In This Issue…

Last Week in Review: Liquidity Defined

Forecast for the Week: Bracing for Bad Data

The Mortgage Market Guide View: Tips for Working With First-Time Homebuyers

Last Week in Review:

Liquidity Defined

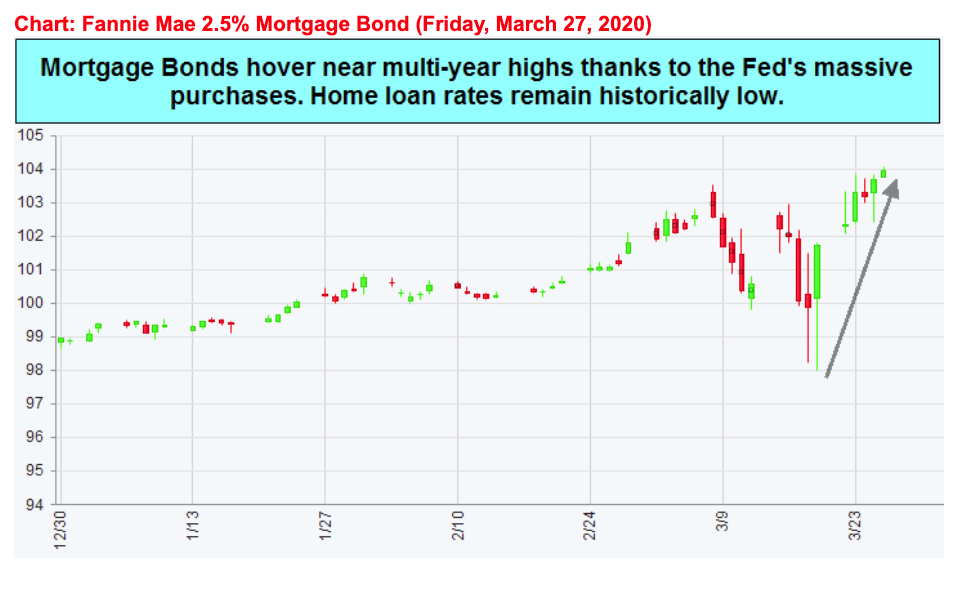

This past week, thanks to the Federal Reserve, home loan rates declined. The high uncertainty around the coronavirus and its impact on homeowners and mortgage payments created a dire need for liquidity in the mortgage-backed security (MBS) market.

This is where the Fed came to the rescue by providing liquidity.

What is liquidity?

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market at a price reflecting its intrinsic value. In other words, it’s the ease of converting it to cash.

Last Sunday, the Fed announced that it would purchase an unlimited amount of MBS in order to provide the much-needed liquidity to get the MBS market to perform correctly.

As a result, MBS prices showed more normal trading activity which resulted in lower rates and more stable pricing this week.

We expect more stabilization in the days and weeks to come as the Fed is committed to getting the MBS market to function as normal.

Bottom line: the Fed’s unlimited MBS buying doesn’t mean home loan rates are going to improve much further, but it will rather stabilize the market and keep rates near current levels, affording homeowners the ability to refinance and secure a low home loan rate.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Bracing for Bad Data

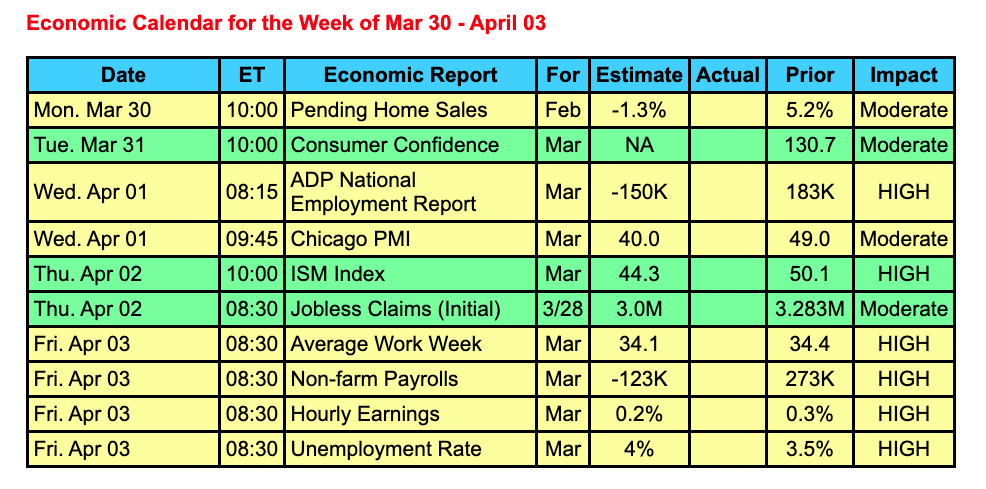

Expect the recent extreme volatility to likely continue this week, but probably to a lesser extent with the Fed stepping in to stabilize the U.S. financial markets.

In addition, the massive stimulus bill enacted by Congress may help to soothe the nerves of many Americans who were hurt both physically and financially from the coronavirus.

Economic reports may not be market movers this coming week as everyone is expecting negative readings everywhere, especially in the labor market. Weekly initial jobless claims, ADP Private Payrolls for March, and the closely watched Jobs Report for March will reveal the initial economic impact of the coronavirus.

The two questions that will be front and center for mortgage professionals in the upcoming week, addressed in the above “Week in Review,” will be: has the mortgage market stabilized, and what is the path for rates for the foreseeable future?

The Mortgage Market Guide View:

Tips for Working With First-Time Homebuyers

Today, many millennials are ready to start looking for a place to call their own. It’s a thrill to help these individuals realize the dream of owning a home, but there are a few challenges that may come up along the way.

The process of purchasing a home is second nature to real estate professionals, but it’s important to remember just how foreign and overwhelming it can be to someone who’s buying for the very first time. Spend more time talking about all the different steps of the process before going out to look at homes. Provide helpful guides that summarize each part of the homebuying process if possible.

Some homebuyers get caught up in the excitement of looking at homes and neglect to think about the long-term responsibilities of owning property. Help your clients connect with a loan officer to determine a budget they can afford and help them stick to it. Advise them about the unexpected costs of homeownership that go beyond the monthly mortgage payments.

Financing is a major concern for many first-time home buyers. They may not have major assets to bring to the table, and a smaller down payment is likely. Assist your clients in finding the best financing options for their needs. Work with an experienced loan officer to ensure they’re aware of local, statewide, and national programs for first-time buyers.

While there is more handholding involved, working with first-time homebuyers can be incredibly rewarding. Use these tips to help your clients find their dream home while staying within their budget.

Sources: Inman, Real Estate Express

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.