In this Issue…

A Look Into the Markets

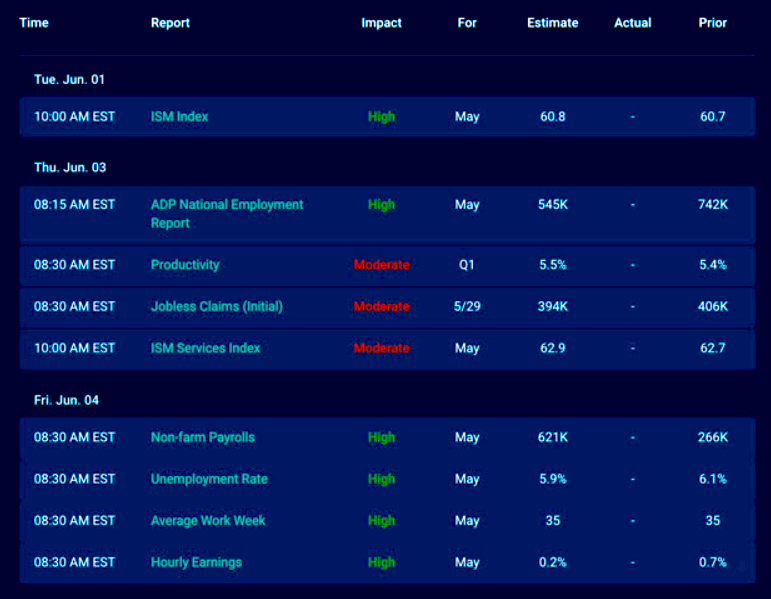

Economic Calendar for the Week of May 31 – 4

A Look Into the Markets

“Summer, summer, summertime / Time to sit back and unwind” “Summertime” by DJ Jazzy Jeff and The Fresh Prince

As we enter the unofficial start of summer, we are staring at home loan rates near multi-month lows and stocks near all-time highs. It is a remarkable environment that is being driven mainly by Federal Reserve monetary policy and the notion that higher inflation in the months ahead will be “transitory,” or short-lived.

Will this low interest rate party continue into the summer months?

Here are three things to watch as we enter June:

1. Will higher inflation be short-lived? Watch the Consumer Price Index and Personal Consumption Expenditure Index for clues. Rather than just the year-over-year numbers, which will be hot due to large increases in energy and food, watch the month-over-month gains. If they remain tame, long-term rates should remain near current levels. However, a much higher spike could cause a sharp increase in rates as renewed chatter for Fed bond tapering emerges.

2. The stimulus plans negotiations. Bonds and rates like uncertainty which will likely not be in short supply as both sides attempt to agree on a plan and how it gets funded.

3. The words of the Fed. The bond buying-program is the single biggest driver to the low rates we are experiencing in housing. If the Fed starts to mention the notion of tapering, we should expect long-term rates, like mortgages, to move higher and likely in a hurry. The last time the Fed uttered the words “taper,” the 10-year note yield went from 1.65% (ironically, right where we are today) to over 3.00% in a matter of a few months. The spike in rates happened before the Fed lowered or tapered the amount of bonds they purchase.

Bottom line: Rates have ticked back down to the best levels in nearly three months. There is a high level of complacency in the bond markets now, which means the market is not worried about a spike in rates. It is a condition like this that typically invites just that: a spike in rates. Those who can benefit from today’s rates should do so before they no longer exist.

Economic Calendar for the Week of May 31 – June 4

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.