In This Issue…

Last Week in Review: Three Things the Fed Said

Forecast for the Week: Action Packed Week Ahead

View: Using Productivity Apps on the Computer to Block Distractions

Last Week in Review:

Three Things the Fed Said

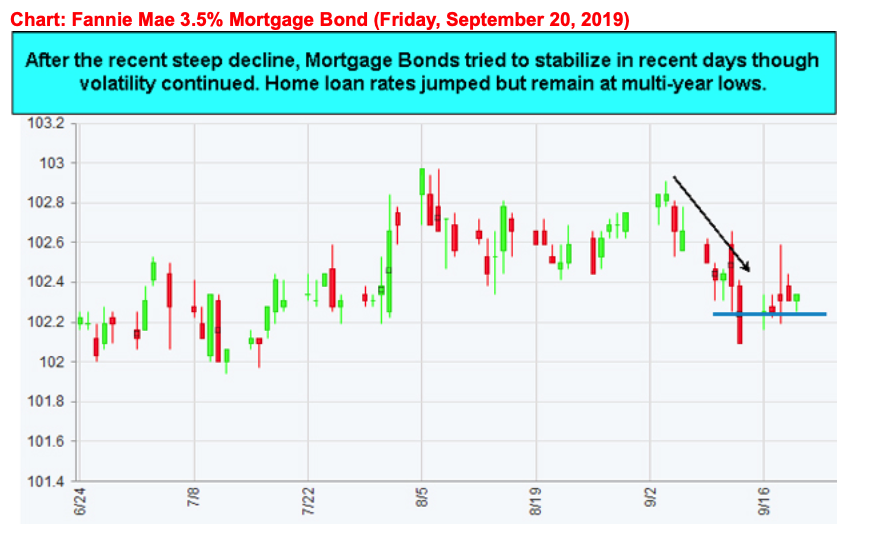

This past week the Federal Reserve cut the Fed Funds Rate for the second time this year, lowering the rate to 2.00%. Remember that the Fed Funds Rate is a short-term, overnight rate that has little effect on home loan rates. Home loan rates respond to the trading activity in Mortgage Bonds, which are influenced by the economic outlook and inflation expectations.

Not all Fed members were on board with the .25% rate cut. A few preferred not to cut rates while another wanted a bigger .50% cut.

Along with the Fed rate cut, here are three important takeaways from Fed Chair Powell’s press conference and the Monetary Policy Statement:

There is no recession in sight. One of the fears in recent months and cause for home loan rates to decline this summer was the fear of a recession. Powell debunked the recession myth, which is the reason why they suggested the possibility of no more rate cuts in 2019…the U.S. economy is doing fine.

The consumer is also alive and well. The main reason the U.S. economy won’t slip into recession is because the U.S. consumer has never been more willing and able to spend money. Consumer spending makes up nearly two-thirds of U.S. economic growth (Gross Domestic Product), so a recession will not occur while the consumer remains confident.

Exports have slowed. This was a negative point from the Fed statement. There are a couple reasons — one being the uncertainty surrounding the U.S./China trade dispute. But there is another reason they have slowed, and it is because our exports are too expensive for other countries, because our U.S. dollar has strengthened against other global currencies. This is why the Fed will likely cut rates again, despite suggesting otherwise, to soften the U.S. dollar and make our exports cheaper to other countries.

After the Fed came and went, home loan rates actually ticked up slightly. Why? The U.S. economy is not slipping into a recession and the Fed will take measures, like cutting the overnight Fed Funds Rate, to prevent it from doing so. Think good news is bad news for home loan rates.

Bottom line: If you have a family member, friend, or client considering a refinance or home purchase, there may never be a better opportunity to lock in a home loan rate, while they hover near three-year lows.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Action Packed Week Ahead

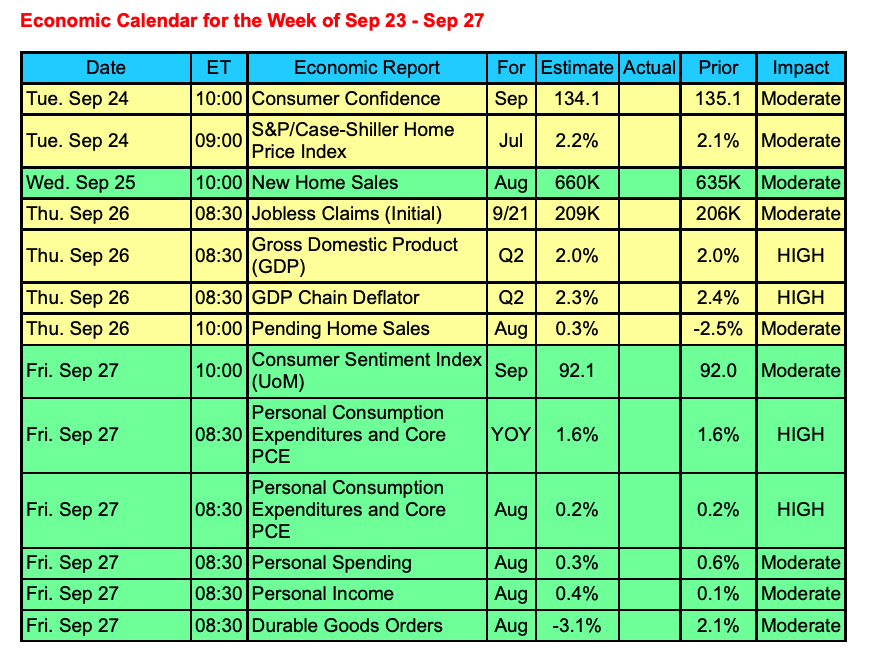

After a volatile week, the upcoming five trading days could continue to deliver more action with a packed economic calendar that features housing, inflation numbers, consumer confidence, spending, and sentiment.

The Fed’s favorite inflation gauge, the Core PCE, will be released this week, which will be closely watched by investors and Fed Chair Powell. Inflation has been running low and should continue to be muted for the foreseeable future.

Throw in the ongoing trade issues and Mideast tensions, and we could see continued volatility. In addition, the Treasury will be selling a whopping $113B in 2-, 5-, and 7-year Notes, which could impact Bond trading.

Reports to watch:

- Housing data comes from Tuesday’s S&P Case-Shiller Index, New Home Sales on Wednesday, and Pending Home Sales on Thursday.

- Consumer Confidence will be released on Tuesday with Consumer Sentiment on Friday.

- The third reading on Q2 2019 Gross Domestic Product comes on Thursday along with Weekly Initial Jobless Claims.

- On Friday, the Core PCE, Personal Spending, and Incomes will be delivered, along with Durable Orders.

The Mortgage Market Guide View…

Using Productivity Apps on the Computer to Block Distractions

Connectivity via the Internet has greatly improved productivity and made it easier to get business done, but instant connectivity also opens the door for interesting distractions such as social media, news sites, online games, and more. With this much accessibility, it doesn’t take much to stray away from the work at hand. Here are a few productivity apps that work as virtual blinders designed to help you stay focused on your important work.

FocusMe works by blocking access to websites that you select. This app also has the option to limit how much time is spent visiting distracting websites throughout the day. Don’t want to spend a lot of time on social media, but can’t stay away? Set up FocusMe to let you catch up with social for a total of an hour a day and no more.

The Freedom app blocks whatever it is that distracts you, whether it’s something on your desktop or on the internet. It also has the ability to sync across all of your devices to apply your block list and help keep your attention from straying on your phone, tablet, or laptop. This app also allows you to save a whitelist of sites that are needed for productivity.

Cold Turkey can do everything that the Freedom and FocusMe apps do and then goes further by entirely blocking you from accessing your computer. If you need to be in a meeting and are in the habit of “let me do that one last thing,” Cold Turkey can help you get away from the keyboard and to the meeting on time.

Let these apps help you reach your best potential by focusing your time and productivity on what matters most.

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.