In This Issue…

Last Week in Review: A Great 2020 Housing Story

Forecast for the Week: Economic Data in the Spotlight

The Mortgage Market Guide View: Understanding 2020 Tax Changes

Last Week in Review:

A Great 2020 Housing Story

Here’s some good news… the continued strength of the labor market, along with historically low mortgage rates, will keep positive housing momentum alive in 2020.

Here’s some good news… the continued strength of the labor market, along with historically low mortgage rates, will keep positive housing momentum alive in 2020.

The Unemployment Rate is currently at a 50-year low of 3.6% with expectations for the index to push even lower to 3.25% by year’s end, matching lows last seen in 1953.

Freddie Mac recently reported that 30-year fixed rate mortgages are at three-year lows while mortgage activity continues to increase.

Low rates, a solid economy, and a strong labor market have also cut mortgage delinquency rates. The Mortgage Bankers Association recently reported that the mortgage delinquency rate in Q4 2019 fell to its lowest level since the current survey series began in 1979.

In addition, the Census Bureau announced that the U.S. homeownership rate rose to 65.1% at the end of Q4 2019, the highest since the end of 2013.

The Fannie Mae Home Purchase Sentiment Index is near all-time highs reflecting that it is a good time to both buy and sell a home.

Finally, the New York Fed reports that $750B in new mortgages were originated in Q4 2019, more than any quarter since Q4 2005.

Bottom line: jobs buy houses, not low rates. But as we move into 2020, we have both a robust labor market and historically low rates — a true Goldilocks situation — fueling housing.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Economic Data in the Spotlight

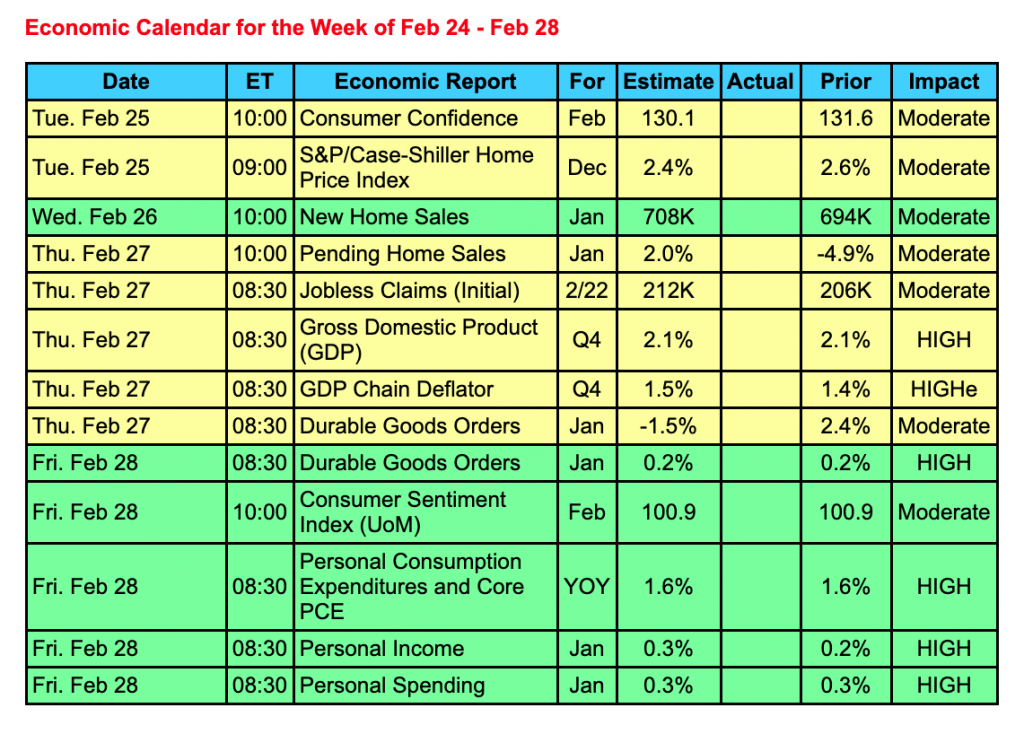

The upcoming week will focus in on a bevy of economic data that will cover a broad array of the U.S. economy including reports on housing, consumer attitudes, manufacturing, economic growth, and consumer spending.

In addition, the Fed’s key measure of inflation, the annual Core PCE, will also be released as it continues to hover at 1.6%, well below the Fed’s target range of 2%.

With earnings season all but over, the financial markets will continue to trade on the coronavirus headlines which will continue to affect investor sentiment.

The current U.S. economy is seeing low rates, tame inflation, a strong job market, and an expanding economy… a true Goldilocks environment.

Reports to watch:

- Housing numbers will be seen from Tuesday’s S&P Case-Shiller Home Price Index followed by Wednesday’s New Home Sales and Thursday’s Pending Home Sales.

- Consumer Confidence will be released on Tuesday with Consumer Sentiment on Friday.

- Durable Orders, Gross Domestic Product, and Weekly Claims will be released on Thursday.

- On Friday, Personal Income and Spending and Core PCE will be delivered.

The Mortgage Market Guide View:

Understanding 2020 Tax Changes

It’s a new decade and you need to become familiar with the new changes in tax law to keep your financials in order. The main changes include higher contribution limits for healthcare and retirement savings plans, as well as a change to the standard deduction.

If you’re contributing to a 401(k), you’ll be happy to know that the contribution limit has increased for 2020. For those under the age of 50, the limit is $19,500 per year, while those aged 50 and over can contribute $26,000 per year. This marks a $500 jump for the younger group and a $1,000 increase for those over age 50. Roth IRAs have slightly higher income thresholds as well, dependent on whether you’re married or single.

The contribution limit for health savings accounts also increased in 2020. The limit is $3,550 per year for those with individual health coverage and $7,100 for family coverage. If you’re 55 years or older, you can increase that number by $1,000 as a catch-up benefit.

The standard deduction has gone up, so it’s important to take advantage of the deductions offered to you instead of trying to calculate your own deductions. Doing your own calculations can get complicated, so unless you have extremely high local and state taxes, pay a substantial amount of mortgage interest, or donate a lot of money to charity, it’s best to stick to the standard deduction. This is especially true since the number has gone up due to inflation.

Plan ahead for these tax changes to make sure you’re taking advantage of every opportunity available when it comes to saving for retirement and paying required taxes.

Sources: Fool.com, Money Talks News, Huffington Post

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.