In This Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of February 1 – February 5

A Look Into the Markets

This past week, the Federal Reserve held their first meeting of 2021 and shared its thoughts on the economy, inflation, and interest rates.

Below are three important takeaways for the mortgage/housing world and overall economy:

1. “In terms of tapering, it’s just premature.”

Fed Chair Jerome Powell, in his press conference, essentially told the world they will continue to purchase $120B worth of Treasurys and mortgage-backed securities for the foreseeable future. This means relatively low mortgage rates throughout 2021.

2. “Frankly, we’d welcome higher inflation.”

The Fed said inflation is not a problem now, and it would like to see higher inflation in the future. This gives the Fed cover to continue its asset purchase program described above for at least this year. However, if the Fed gets what it wants, higher inflation, it will be talking about “tapering” bond purchases and even hiking interest rates. Follow consumer inflation readings going forward, as they will be what the Fed watches to determine the need for future rate hikes and less bond buying.

3. “There’s nothing more important to the economy right now than people getting vaccinated.”

All of the stimulus to help revive and stimulate the economy doesn’t do much if businesses can’t open and people are not out and about. The initial vaccination process had issues, but the process has since ramped up around the country, and there are more vaccines on the way.

When you couple all of the stimulus from both the Fed and the government with economies reopening and the American spirit, we should expect strong economic growth later this year. At that time, we may start to see a concern with inflation and a need to “taper” bond purchases, as described above.

Bottom line: The Fed continues to support the housing industry by purchasing bonds, until they get what they want: higher inflation. If you or someone you know would like to talk about the incredible opportunity, please contact me.

Looking Ahead

Next week is Jobs Week. On Wednesday, we get a look at private job creation within the ADP Report. Then next Friday, we will see the January Jobs Report which includes the official unemployment rate, the number of jobs created or lost, and hourly earnings, or how much people are paid.

Mortgage Market Guide Candlestick Chart

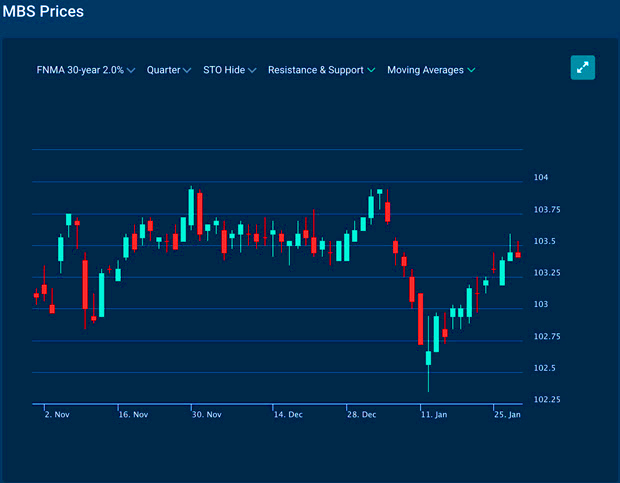

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-Year 2% Coupon, where current closed loans are being packaged. The right side of the chart shows a pause in the recent rise in prices, meaning a pause in the recent improvement in rates. If MBS prices retreat lower from here, rates creep higher. The opposite is true.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, January 29, 2021)

Economic Calendar for the Week of February 1 – 5

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.