In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of November 8 – November 12

A Look Into the Markets

This past week, the highly anticipated Fed Meeting took place. As expected, the Fed announced it will taper bond purchases starting later this month. The good news? Bonds and stocks didn’t have a tantrum. Let’s break down what happened and what to look for in the weeks ahead.

“In light of the substantial further progress the economy has made toward the Committee’s goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases” FOMC Statement – Nov 3rd, 2021.

Fed Chair Jerome Powell held a press conference 30 minutes after issuing the Fed Monetary Policy Statement to provide further color on the Fed’s outlook and to take questions.

The Fed has been very clear that they want to finish tapering bond purchases by the middle of next year. They’ve also shared that there will be no rate hikes until they are finished tapering.

“The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook” FOMC Statement – Nov 3rd, 2021.

The “but” and idea that they are prepared to adjust purchases means that if inflation or inflation expectations rise further, the Fed may very well accelerate the tapering, thereby finishing bond-buying sooner and opening the door to rate hikes sooner. The opposite is true so, if we underperform or inflation moderates sooner, the Fed could taper more slowly, thereby pushing rate hikes out further.

“We don’t think it is time to raise rates” Fed Chair Jerome Powell – Nov 3, 2021, Fed Press Conference.

“We continue to articulate a different and more stringent test for the economic conditions that would need to be met before raising the federal funds rate”

This more “stringent” test means we need to see maximum employment. In the last 12 months, the Fed has redefined what “maximum employment” means, and they reiterated that this week.

The Fed wants to see maximum employment “broad-based and inclusive”, meaning they want to see Hispanic, Black, and Asian unemployment come down much further. They also just added they want to see maximum “participation” – meaning they want to see the size of our labor pool increase…it is currently at a 45-yr low. Until these metrics meaningfully improve, the Fed is not likely going to hike rates.

Presently, the financial markets are pricing in a high probability of three rate hikes in 2022. For the Fed to hike rates three times next year, the Fed will have to be finished with tapering and we will need to see enormous labor market improvement…time will tell.

Bottom line: Home loan rates are behaving well post-taper announcement, making for a great opportunity to purchase or refinance. Let’s get into what we are looking at now, with the Fed announcement behind us.

Looking Ahead

The big themes to follow over the next few weeks will be the debt ceiling and infrastructure bill debates. The results from election day could add another layer of complexity, which could delay and further shrink the overall package; all of which is good for bonds/rates. We are going to get a couple of inflation looks by way of CPI and PPI. Should those numbers come in hot, bonds could suffer and quickly.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBS prices made an impressive bounce off the lows of 2021, helping mortgage rates improve. If MBSs can hold above price lows, we will continue to see 30-yr mortgage rates in the low 3% range. The opposite is true.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, November 5, 2021)

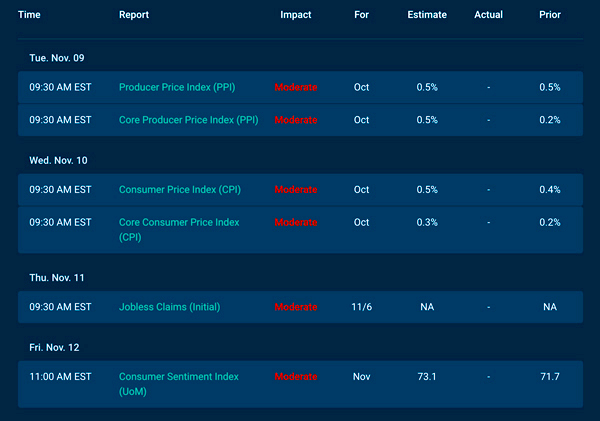

Economic Calendar for the Week of November 8 – 12

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.