In This Issue…

Last Week in Review: A Look Into the Markets

A Look Ahead: Mortgage Market Guide Candlestick Chart

View: Economic Calendar for the Week of June 22 – June 26

Last Week in Review:

A Look Into the Markets

This past week, Freddie Mac reported mortgage rates hit the lowest in U.S. history — 3.13%.

The improvement in rates is a direct result of jobs returning, lowering the risk of mortgage default, coupled with increased competition forcing the industry to “sharpen” pricing.

What happens next for rates?

We are watching fear versus hope play out again and the coronavirus is taking the headlines.

A spike in cases and hospitalizations in several “re-opened” states is causing fear, anxiety, and uncertainty, which Stocks hate and Bonds and interest rates love.

On the other side of the coin, there are many positive, optimistic, and hopeful reasons why Stocks remain elevated and are limiting the improvement in rates. These include:

- States and businesses re-opening.

- Fed stimulus continuing to support Stocks and Bonds.

- Low rates helping homeowners and fueling consumer spending.

- Pent-up demand. The savings rate hit 33%, with many Americans staying home and just starting to get outside.

- Homeownership demand and housing is doing extremely well and will add to the economy.

- Additional Treasury and administration stimulus will be passed to underwrite the economic recovery.

Bottom line: With home loan rates at historic lows, housing demand increasing, and many positive forces at play, today makes an incredible time to lock at the best rates ever. If the positive forces mentioned win the day and a second surge in cases doesn’t reemerge, rates may not improve much further, if at all. Finally, remember that the 10-year Note yield has not moved beneath .60% for any sustained time during the darkest days of COVID-19. This means that in order for rates to improve much further, things may have to get even more uncertain than those times.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

A Look Ahead:

Mortgage Market Guide Candlestick Chart

After the big gains seen for Mortgage Bonds over the past two years, prices have stabilized and trade at all-time highs.

The stabilization of the U.S. financial markets was due to the restart of quantitative easing by the Federal Reserve in mid-March to settle the pandemic-induced shutdown of the U.S. economy and the subsequent extreme volatility.

View:

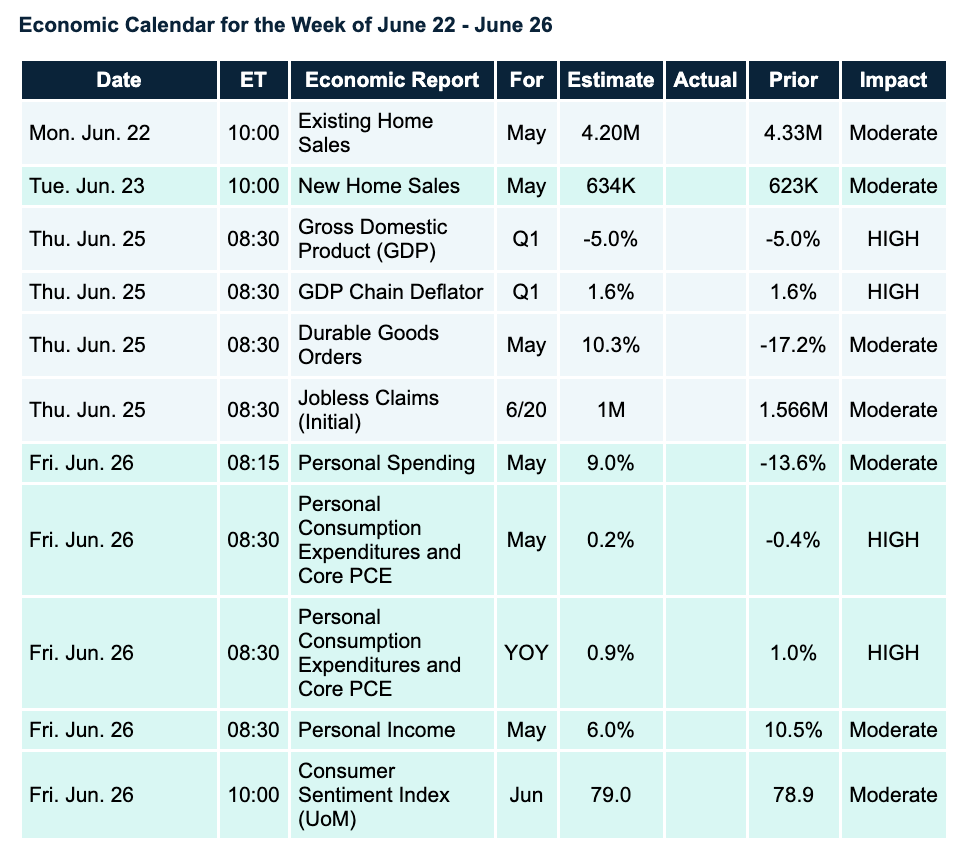

Economic Calendar for the Week of June 22 – June 26

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.