In This Issue…

Last Week in Review: The Lowest Rates EVER

Forecast for the Week: Jobs and a Fed Surprise

The Mortgage Market Guide View: 3 TED Talks to Help You Achieve Work/Life Balance

Last Week in Review:

The Lowest Rates EVER

Bonds love bad news, uncertainty, and fear, which is causing rates to move lower.

Bonds love bad news, uncertainty, and fear, which is causing rates to move lower.

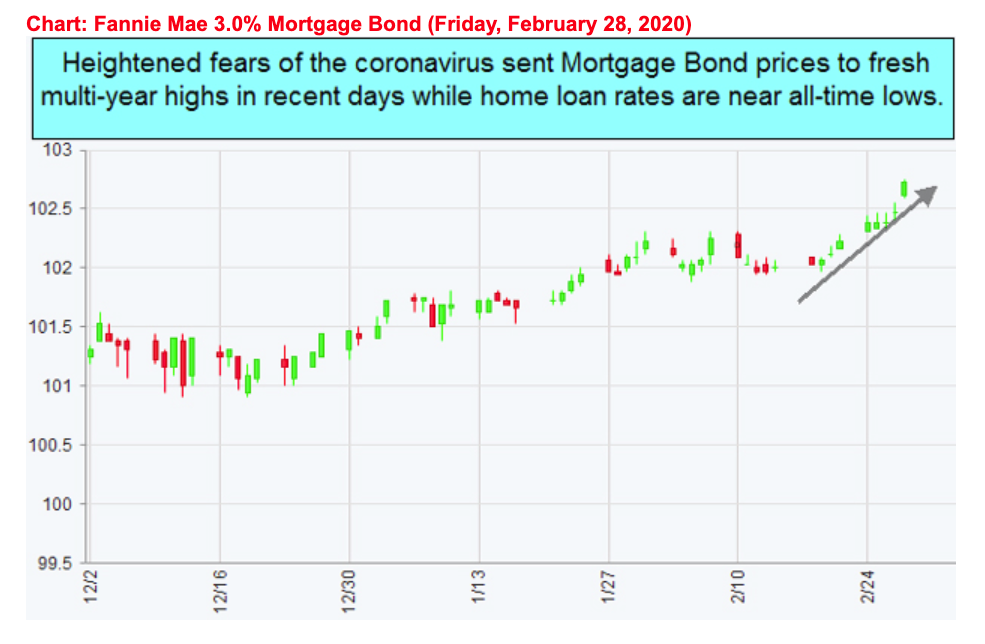

This past week, the escalation of the coronavirus fears caused enough anxiety to push rates down to the lowest levels in U.S. history.

Here’s what we know: Mortgage Bonds, which determine loan pricing, ticked to the best levels ever on Thursday, and the 10-year Note yield hit 1.25%, the lowest EVER!

Here’s what we don’t know: what is next for the coronavirus or its impact on the global economy.

With that said, if the coronavirus story brightens at all and becomes less uncertain or better, we could easily see rates move up just as quickly as they moved lower. On the other hand, should the coronavirus story worsen deeply, we should expect rates to fall further.

Bottom line: with rates at the lowest level in our history and hinging on the status of the coronavirus outbreak, now may present the opportunity of a lifetime to either refinance or purchase a home.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Jobs and a Fed Surprise

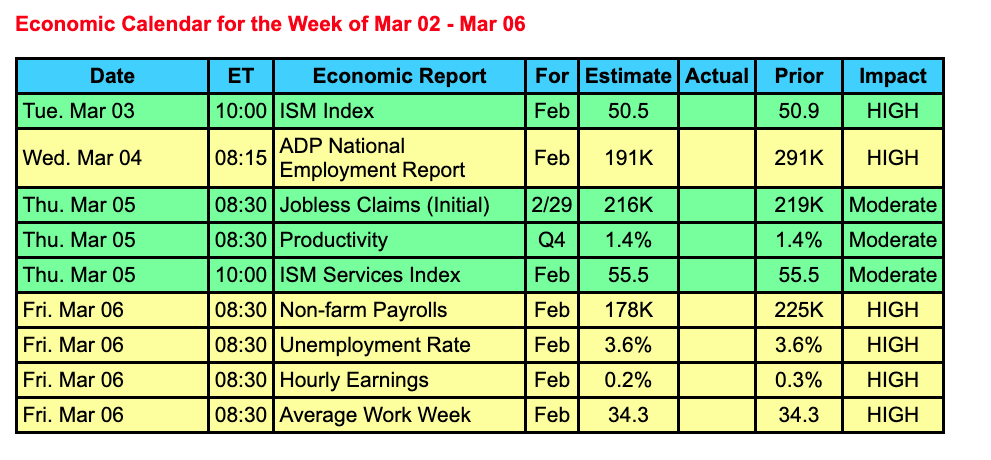

After last week’s packed economic calendar, this week will continue to provide key reports which include the most important economic reading to follow — the Jobs Report.

The markets will be glued to the headlines around the coronavirus to find out if it even impacted the labor market in February.

In addition to the labor market news, data will come from both the manufacturing and service sectors.

We may also hear from the Fed, who might hint at a rate cut as early as March to help combat the negative economic effects of the coronavirus. Remember, long-term Bonds don’t necessarily like rate cuts, and they showed as much last year as mortgage rates actually ticked up after three Fed rate cuts.

Reports to watch:

- Manufacturing data will come from Tuesday’s national ISM Manufacturing Index.

- Labor market data will be delivered on Wednesday with ADP Private Payrolls, Thursday’s Weekly Initial Jobless Claims, and Friday’s government Jobs Report, which includes Non-Farm Payrolls, the Unemployment Rate, and Hourly Earnings.

The Mortgage Market Guide View:

3 TED Talks to Help You Achieve Work/Life Balance

It’s clear that our lives are getting busier and busier. We have long commutes, work commitments, our kids’ after-school activities, family obligations, not to mention our efforts to stay healthy and in shape. It’s often difficult to figure out how to find the time and energy for everything, but the following TED talks can inspire busy working professionals, working parents, students, and caregivers to find balance.

“How to Make Work-Life Balance Work” insists we let go of the notion that creating balance requires a dramatic life makeover. Instead, author and marketer Nigel Marsh suggests making smaller, more significant changes that will radically improve your life and relationships.

“The Power of Time Off” addresses the overlooked and underestimated value of time taken away from work. Stefan Sagmeister believes in time off so strongly that he closes his design studio every seven years — giving his employees an entire year off. His reasoning? It’s important for him and his team to keep their creative viewpoints fresh and become newly inspired.

“How to Gain Control of Your Free Time” by time management expert Laura Vanderkam addresses and offers viable strategies that will allow us to make the most out of the 168 hours in each week. She asserts that instead of trying to find the time for the things they want, those who are successful identify those things and make them priorities.

While work-life balance means something different to each of us, we can all agree that holding onto perfectionism and the stress that never-ending workdays cause us is damaging to our relationships and our overall happiness.

Sources: Flex Jobs, Ted.com

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.