In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of February 14, 2022

A Look Into the Markets

Interest rates ticked up to the highest level in over 2 years in response to another increase in consumer prices. Let’s discuss what happened and what to watch for next week.

40-Year High Consumer Inflation

On Thursday, the Bureau of Labor Statistics (BLS) reported the Consumer Price Index (CPI) came in at a scorching 7.5% year over year. You name it, everything has gone up in price. Enormous year-on-year increases in food, energy, and housing are inflicting consumers with economic “pain”.

When you strip out food and energy costs, which are more volatile, consumer prices are still rising 6% year over year; more than double the Fed’s tolerance level.

The big disappointment was the 0.6% increase in prices month over month, as this shows inflation is not showing signs of moderation and the high levels are certainly not “transitory”.

Inflation is an economic killer. It is a tax that does not get collected and if people believe prices will be higher in the future, inflation could become entrenched.

The good news, if there is any? Inflation Expectations for the future remain relatively low. The 10-Yr Treasury Breakeven rate, or what the bond market expects inflation to run on average over the next 10 years is a relatively low 2.42%.

The Fed Mandate

The Federal Reserve has mandates to maintain price stability – inflation. How does the Fed fight inflation, this king of pain? By tightening monetary policy through rate hikes and balance sheet reduction, in hopes to slow demand and ease pricing pressures.

At the last Fed Meeting, Chair Jerome Powell, said they would hike rates in March “assuming” the economic data comes in as expected. Inflation is worse than expected, so we should fully expect a rate hike. Shortly after the CPI, the markets priced the probability of a 50-basis point rate hike at .50%. It is important to note that the Fed is going to hike the Fed Funds Rate, which has no direct impact on home loan rates. It will have an immediate effect on short-term loans like auto, credit card, and home equity lines of credit.

Uncertainty and 2018 Revisited

The financial markets are on edge as it is not clear how many times the Fed will hike rates and how many the economy can absorb before materially slowing down. This will be the balancing act the Fed will have to deal with in the weeks and months ahead. The incoming data will determine if and how many times the Fed will hike rates, meaning we will be dealing with continued uncertainty and volatility.

If the Fed can hike rates a couple of times and the economy and financial markets can absorb them, then we should also expect slightly higher mortgage rates as the year progresses…exactly what happened in 2018.

Also, back in 2018, the Fed “overcooked” the rate hikes, hiking a fourth time in December 2018. The result? Long-term rates slid sharply lower as the extra rate hikes slowed economic activity. The Fed ended up spending 2019 easing back and cutting rates. There is a fear in the stock market that the Fed will repeat the same moves.

Bottom line: The current environment remains like 2018, where rates creep higher over time in response to a hawkish Fed and the threat of multiple rate hikes. If you are considering a mortgage, rates are still suppressed thanks to the Fed bond-buying program which will end in March. Don’t delay.

Looking Ahead

Next week, we get important readings on Retail Sales and housing. The former will tell us if the consumer is still willing and able to pay higher prices. This is important to follow because if consumer spending slows, economic growth will slow. And this will make things very difficult for the Fed to hike rates too aggressively.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is a 1-yr view of the Fannie Mae 30-year 3.0% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBS prices have declined over the past two months, causing rates to touch levels last seen in late 2019. In the next few weeks, we should expect home loan rates to remain elevated as we approach next month’s Fed Meeting and March’s CPI reading.

Chart: Fannie Mae 30-Year 3.0% Coupon (Friday, February 11, 2022)

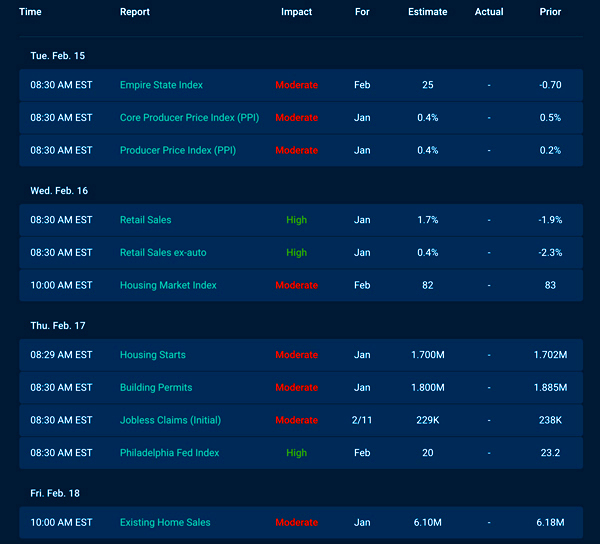

Economic Calendar for the Week of February 14 – 18

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.