In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of February 8 – February 12

A Look Into the Markets

“Good times, bad times. You know I’ve had my share” – Good Times, Bad Times – Led Zeppelin

This past week, the meme stock short covering phenomena seemed to fade a bit. The lack of further drama, along with solid corporate earnings, pushed stocks sharply higher at the expense of bonds and rates.

All Good Things Come to an End

Interest rates hit historically low levels last year due to the pandemic outbreak and the worst quarterly decline in economic growth ever. Those rates have helped millions of homeowners refinance and save significant money on interest expense. On the purchase side, along with several other tailwinds, low rates have fueled a bonanza in housing.

Fortunately, we are closer to getting past the pandemic as vaccines are now seeing widespread distribution. This, along with enormous stimulus measures, pent-up consumer demand, and easy monetary policy, tells us the good times of ultra-low rates may have come to an end.

The Yield Curve Is Talking

Economists look at things like the yield curve in the bond market to predict oncoming recessions or periods of economic expansion. At the moment, the difference or “gap” between the 2-year note yield and 10-year yield is at the widest level in over three years. This means the bond market is telling us we are about to see an era of economic expansion. Yes, better times ahead. Bonds and rates don’t like good news and better times, and it’s why we have seen an uptick in rates since the beginning of the year.

Inflation Expectations at Nearly 7-Year Highs

The 10-year breakeven inflation rate, what we expect to see inflation average over the next 10 years, is just a few basis points away from the higher levels in almost seven years. With Congress batting around another $1 trillion plus stimulus bill, along with fully reopening the economy, there is reason to believe these inflation expectations will rise even further. When inflation moves higher, rates move higher … period.

What About the Fed?

The Fed has played a pivotal role in keeping rates relatively low by purchasing $120B worth of Treasurys and mortgage-backed securities (MBS). But despite those efforts, rates have crept steadily higher with the 10-year yield moving from .50% last August to 1.15% as of this writing.

Should rates move too high too quickly, the Fed will likely do more to try and pin down long-term rates, like purchase even more bonds or invoke some sort of yield curve control.

Bottom line: Rates have crept higher, and with the anticipation of better days ahead and so much stimulus, we should expect a further uptick in rates. If you or someone you know would like to talk about this incredible interest rate opportunity, please contact me today.

Looking Ahead

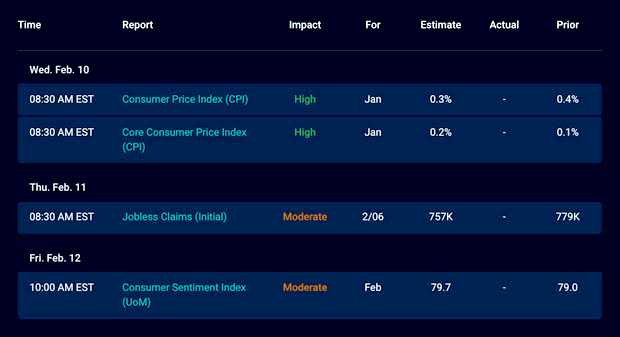

Next Wednesday the Consumer Price Index (CPI) will be reported. This reading on consumer inflation will attract the attention of the financial markets and could be a market mover, especially if hotter than expectations. At the same time, the ongoing stimulus negotiations and continued reporting of corporate earnings will determine the directions of stocks, bonds, and rates.

Mortgage Market Guide Candlestick Chart

The Candlestick chart of MBS below shows prices declining on the right side, which means rates are ticking higher. Notice the purple line, which is the 200-day Moving Average (MA), just beneath current levels. MBS prices do not cross above or below the 200-day MA very often. So as long as prices remain above, rates will remain near current levels. However, should the aforementioned reasons above push prices beneath the support at the 200-day MA, home loan rates will rise further.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, February 5, 2021)

Economic Calendar for the Week of February 8 – 12

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.