In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of October 25 – October 30

A Look Into the Markets

Interest rates ticked up week over week and are near the highest levels of 2021. Let’s break down three things moving the markets and what to watch for in the weeks ahead.

“Truckin’, got my chips cashed in” … Truckin’ by The Grateful Dead

1. Buy on the Dip is Back

Stocks had a bad September, with the S&P 500 falling 4.8%, its worst month since March. After a multi-year rally with major indices doubling in value since March 2020. Many market analysts called for a much bigger drop in September.

It has not come to pass and in October, we are seeing investors jump back in and “buy the dip”, sending stocks to fresh historic highs. What has been the main driver of the stock gains?

Earnings, earnings, earnings. Many firms from the banking to the technology sector reported stronger than expected 3rd quarter earnings and maintained their future growth targets.

As stocks go higher, it is typically at the expense of bonds/rates as has been the case this month.

2. Fed Taper Cometh

November 3rd is just around the corner. That is the day the Federal Reserve meets and, likely announces their intentions to start tapering or scaling back their $120B monthly bond purchases.

The Fed started this bond-buying program in March 2020 to help stabilize the mortgage-backed security (MBS) market and help pin down long-term rates to stimulate the purchase and refinance market. Those goals have been met, so the Fed is ready to taper.

MBS prices have been moving lower the past few weeks in anticipation of the Fed taper announcement. Are we seeing a sell on the rumor and a potential buy on the news? Meaning, is the bond market moving lower on the news we expect to hear only to stabilize once the official announcement is made? It’s quite possible if history is any guide. Back in 2013, the bond market endured a “taper tantrum” when the Fed remarked about possibly scaling back purchases. However, when the Fed started the tapering many months later, MBS prices improved as did home loan rates.

This will be an important event and subsequent bond market reaction to follow as rates do threaten to move to the highest levels of the year.

3. Supply Chain Disruption

We are seeing shortages of many goods as the globe struggles to ramp up production to meet demand. Apple just announced they expect to sell far less of their iPhone 13s this holiday because of chip shortages.

On top of this, we currently have nearly 200 cargo ships floating in our waters waiting to be unloaded and shipped throughout the country. The problem?

We do not have enough people working in the ports and driving trucks to help move the goods throughout the country. It has been reported that we may need an additional 80,000 truckers here in the US just to get past this current supply chain disruption and meet demand.

What will be the effect? Scarcity and higher prices. It now appears the supply chain disruption is going to last well into 2022 and that means higher prices (inflation) will be more persistent.

Just this past week, the National Association of Home Builders said the supply chain problems have caused shortages in cement, drywall, and many other materials required to build homes. This will lead to even higher new home prices in the year ahead.

Inflation is the archenemy of bonds. If inflation remains stubbornly high, it will put upward pressure on rates, especially if the Fed is buying fewer bonds.

Bottom line: If you are considering a home loan, now is the time. Home loan rates are testing the highest levels of the year. A price to move lower from here would usher in even higher rates. Look at the chart below for more detail.

Looking Ahead

Next week is a monster news week. There are a bunch of corporate earnings. The Treasury will sell a boatload of Treasuries. And if that were not enough, the Fed’s favored gauge of inflation – the Core PCE will be released as well as the 1st reading of 3rd Quarter GDP.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The bond continues to bounce off support at $99.50, the price lows of 2021. If that support continues to hold, we may see bonds and rates modestly improve. However, should the bond fall beneath this important floor, we will likely revisit pre-pandemic rates.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, October 22, 2021)

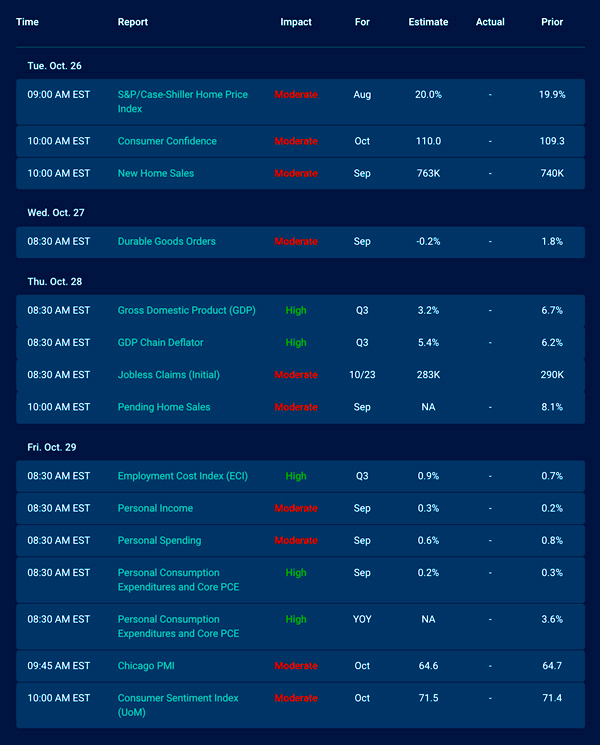

Economic Calendar for the Week of October 25 – 29

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.