In This Issue…

Last Week in Review: Uncertainty Helps Rates

Forecast for the Week: Big News Week

The Mortgage Market Guide View: Learn to Write Compelling Listings

Last Week in Review:

Uncertainty Helps Rates

Bonds love uncertainty and bad news, and as a result, rates improve when not-so-good news emerges.

That was the story this past week, as China has reported a new deadly coronavirus has started to spread in their country. At this point, the virus, which spreads through human contact, has taken several lives and has affected hundreds.

A known case in the U.S., several Chinese cities quarantined, and uncertainty over what happens next with the virus has the financial markets on edge.

In response to the uncertainty, many investors around the globe are placing their money into the relatively safe-haven of the U.S. dollar and U.S. denominated assets like Bonds — which has helped home loan rates improve to the best levels in three years.

If the virus gets contained quickly and doesn’t spread further, the modest improvement in rates this week could reverse very quickly.

At the same time, should the virus story get worse and become even more uncertain, we should expect Bond prices to climb even higher, helping home loan rates even further.

Bottom line: with home loan rates now touching the best levels in three years, anyone considering refinancing or buying a home would be wise to take advantage of what may be a brief further improvement in rates fueled by the coronavirus uncertainty.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Big News Week

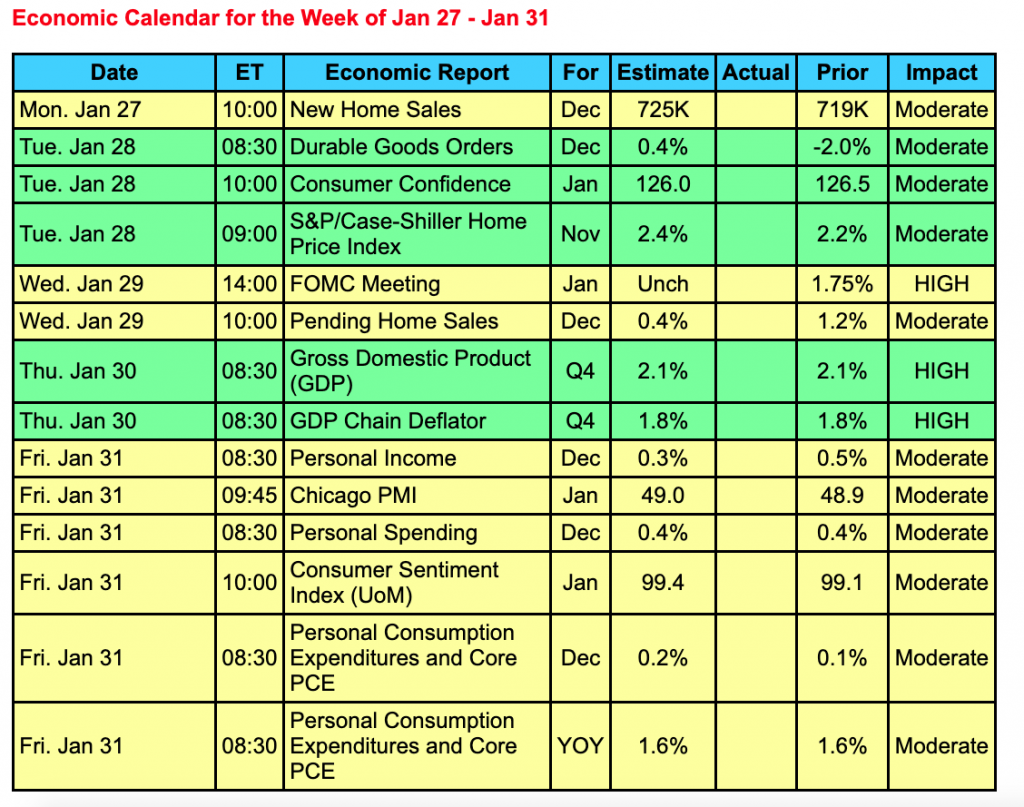

There is a lot to follow in this upcoming week. We will see a slew of economic data that will cover a big chunk of the U.S. economic landscape such as inflation numbers, housing, and consumer attitudes, to name a few.

In addition, the heart of earnings season will take place with recent numbers streaming to the positive side. Of the S&P 500 companies that have reported thus far, 70% have beaten expectations.

And if that weren’t enough, we also have the two-day Fed meeting beginning on Tuesday and ending Wednesday at 2:00 p.m. ET with the release of the Monetary Policy Statement. Fed Chair Powell will hold a press conference following the statement release at 2:30 p.m. ET. There is a zero percent chance of a change to the short-term Fed Funds Rate, but the meeting always carries some headline risk.

Investors will also keep a close eye on the coronavirus headlines.

Reports to watch:

- Housing data will come from New Home Sales on Monday, S&P Case-Shiller Home Price Index on Tuesday, and Pending Home Sales on Wednesday.

- The closely watched Durable Orders report will be released on Tuesday.

- Consumer Confidence will be delivered on Tuesday followed by Consumer Sentiment on Friday.

- The first reading on Q4 2019 Gross Domestic Product will be announced on Thursday along with Weekly Initial Jobless Claims.

- Inflation data will come from Friday’s Core PCE and the Employment Cost Index with Personal Spending and Incomes accompanying the PCE data.

The Mortgage Market Guide View:

Learn to Write Compelling Listings

When a potential homebuyer goes online in search of properties, great photographs and property descriptions help to capture their attention. Writing compelling listings will help you stand out in a competitive real estate market, and here are a few tips to help you get started.

- Create a captivating headline. Write something that immediately grabs the reader’s attention and encourages them to read more of the listing.

- Use words that evoke emotion. Instead of simply saying the property has a big backyard, say something like, there is plenty of room in the backyard to host memorable family events and parties.

- Use short paragraphs or bullet points. Don’t get bogged down in lengthy sentences. Get to the point so you don’t lose the readers’ attention.

- Be honest but not negative. Describe the property accurately, but choose wording that inspires the reader to schedule a tour. Avoid phrases such as the house needs TLC. Instead, point out the positive features and that the house is ready for new owners to modernize it.

- Choose adjectives wisely. Stay away from words such as cozy, charming, and rustic. Most people know that means small and needs work. Instead, use a phrase such as this one-bedroom home is the perfect choice for a young couple looking for their first home that they can lovingly update.

- Highlight special features. If the home has a large soaking tub in the master bath, mention it. If the house has a sunroom or beautifully landscaped garden with pathways and fountains, mention those unique features.

If you struggle with writing, consider hiring a real estate copywriter to help you.

Source: OutboundEngine

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.