In This Issue…

Last Week in Review: Fed Rate Cut Coming — But Don’t Wait

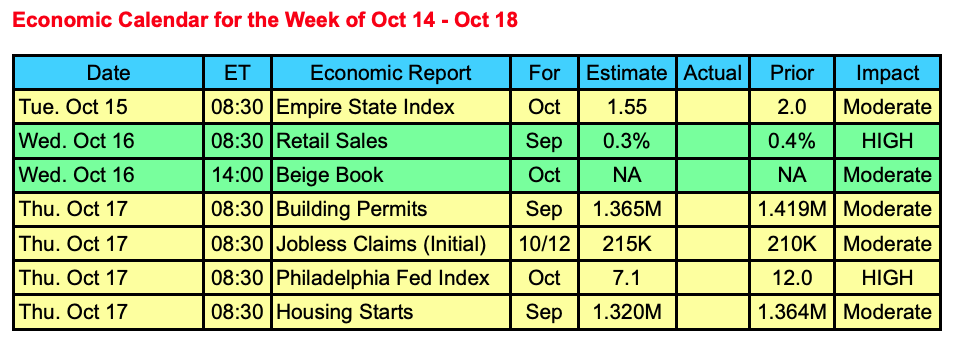

Forecast for the Week: A Packed Short Week

View: Expense Tracker Apps Help You Keep Track of Your Spending

Last Week in Review:

Fed Rate Cut Coming — But Don’t Wait

U.S. Bond yields and home loan rates ticked modestly higher this week as the world watches the U.S. and China have their first serious talk since July. There is a growing sentiment that the U.S. and China will agree to some short-term measures like a postponement of tariffs, while the two sides work on a more comprehensive agreement.

A short-term agreement or small win with U.S. and China would be good news, and home loan rates hate good news, hence a reason for the modest uptick in rates.

Also pressuring rates higher is the notion the Fed will once again cut rates on October 30. Yes, a Fed rate cut is putting pressure on home loan rates. A Fed rate cut is designed to help the U.S. economy avoid a recession, while increasing inflation. Both of which are bad news for long-term Bonds like mortgage backed securities, which price home loan rates.

For folks considering a new mortgage, it is important to note that home loan rates literally stopped improving once the Fed started cutting rates back on July 31st — look at the chart below.

So, don’t wait until October 30 and think rates will be .25% lower because the Fed will be cutting the short-term Fed Funds Rate. Home loan rates could be lower by month’s end, but the driver will more likely be the outcome of the U.S./China talks and not what the Fed is doing.

Bottom line: home loan rates remain right near three-year lows as the financial markets watch the outcomes of the U.S. and China talks. Good news will limit how much home loan rates can improve. The opposite is also true.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

A Packed Short Week

The upcoming week is holiday shortened with Columbus Day being observed on Monday. The U.S. Bond markets are closed, while the Stock markets undergo normal trading hours.

The fears of a U.S. recession are centered around our manufacturing sector and this upcoming week we will see two key reports from the industry. If these readings disappoint, the chance of a Fed rate cut goes higher still.

We will also receive a couple housing reports this coming week. Housing has been a bright spot in our economy thanks to 50-year low unemployment and historically low home loan rates. We see housing adding a boost to 3rd quarter GDP.

Economic data will continue to take a backseat to the U.S./China trade talks, along with heightened tensions in the Mideast, and the ongoing circus in Washington. In addition, quarterly earnings season unofficially kicks off in the upcoming week, and the numbers and guidance could have a major impact on the markets as well as mortgage rates.

Reports to watch:

- Manufacturing data from Tuesday’s Empire State Manufacturing Index and Friday’s Philadelphia Fed Index will be closely scrutinized.

- Another key report will be Tuesday’s Retail Sales report, which will gauge the strength of the U.S. consumer.

- Housing Starts and Building Permits will be delivered on Thursday, along with Weekly Initial Jobless Claims.

The Mortgage Market Guide View…

Expense Tracker Apps Help You Keep Track of Your Spending

Bookkeeping is a necessary part of operating a business, but it’s not always easy to keep track of every penny spent. Receipts can get lost and purchases can be overlooked, which results in a disaster for the bank account. Using an expense tracking app eliminates spending uncertainties and helps you keep on top of how much money is in your account.

First, make sure you’re tracking credit card spending in one place. Business credit cards are awesome because they offer perks like points and mileage for their use, but it’s also easy to overspend. An expense tracker can pull spending information from your credit card and combine this with your other accounts. You get to see where money is going at a glance and know when it’s time to put on the brakes.

When it comes to tracking your checking account balance, do you look at it now and again, then keep a running balance in your head? An expense tracker helps you break that habit. Enter expenditures or take pictures of receipts for later entry. You’ll know how much money you have at a glance and can reconcile it against the account when you have time.

Lastly, sticking to your budget helps keep the balance in the black. Sometimes extra cash comes in and you’re tempted to spend it. Use an expense tracker to help you find out if you have an upcoming bill that the extra cash can go towards instead. Having extra cash on hand for an unexpected expense is always helpful and supports a healthy budget.

Sources: FitSmallBusiness, NerdWallet, Fisher401k.com

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.