In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of May 10– 15

A Look Into the Markets

“Can you take me High Enough?” by Damn Yankees

This past week we watched long-term rates, like mortgages, improve slightly despite a surprising comment from Treasury Secretary, Janey Yellen. Let’s break it all down and look at what’s on tap for next week.

“It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat” – Treasury Secretary, Janet Yellen

Janet Yellen was being interviewed on Zoom when she unleashed this seemingly innocent and likely honest comment. Well, it sent shockwaves across the stock market, pushing the NASDAQ down as much as 400 points on Tuesday alone.

Yellen was once the Fed Chair, and in that former role, it would be her duty to share comments on monetary policy. As Treasury Secretary, it is not her role to discuss rates. Especially, considering the active Fed Chair Jerome Powell saying over and over just days earlier at the Fed Meeting that “now is not the time” to raise rates.

There is big pressure on the Fed to help keep rates low. First and foremost are the upcoming “Plans” being debated in Washington D.C. The American Jobs Plan and American Family Plan are estimated to cost another $4 trillion, on top of the $1 trillion-plus still not spent from the American Rescue Plan. All this spending must be paid for by selling new bonds in the market. What we as a country can’t afford now is higher rates as the expense to service all this new debt will be an enormous burden.

Sell in May and Go Away

Stocks, especially the tech-laden NASDAQ, may have used Yellen’s comment as a reason to sell – but some of the downward pressure in stocks may be a seasonal phenomenon called “Sell in May and Go Away”. The idea is that stocks generally underperform during the summer months when many take vacations, thereby creating lower trading volume, larger price swings and more risk.

As you could imagine, the pain in stocks was a gain for bonds. The 10-year yield declined to 1.56%, down nicely from 1.75% from just a few weeks ago.

If the summer selloff in stocks continues, we may see further improvement in rates.

Opportunity knocks again

With the recent improvement in rates, many more people can still benefit from a refinance and it will certainly help drive the purchase market. However – any rate improvement could be short-lived – here’s three reasons why locking at today’s rates may make sense:

Treasury Secretary Janey Yellen’s comments for higher rates, was honest. Lumber and other commodity prices are soaring – higher rates would cool that off.

There is growing pressure on Fed Chair Powell to start “tapering” bond purchases. Again, in response to “frothy” assets like stocks and real estate.

We are going to see higher inflation numbers over the next few weeks – what we don’t know is how high the numbers will be or how bonds will react. Bonds do not like inflation – it’s like kryptonite to Superman…a killer.

Bottom line: Rates have improved of late, but the good times may be relatively short-lived. Those thinking about locking in today’s rates should do so.

Looking Ahead

Next week we will get a reading on consumer inflation by way of the Consumer Price Index (CPI). It is forecast to come in above 3% year over year – mainly due to year over year increases in oil and commodities. This will be the first time in 50 years since headline year over year consumer inflation will be higher than 30-year mortgage rates.

Longer-term, this would be unsustainable as inflation can’t run above mortgage rates. Either inflation must decline or rates must move higher to compensate for higher inflation or a little bit of both.

The Fed is forecasting inflation to moderate later this year, that is why they say they are “not even thinking about, thinking about” raising rates or tapering bond purchases. We shall see if this comes to pass.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices go higher, rates go lower and vice versa.

Along the right side of the chart, you can see a bunch of Green Candles with prices moving higher – that’s good, that means rates are improving.

In addition to three fundamental reasons why folks should consider locking at today’s rates – there is also a technical reason to do so. If you look at the late February on the left side of the chart, you can see three big Green candles which meant a nice decline in rates. A top in prices and bottom in rates happened at the $101.50 – just a little above current prices. This means MBS might struggle to get back above this “resistance” area in the absence of very friendly bond news.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, May 7, 2021)

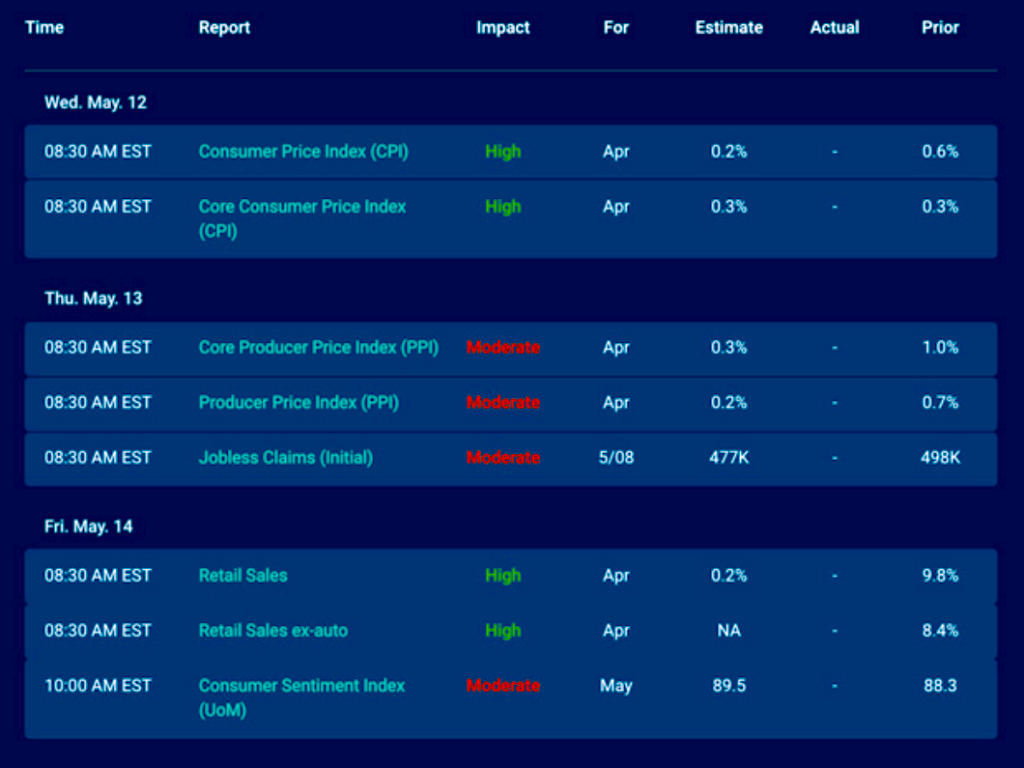

Economic Calendar for the Week of May 10 – 14

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.