In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of November 1 – November 5

A Look Into the Markets

After weeks of prices dropping and rates creeping higher, mortgage-backed securities (MBS) bounced sharply higher this past week – helping home loan rates improve week over week. Let’s break down three reasons why we might have just seen the highest rates in 2021 and what to watch for in the weeks ahead.

1. Opposite of the Herd

This past week, the 10-yr Note yield touched 1.70% for the first time since May and has since fallen sharply into the 1.50s%. If you watch business television, read articles online or listen to market watchers on the radio, you can hardly find a single person who doesn’t think rates will go higher.

It is during these moments when virtually everyone says something will happen that the opposite takes place. For instance, there was an article out recently saying “Buying on the dip is dead for stocks”. It was on that exact day that stocks rocketed higher once again and have not looked back.

Bottom line: If everyone thinks rates are going higher, do not be surprised if rates move lower.

2. Sell on the Rumor, Buy on the News

In the stock world, the saying is “buy on the rumor, sell on the news” – where stocks move higher in anticipation of good news and ultimately sell when the good news is announced.

We might be seeing the opposite in the bond market. This coming week, it is widely expected the Fed will announce a tapering or scaling back of bond purchases. The bond market knows this, and rates have been creeping higher for weeks.

Maybe, just maybe, we will see bonds continue to improve or at least not move lower once the Fed makes the official announcement next week.

3. Fed Rates Could Lead to Lower Long-Term Rates

Yes, you read that correctly. The Fed is going to announce bond tapering and wants to wrap up their pandemic-induced bond-buying by mid-2022. Once the Fed wraps up tapering, then they can proceed with possibly hiking rates.

Remember, when the Fed hikes rates, they are hiking the Fed Funds Rate, which is the overnight rate banks use to lend to one another. This rate affects short-term loans like credit cards, home equity lines of credit, and auto loans. A rate hike or rate cut by the Fed has no direct effect on long-term rates like mortgages, but it could help keep mortgage rates remain relatively low – here’s why?

The chance of a Fed rate hike in June 2022 is now at 60% up from just 20% one month ago. Persistently higher inflation is the reason why the probability of a rate hike is moving higher.

So, the Fed is going to hike rates, likely sooner than recently believed, because inflation remains stubbornly high. The rate hike is designed to tamp down inflation and prevent it from getting out of hand.

Do you know what likes tamped down or lower inflation? Yes, long-term bonds like MBS. Inflation is the archenemy of long-term bonds. If inflation moves higher, so do long-term rates. The opposite is true.

Bottom line: If you are considering a home loan, now is an amazing time. We shall see how MBSs ultimately react next week when the Fed announces the taper. If the bond market reacts poorly, we have technical levels we are watching, which would signal we are moving to an era of higher rates.

Looking Ahead

As our theme song goes “nothing else matters”. This week it is all about the Fed – no other news “matters”. The market is widely expecting them to hold rates steady and announce a tapering of bond purchases. What we don’t know is how the bond and stocks markets will react. There is so much volatility in the bond market with rates creeping higher and experiencing fleeting improvements. We will soon find out if the taper will hurt rates or if this present rate improvement continues.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The Bond made an impressive price bounce off the lows of 2021, helping mortgage rates improve. Next week’s Fed Meeting will likely determine if the price bounce will continue, sending rates even lower, or will the taper announcement cause rates to increase.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, October 29, 2021)

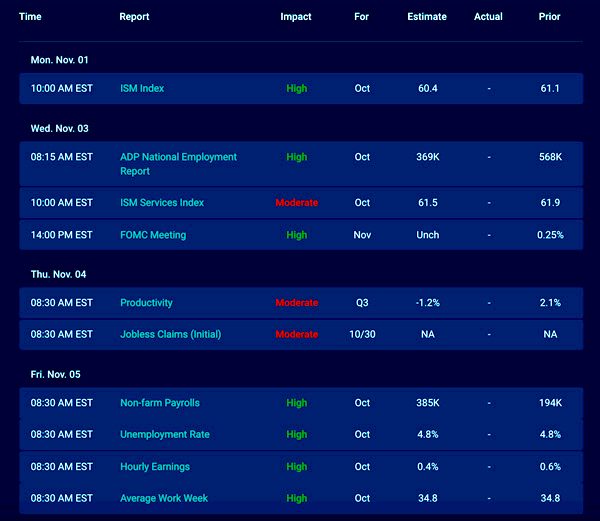

Economic Calendar for the Week of November 1 – 5

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.