In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

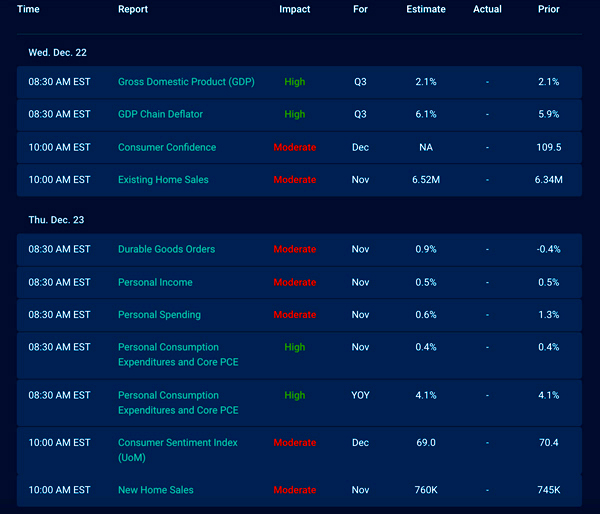

Economic Calendar for the Week of December 20 – December 24

A Look Into the Markets

It was Fed week. The highly anticipated Federal Reserve meeting took place last Wednesday, where they issued the FOMC monetary policy statement and Fed Chair Powell held a press conference. Let’s break down what happened, the market’s reaction, and what to look for in the weeks ahead.

The Federal Reserve is Speeding up the Taper

“In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities.” Fed Monetary Policy Statement, Dec 15, 2021.

This is the long way of saying that the recent spike in inflation is forcing the Fed to end its bond-buying program by mid-March 2022. With consumer prices increasing by nearly 7% year over year, the Fed wants to remove this accommodative bond-buying program and pave the way for Fed rate hikes.

How many rate hikes? The Fed shared their “dot plot” which highlights the voting Federal Open Market Committee (FOMC) members forecast on rate hikes and it showed the Fed feels there will be three rate hikes in 2022, three more in 2023, and one more in 2024.

In response to the taper and rate hike forecast, long-term rates held steady and didn’t increase … why? The bond market may be questioning whether the Fed can increase rates that many times and if it does, it would likely slow down the economy. Bonds love bad news and if the economy slowed down, that would be a reason for lower rates.

Remember, when and if the Fed hikes rates, it will have no direct impact on mortgage rates. Rate hikes affect short-term loans like credit cards, autos, and home equity lines of credit.

The Jerome Powell Presser

Shortly after the Fed statement was released, Fed Chair Jerome Powell held a press conference and it was here, where he made the markets feel good about the action they are taking. Here are some key quotes and their impact:

“FOMC rate predictions don’t represent a plan”. Even though the “dot plot” or Fed rate forecast showed three hikes coming in each of the next two years, Powell reminded the world that any rate hikes would be based on incoming data.

“Nobody knows where the economy will be a year from now”. This line soothed the markets that the Fed will not hike rates for the sake of hiking rates, and it will take time and data to determine if and, when it would be appropriate to hike rates.

“Labor Force Participation Rate (LFPR) subdued is disappointing”. Part of the Fed’s dual mandate is to promote maximum employment. In the absence of seeing a meaningful improvement where more people reenter the labor force and are working, the Fed may be pressured to hold off hiking rates.

“The path of the economy continues to depend on the course of the virus”. With cases rising in some areas and mandates/restrictions being instituted in others, there is a sense that the Fed may have to be patient on rate hikes as we still deal with economic activity being impacted by the virus.

Lastly, the Fed Chair took a question about hiking rates with long-term yields and touched on a reason we may see long-term rates relatively low for a longer time. Why? Low global yields. Both Japanese and German 10-year bonds have negative yields with the latter yielding -0.35%. For global investors searching for yield, our 10-year Note yielding 1.45% looks frothy compared to other options so we should expect investors to continue to buy our Treasuries. Thereby keeping our long-term rates relatively low.

Bottom line: The Fed just completely shifted its position from dovish to hawkish. The speeding up of the taper and growing likelihood of rate hikes, means we are likely to experience more volatility in the weeks and months ahead. If you have clients considering a purchase or refinance, now is the time to secure a home loan before we return to pre-pandemic mortgage rates.

Looking Ahead

Next week is a holiday-shortened week with the markets closing early on Thursday and closed Friday in celebration of Christmas. We could experience market volatility with many traders out for the holiday, especially with the closely watched Core Personal Consumption Expenditure (PCE) scheduled for release.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The bond bounced off 2021 lows, helping rates modestly improve. If prices remain above those recent lows, mortgage rates will remain at or slightly better than current levels. But a drop beneath those lows will quickly usher in pre-pandemic mortgage rates.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, December 17, 2021)

Economic Calendar for the Week of December 20 – 24

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.