In This Issue…

Last Week in Review: Recovering From the Coronavirus

Forecast for the Week: Back to Business

The Mortgage Market Guide View: Learn To Blog Regularly to Increase Traffic to Your Website

Last Week in Review:

Recovering From the Coronavirus

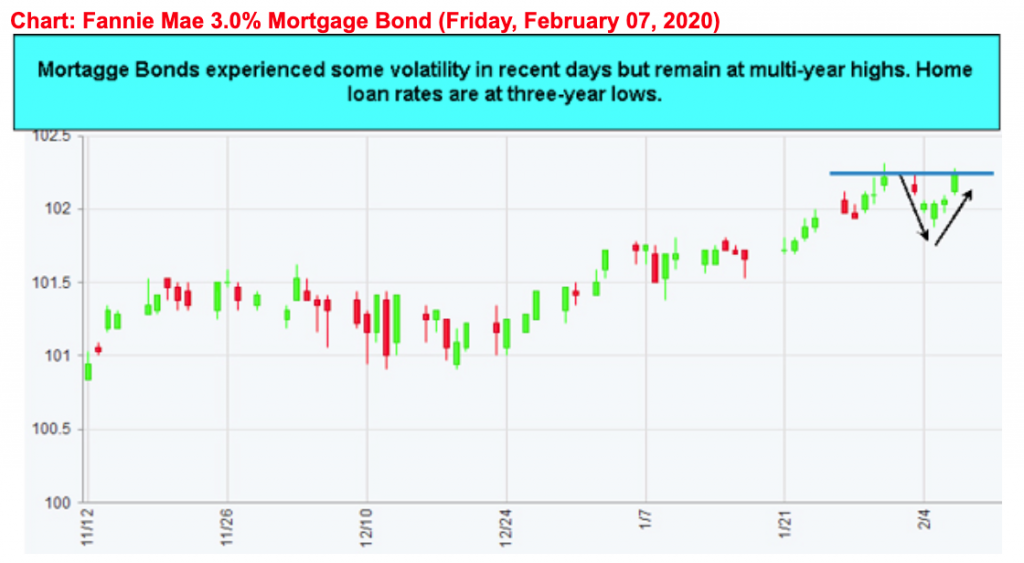

This past week was a bit rough for the Bond market as home loan rates steadily ticked higher and off the best levels in three years.

This past week was a bit rough for the Bond market as home loan rates steadily ticked higher and off the best levels in three years.

The coronavirus has been a tailwind to the Bond market and home loan rates for the past few weeks, but this week the story seems to be less negative and less uncertain. As better news started to emerge in the coronavirus headlines, financial markets started paying attention back to the economic outlook or “future” of our economy.

The news has been solid across the board with better than expected readings in manufacturing, services, and jobs.

The end of the impeachment process also removed uncertainty and helped Stocks focus on the good economic news at the expense of Bonds and home loan rates.

Bottom line: while rates ticked up week over week, they remain within a whisker of the best levels in three years. If the coronavirus outbreak story becomes more positive, home loan rates could inch higher still, meaning now is a great time to refinance or purchase a home.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Back to Business

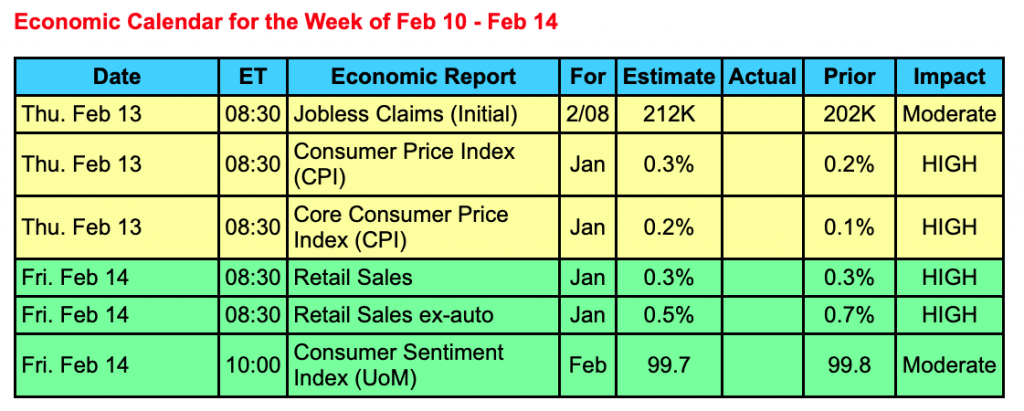

With fears of the coronavirus easing and the shenanigans of the impeachment process behind us, the markets can now get back to what usually drives sentiment… economic data, consumer confidence and spending, inflation numbers, and monetary and trade policy.

The upcoming week will bring a key inflation report from the Consumer Price Index along with a gauge of consumer spending in the Retail Sales report. In addition, earnings season will continue, though most of the big-name companies have already reported. Of the 60% of S&P 500 companies that have reported earnings so far this season, 71% of them have beaten analyst expectations.

Fed Chair Powell will be on Capitol Hill on Tuesday and Wednesday testifying on the state of the U.S. in his Monetary Policy Report to Congress, originally called the Humphrey-Hawkins Testimony. We don’t see any glaring words from the Fed Chair, but we will be closely watching.

Reports to watch:

- Economic data is on the light side this week and kicks off on Thursday with Weekly Initial Jobless Claims that continue to hover near 50-year lows.

- On Friday, the Consumer Price Index, Retail Sales, and Consumer Sentiment will be released.

The Mortgage Market Guide View:

Learn To Blog Regularly to Increase Traffic to Your Website

When you’re looking to get more business or customers, it’s important to have a website. However, a static website may not receive the amount of traffic you need to gain new clients and customers. One way to increase traffic to your website is with a blog. You want to write a blog at least once per week using solid Search Engine Optimization (SEO) practices. Be sure to write about topics that are relevant to your industry and provide a benefit to your reader. Here are a few advantages of blogging.

- Increase traffic to your website. Using good keywords that are pertinent to your business helps search engines point people to your blog and website.

- Become an authority in your industry. When you write information that is beneficial to your reader, they will look to you to receive more information, and return to read your blog every time you publish it.

- Build trust with customers. When the information you put out there is solid and evidence-based your readers will learn to trust your topics and ultimately buy your goods or services.

- Capture more leads. In the real estate business, you want as many leads as possible. Each lead is a potential customer and sale. Blogging helps to capture those leads.

- Encourage action. When people return to your website to read the blog, they’re more likely to act and either buy your product or service or contact you for further information.

If you aren’t sure how to start blogging, hire someone to help you get started or find some online tutorials.

Sources: Lyfe Marketing, Prism Global Marketing Solutions

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.