In This Issue…

Last Week in Review: Home Loan Rates Decline Again

Forecast for the Week: Key Labor Market Reports on Tap

The Mortgage Market Guide View: Are You Ready for Tax Season?

Last Week in Review:

Home Loan Rates Decline Again

The coronavirus outbreak in China continued to grip the financial markets this week. The total affected and number of deaths rose sharply throughout the week suggesting the virus is not yet contained.

The coronavirus outbreak in China continued to grip the financial markets this week. The total affected and number of deaths rose sharply throughout the week suggesting the virus is not yet contained.

Stocks hate uncertainty and Bonds love uncertainty. As a result, Bonds traded higher to their best levels since October, pushing home loan rates lower to the best levels in three years.

It wasn’t all bad news this week though as economic readings here in the U.S. continue to show that our economy remains strong.

We also had a Fed meeting where the Fed left rates unchanged and did say the U.S. economy remains in a good place. Fed Chairman Powell also said the impact of the coronavirus on the global economy remains uncertain.

Over on Wall Street, corporate earnings overall have been very positive with Apple doing much better than expectations.

Bottom line: home loan rates will continue to be supported by the coronavirus uncertainty until they aren’t — meaning, the present quick decline in rates the past two weeks may prove fleeting should the coronavirus outbreak become more contained and less uncertain.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Key Labor Market Reports on Tap

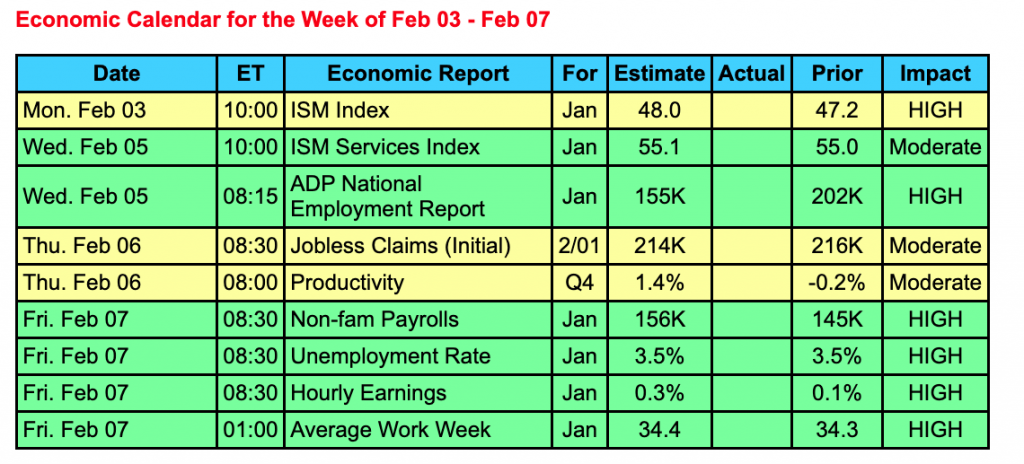

Job creation data will be in the spotlight in the upcoming week with two key reports on the radar.

The ADP Private Payrolls Report and the government’s Jobs Report, both for January, will be front and center and will be closely monitored by both the Federal Reserve as well as the investing community.

Earnings season will continue next week. However, the bulk of the reports are behind us.

The markets will also continue to be gripped in the coronavirus headlines with the financial implications still uncertain in these early stages. There could be a slowdown in China’s economy if the virus is not contained within a decent amount of time. How this story goes will determine how global Stock markets, Bonds, and home loan rates perform.

Reports to watch:

- The ISM Manufacturing Index will be released on Monday followed by the ISM Service Index on Friday.

- Labor market data will come from Wednesday’s ADP Private Payrolls with the government’s Jobs Report on Friday which includes Non-Farm Payrolls, the Unemployment Rate, and Hourly Earnings.

The Mortgage Market Guide View:

Are You Ready for Tax Season?

The new year is here and it’s time to start preparing for the tax season. Most businesses and individuals have until April 15 to file their taxes, unless an extension has been granted. Before you start the filing process, follow these three tips to help you get ready for tax season.

- Gather documents. You’ll need 1099 forms, W-2s, 1095-A forms, receipts, mileage logs, invoices, bills, and/or other pertinent paperwork available and organized before filing. Keeping the paperwork orderly throughout the year is easier for you or your accountant than trying to scramble last-minute to ensure you have everything.

- Check your withholdings and make adjustments. Make sure that your employer is withholding enough of your paycheck to cover taxes. Updating the W-4 form, which tells employers how much to withhold, is essential for having the proper amount withheld. If you don’t withhold enough throughout the year, you may end up owing money to the IRS.

- Learn how to file electronically. Filing electronically is efficient, and any money owed to you gets deposited directly into your bank account. E-filing is fast, secure, and fairly easy. Most online services for e-filing will walk you through the process, give suggestions on what you can deduct, and even show you your audit risk level. Start the process in advance of the filing date so you have time to learn the program, make adjustments, and review your taxes before filing.

While you can fill out and file your own taxes, consider hiring an accountant for more complex tax returns.

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.