In This Issue…

Last Week in Review: All Time Low For 30-Year Home Loan

A Look Ahead: Watch 3 Key Labor Reports

The Mortgage Market Guide View: 4 Best Customer Service Strategies

Last Week in Review:

All Time Low For 30-Year Home Loan

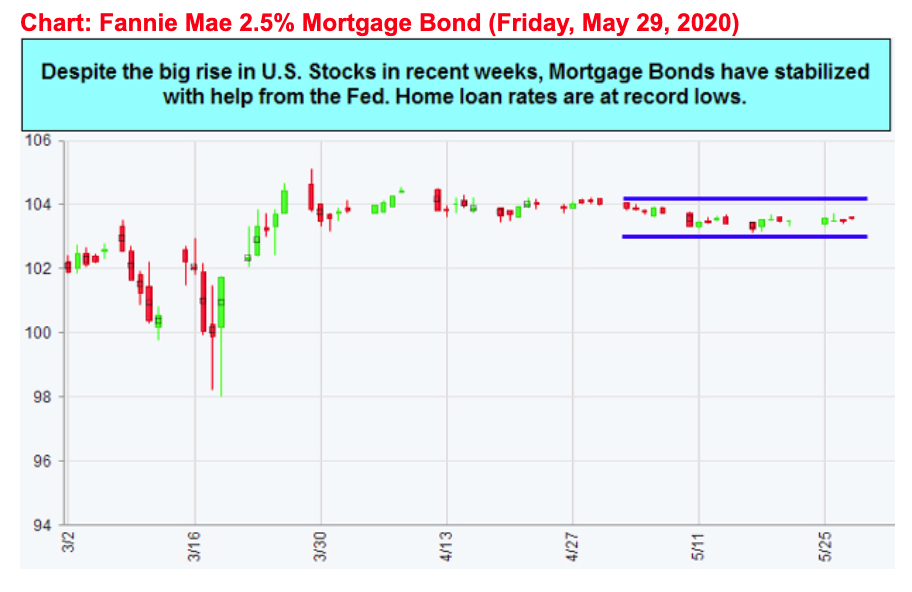

This past week, Freddie Mac reported the 30-year home loan rate hit an average all-time low of 3.15%.

As the unofficial start of summer has begun and states continue to reopen, this is welcome news, but there is even more to the story.

- Refinance activity remains elevated and with the average refinance loan amount declining, it means many borrowers with smaller loan amounts are able to lower their interest rate expense. This can be a positive economic contributor in the months ahead.

- Housing demand has increased sharply over the past couple of weeks and the low-interest rates have been a contributing factor.

There was a lot of bad economic data this past week, but most of it was backward-looking. Within Weekly Initial Jobless Claims was continuing claims, a ray of sunshine and a leading indicator of labor market strength.

Last Thursday, nearly 4 million more people than expected came off unemployment benefits — meaning people are finding work or have gotten rehired. We are watching to see if this trend continues as the U.S. economy continues to reopen.

Bottom line: With rates at all-time lows, housing demand remaining strong, people going back to work, and optimism rising, we should expect the housing market and broader economy to continue to improve and ultimately thrive in months ahead.

A Look Ahead:

Watch 3 Key Labor Reports

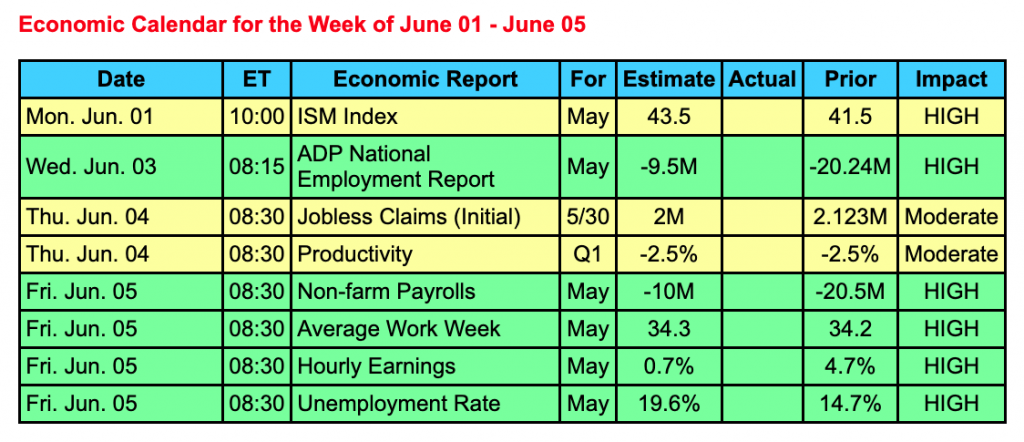

We talked about continuing claims, and this coming week will be centered around three key labor market reports.

The jobs market has been decimated by the pandemic-induced shutdown of the U.S. economy. Since March 23, 40 million Americans have gone unemployed.

ADP Private Payrolls and the government’s Jobs Report for May will be released this week, along with the Weekly Initial Jobless Claims and continuing claims data. The numbers will be closely watched by markets around the globe.

The growing optimism surrounding the reopening of state economies, global quantitative easing (QE), and further stimulus from Congress could continue to push Stocks higher. The huge added Bond supply required to fund the stimulus measures could also limit how low rates can go. We shall see.

Reports to Watch:

- The national ISM Manufacturing Index will be released on Monday followed by the ISM Service Index on Friday.

- Weekly Initial Jobless Claims and Productivity will be delivered on Thursday.

- ADP Private Payrolls will be announced on Wednesday with the Jobs Report on Friday.

The Mortgage Market Guide View:

4 Best Customer Service Strategies

Buying or selling a home is a lengthy process, so giving your clients excellent service is essential for keeping their business and attracting new customers. Try out these customer service strategies to keep your clients happy and start building lasting relationships for your business.

Respond right away. Whether you respond to calls and emails personally or you have your own team, make sure that customers don’t have to wait on hold or leave a message when they have an important question. Answering the phone right away when customers call shows that they are a top priority.

Ask questions. Get to know your customer by asking questions about their preferences. Some people prefer to be frequently updated via text, while others might want the personal touch of a face-to-face meeting. Being curious about your client’s needs can also help you anticipate challenges before they happen.

Celebrate successes. Buying a home and securing a loan is a big step in someone’s life, so take the time to congratulate your clients on achieving a milestone with a thank-you card or a closing gift.

Follow up. Maintaining a relationship with your clients even after you’ve closed a deal can help you get additional business and keep you at the top of their mind if they ever want to sell their home or buy another property.

If you take the time to personalize your customer service with these tips, you can set yourself up for a big payoff in the form of loyal clients and a great community reputation.

Sources: Acquire.io

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.