In This Issue…

Last Week in Review: Reopening the Economy

A Look Ahead: Will there be More Help From the Fed?

The Mortgage Market Guide View: Using Video Conferencing Tools to Connect with Clients

Last Week in Review:

Reopening the Economy

As the unofficial start of summer begins with the Memorial Day holiday, there are three trends worth following which may determine how the economy moves past the coronavirus.

As the unofficial start of summer begins with the Memorial Day holiday, there are three trends worth following which may determine how the economy moves past the coronavirus.

- The reopening. Most states have begun to open up in some form. A few states have been open for weeks and have not yet seen a resurgence in cases, which if the trend continues, would be a great proxy for the rest of the country.

- Don’t fight the Fed. Last Sunday on 60 Minutes, Fed Chairman Powell reiterated that the Fed will do whatever it takes to help underwrite the economic recovery. If the Fed, Treasury, and administration continue to throw every resource necessary to help the economy, it will likely work.

- American spirit. We are seeing incredible increased demand in online shopping, DIY projects, and more. It seems reasonable that American spirit and optimism can continue to rise as we enter the summer months and states gradually reopen.

When you couple American spirit and states reopening safely, along with continued Fed support, you have all the ingredients required for an economic recovery. Let’s see what the next few weeks bring.

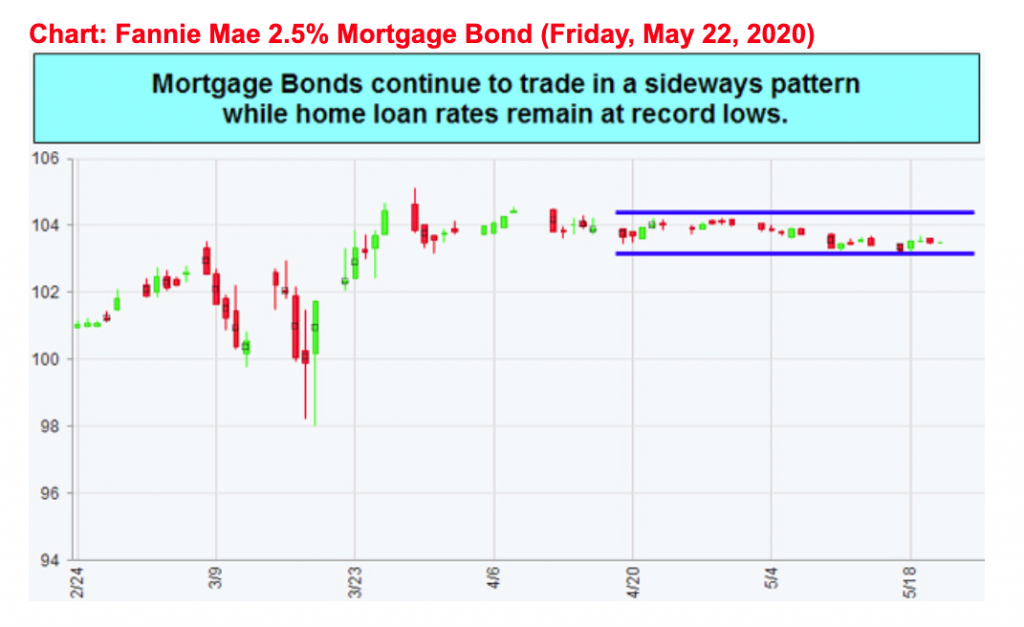

Meanwhile, home loan rates are at all-time lows and the housing market continues to see buying demand.

On the other side of the virus, we may very well see a strong housing market for all the reasons above, plus the pent-up demand created by increased household formation.

Better days are surely ahead.

Last Week in Review:

Reopening the Economy

All U.S. financial markets are closed on Monday for Memorial Day.

The holiday-shortened week will continue with more of the same including headlines streaming in on states reopening, the number of virus cases, and possibly more news from the Fed and Congress to stimulate the economy.

Key economic data will be released with housing numbers, consumer attitudes, economic activity, inflation data, and weekly claims.

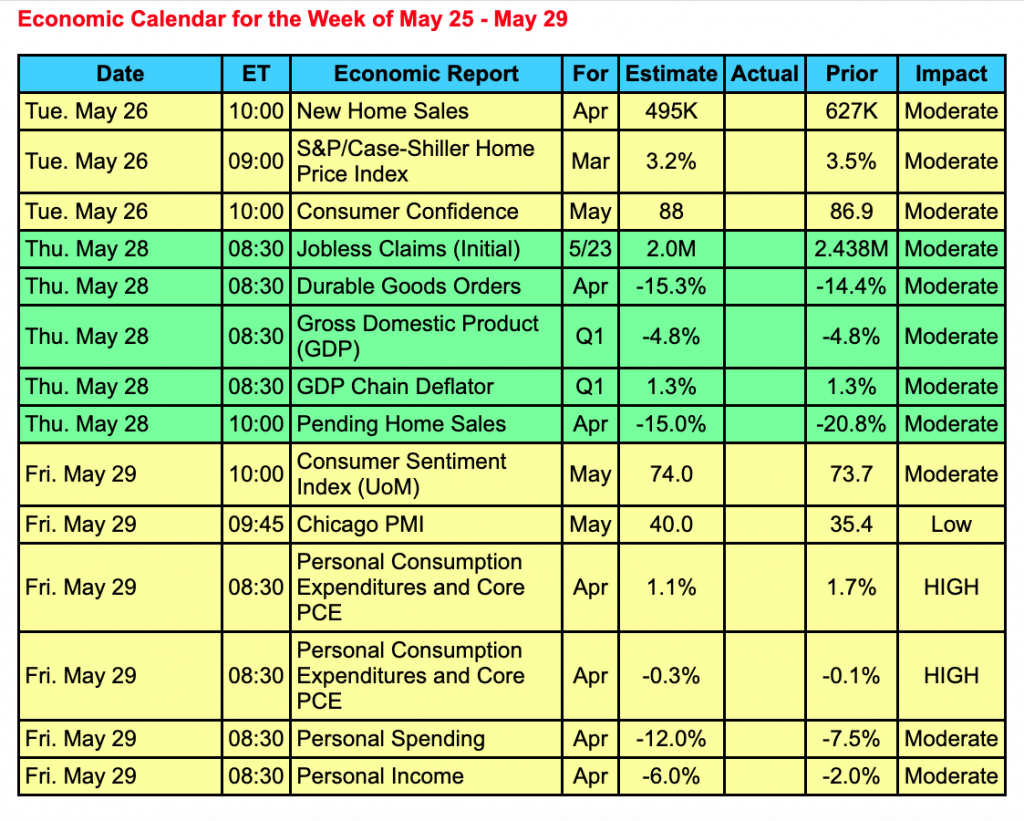

The Weekly Initial Jobless Claims numbers will be closely watched. The numbers have declined but they are still in the millions each week.

Reports to Watch:

- Housing data will come from the S&P Case-Shiller Home Price Index and New Home Sales on Tuesday, and Pending Home Sales on Thursday.

- Consumer Confidence will be released on Tuesday with Consumer Sentiment on Friday.

- Weekly Initial Jobless Claims will be delivered on Thursday along with the second reading on Q1 Gross Domestic Product.

- On Friday, Personal Income and Spending and the Core PCE will be released.

The Mortgage Market Guide View:

Using Video Conferencing Tools to Connect with Clients

When you can’t meet with a client in person, you need to get creative with the ways you connect. As video conferencing becomes more advanced and has better features, more real estate and mortgage professionals are using this technology to reach out to clients. Learn how you can get the most out of this technology.

Implementing remote technology into your day-to-day work is a great way to serve out-of-city and out-of-state clients. They’ll appreciate the convenience of being able to meet virtually.

Different remote services you could provide include home walkthroughs, initial meetings, document reviews, and anything else you would normally do in person. Using video chat rather than email or phone calls is more personable. Clients tend to prefer seeing your facial expressions and body language when communicating.

One increasingly popular video conferencing application is Zoom. You can use Zoom on your computer, laptop, tablet, or smartphone, making it easy to connect with clients anywhere. Zoom has some useful features such as screen share, making it easy for you to show clients documents or photos of listings. Zoom also has a messaging feature, allowing you to send links or take notes during a meeting.

Another great video conferencing tool is Vast Conference. This website features HD video, clear sound quality, and scheduling integrations. You can use this tool without downloading anything, which some clients may prefer.

Thanks to video conferencing innovations, connecting with your clients remotely has never been easier. Check out the software and tools we discussed to get started.

Sources: Zoom, ConferenceCalling.com

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.