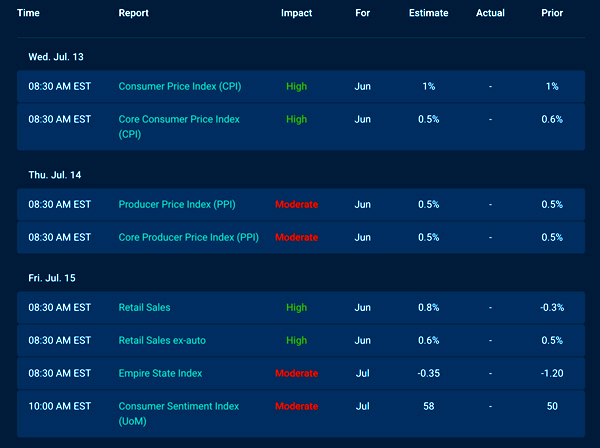

Economic Calendar for the Week of July 11 – 15

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.