In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of April 19 – 23

A Look Into the Markets

“The whole shack shimmies when everybody’s movin’ around” – “Love Shack” by the B-52s

When stocks rise, rates typically decline. When inflation moves higher, rates typically increase. As the economy reopens, rates will rise.

Well, stocks rallied to all-time highs, inflation spiked, and the economy continues to reopen. However, rates improved to the best levels in a month.

There are three things the financial markets are saying this week that are important for interest rates, stocks, and the economy in general.

1. Higher Inflation May Be a Short-Term Phenomena

The March Consumer Price Index (CPI) came in at 2.6% year-over-year, the highest level since August 2018. All signs are pointing to even higher consumer inflation in the next three months. BUT the market is forward-looking. Bonds are already looking at where inflation is going to be four months from now. At the moment, the bond market is not worried about inflation, because if it was, rates would be higher.

2. The Fed Has Our Back

Despite a vocal slip midweek where Fed Chair Powell said they would taper bond purchases “well in advance” of hiking rates, stocks are basking in the glow of the notion the Fed is still “not even thinking about, thinking about” hiking rates or tapering its bond purchase program.

3. Economic Reopenings Are Stimulus

The economic reports this past week highlighted pent-up consumer demand and the positive impact of states reopening their economies. Retail Sales, a measure of consumer spending activity, rose a scorching 9.8% on a month-to-month basis. Moreover, Initial Jobless Claims, those seeking first-time unemployment benefits, fell to the lowest level since the early days of COVID.

Bottom line: The financial markets are saying inflation is not a problem yet, and the consumer is going to drive economic growth. And during it all, the Fed will keep rates low, helping the recovery further and putting upward pressure on stocks. This is an amazing moment to take advantage of the current interest rate environment, as the present improvement in rates could be short lived.

Looking Ahead

The American Jobs Plan is the next hurdle for the financial markets. Within the proposal are higher taxes, which bonds and rates might like because they slow down economic growth. Watching this plan get debated in the coming days, weeks, and months will likely cause some chaos and uncertainty, which bonds/rates may also like in the near-term.

Next week brings housing reports, and the New Home Sales reading might be weak as builders deal with the meteoric rise in lumber and materials. Lumber prices are up 350% since April 2020 with no relief in sight.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. The right side of the chart shows prices continue to move slightly higher over time, which means rates are improving slightly as well.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, April 16, 2021)

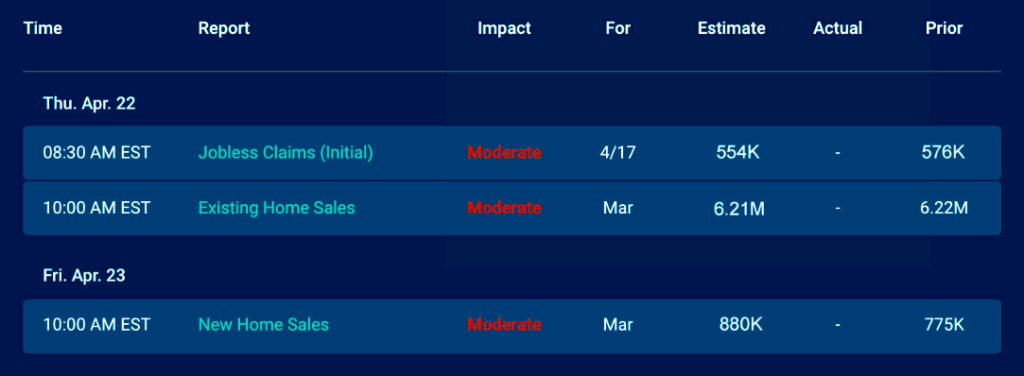

Economic Calendar for the Week of April 19 – 23

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.