In this Issue…

A Look Into the Markets

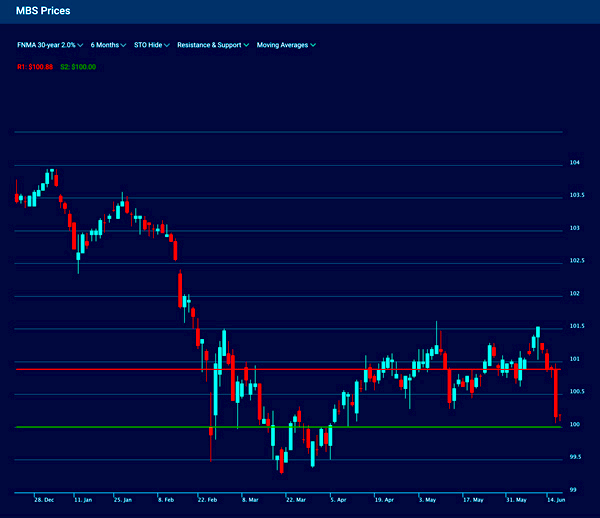

Mortgage Market Guide Candlestick Chart

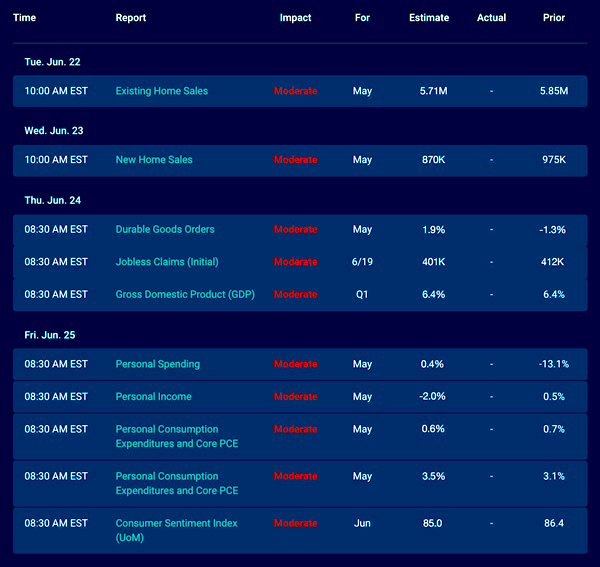

Economic Calendar for the Week of June 21 – 24

A Look Into the Markets

“Check ignition and may God’s love be with you (two, one, lift off)” – “Space Oddity” by David Bowie

This past week the Federal Reserve had their June meeting and prepared the markets for liftoff, meaning when they would hike rates in the future. The initial bond market reaction was negative with both home loan rates and long-term Treasury rates moving higher. Let us break it all down and discuss what to look for in the weeks and months ahead.

The “Talking About, Talking About” Meeting

At the previous Fed meeting in April, the Fed had been forecasting the next rate hike to the Fed Funds Rate would be in 2024. On Wednesday, June 16, the Fed pulled forward those projections and are now seeing the likelihood of the next rate hike in March 2023 followed by as many as two more hikes in 2023.

What Happened?

The Fed acknowledged that inflation may run hotter and be more persistent than originally expected. This is the reason why the Fed may have to hike rates sooner than previously forecasted. While a Fed rate hike has no direct effect on home loan rates, this announcement does influence mortgage rates going forward, but how?

The Fed will have to start tapering bond purchases well in advance of a Fed Funds Rate hike. This means they will slow their bond purchasing program sooner than previously envisioned, which will likely lead to higher mortgage rates sooner than expected. Fed Chair Jerome Powell said the Fed members at the meeting did talk about the notion of tapering. This means the “we are not even thinking about, thinking about” tapering line has been discarded. The Fed is no longer thinking, but discussing, rate hikes and less bond buying.

In trying to calm the markets, more specifically stocks, the Fed did clearly state that any rate hike or change to the bond-buying program will be based on the incoming data in the months ahead. So, while the Fed is preparing the markets for quicker and more rate hikes, it may not happen as soon as March 2023, which, by the way, is still a long time from now.

Moreover, for this to happen, the incoming economic data over the next several months must support the Fed move. This means we must pay close attention to the labor market, economic growth, and inflation readings. If they run hot later this year, we should expect the Fed to come out and say they are about to begin tapering their bond purchases.

Wednesday’s Fed announcement caused a knee-jerk reaction of lower bond prices, but Thursday we watched prices stabilize, and the 10-year note yield is still hovering at 1.46%, a multi-month low.

Bottom line: This is an amazing moment to take advantage of an interest rate environment that is being manipulated by the Fed bond-buying program. This bond-buying program is now in jeopardy should economic data come in stronger or hotter than expected. If you are considering a refinance or purchase, home loan rates may not improve much or at all from here. Now is a great time to lock.

Looking Ahead

As shared above, the incoming economic data will determine when the Fed decides to taper bond purchases and ultimately hike rates. Inflation is one of the more important readings to watch, and next Friday the Fed’s favored gauge of consumer inflation, the Core Personal Consumption Index, will be released. If it is a hot reading, rates could move higher. The opposite is also true.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBSs are now near support at the green horizontal line. If prices remain above that line, home loan rates will remain at or better than current levels. Should prices fall beneath that green line, rates will move another leg higher from here.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, June 18, 2021)

Economic Calendar for the Week of June 21 – 25

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.