In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

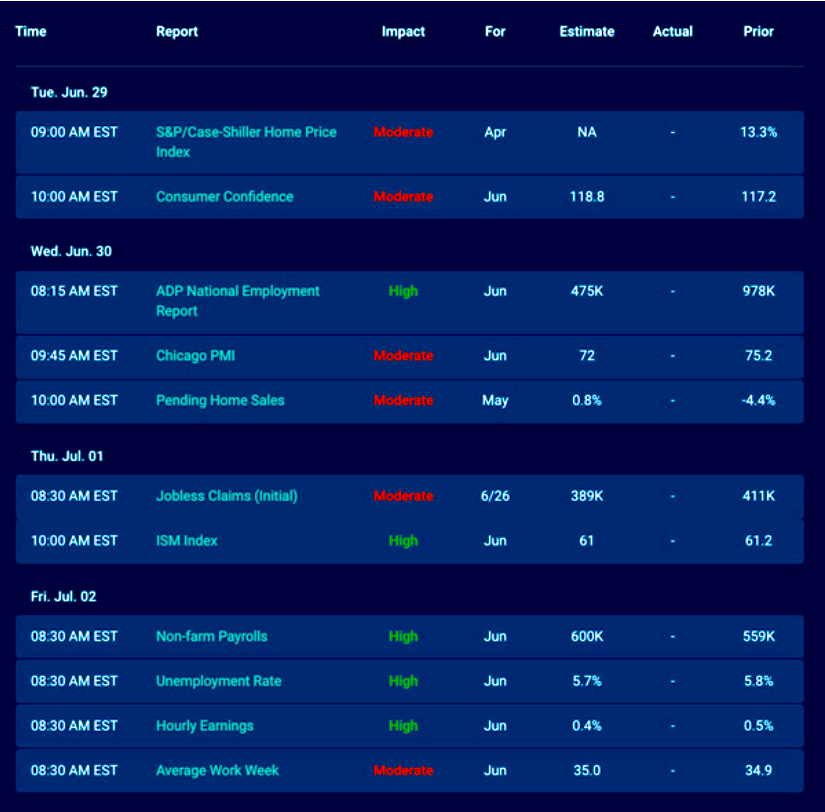

Economic Calendar for the Week of June 28 – July 2

A Look Into the Markets

“Was a time when I wasn’t sure but you / Set my mind at ease” –“Patience” by Guns N’ Roses

This past week home loan rates improved slightly as Fed Chair Jerome Powell was on Capitol Hill sharing the Fed’s midyear economic outlook. Let us break down what the Fed Chair said, since his words also pushed stocks higher with the NASDAQ reaching all-time highs.

“Long Way to Go on U.S. Economic Recovery”

The Fed could not be clearer than with this line. IF the economy has a long way to go to recovery, THEN the Fed will not be hiking rates anytime soon and will also not likely taper bond purchases in the near future.

Recent economic readings have shown some signs of weakness and a recent report showed over 9 million job openings. The Fed has a dual mandate of maintaining price stability (inflation) and promoting maximum employment. On the latter mandate, the economy is coming up short, and this gives the Fed cover to not raise rates.

“I Have a Level of Confidence in the Prediction of Transitory Inflation.”

The financial markets appear to agree with the Fed. The 10-year note yield at 1.48% is certainly not worried about inflation right now. We will not find out if higher inflation is transitory until later in the year, or even next year, and Powell reiterated this by saying,”It may take some patience to see what is really happening,” or as Axl Rose sang, “All we need is just a little patience.”

On the inflation front, we all must hope the Fed is correct about high inflation being temporary. Persistent and high inflation is devastating to an economy. Outside of supply chain bottlenecks, which have caused high prices in items and appear to be somewhat temporary, there are components of inflation that appear to be “sticky” and less temporary, like wages and housing. We shall find out if the Fed will get it right. Powell did say it’s, “Very, very unlikely the U.S. will suffer 1970’s type inflation.” For the moment, bond markets and rates seem to agree.

“Optimism About the Path of the Economy and Strong Job Creation”

Recent job creation numbers have been reported beneath expectations, which again gives the Fed reason to hold rates near zero while continuing to purchase bonds.

Bottom line: This is an amazing moment to take advantage of an interest rate environment that is being manipulated by the Fed bond-buying program. This program is now in jeopardy, should economic data come in stronger or hotter than expected. If you are considering a refinance or purchase, home loan rates may not improve much or at all from here; now is a great time to lock.

Looking Ahead

Next week brings important employment figures with ADP on Wednesday and the Jobs Report on Friday. The Fed has a desire to allow the labor market to run hot before hiking rates. With 9 million people still unemployed and 40% of them unemployed for more than 27 weeks, the Fed is right: the economic recovery has a long way to go.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

MBSs are trading beneath their 50-day moving average (yellow line). If prices remain beneath this yellow line, home loan rates will remain at, or lower than, current levels. Should prices be able to break above the yellow line, rates could move another leg lower from here.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, June 25, 2021)

Economic Calendar for the Week of June 28 – July 2

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.