In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of January 3, 2022

A Look Into the Markets

As we enter 2022, let’s discuss what’s happened in this final trading week and what to watch for as the New Year begins.

“Nothing changes on New Year’s Day” – New Year’s Day…by U2

1.) Markets Looking Beyond Omicron

This week mortgage-backed securities (MBS) lost pricing, causing home loan rates to tick up. The main culprit is the optimism that Omicron will come and go without significant human and economic toll.

It appears, at least for now, that Omicron is highly transmissible, but the majority of cases are mild and don’t require advanced medical attention or hospitalization. This is a reason why the CDC lowered the COVID isolation guidelines from 10 to 5 days.

Around the globe, Omicron is spreading rapidly, and different countries are instituting different solutions. The economic disruption abroad is holding global rates low, which in turn applies downward pressure on our rates. Upon more optimism around the globe, we could quickly see an uptick in global rates, including here in the US.

Remember the Fed said in their December Statement: “The path of the economy continues to depend on the course of the virus”. This is important because if the economy remains disrupted, it could have an impact on the Fed’s decision to hike rates.

2.) Timberrrrrr

Just when you thought it was safe to go out and build your deck, the price of lumber shoots up to $1170, essentially doubling from $529 since November 15th. Flooding in Canada was part of the problem on top of scorching housing demand.

In the absence of an easing in lumber pricing, this inflation will have an impact on the housing market, with both purchase prices and rents increasing.

3.) Wage-Based Inflation

Initial Jobless Claims, a leading indicator of labor market health, remains very low with weekly figures hovering at pre-pandemic levels. This highlights the ease of people being able to find employment. Currently, there are over 11+ million jobs available to be filled and 6.9 million “unemployed” people.

This labor market problem of too many open jobs and not enough people to fill them is not easily fixed and does create another problem – inflation.

To find qualified individuals, companies are pressured to pay higher wages, which leads to “wage-based” inflation. Meaning, if companies must pay people more, they likely must raise prices for goods and services. The wage-based inflation caused by the labor market shortage is not an easy fix for the Federal Reserve, which is tasked to “promote maximum employment”. This is a story to follow closely in 2022 as the already high inflation is applying pressure on the Fed to hike interest rates.

Bottom line: The rise of Omicron has introduced uncertainty, which may soon pass. If you have clients considering a purchase or refinance, now is the time to secure a home loan before we return to pre-pandemic mortgage rates.

Looking Ahead

History has shown January to be one of the more volatile months for interest rates. The bond market is dealing with push/pull news from Omicron along with the threat of inflation, Fed tapering, and rate hikes.

Next week there are key labor market readings by way of the ADP Report on Wednesday and Jobs Report on Friday. If these reports are strong, it will further the case for the Fed to raise rates sometime in the 2nd quarter of 2022.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBS remains just above 2021 price lows, meaning the highest home loan rates of the year. If MBS can remain above these important price lows, we will likely see rates remain near current levels. However, a drop beneath those lows will quickly usher in pre-pandemic mortgage rates.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, December 31, 2021)

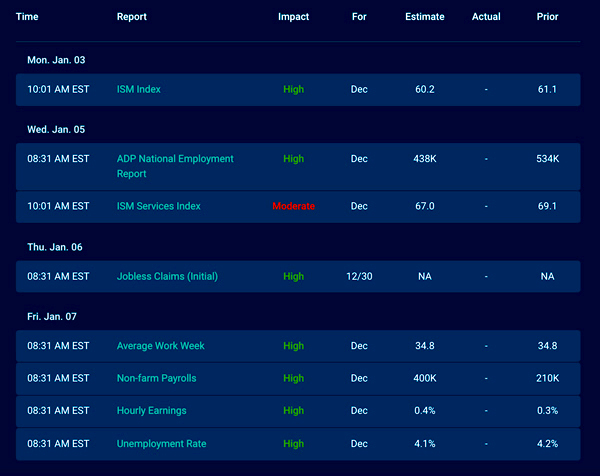

Economic Calendar for the Week of January 3 – 7

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.