In this Issue…

A Look Into the Markets

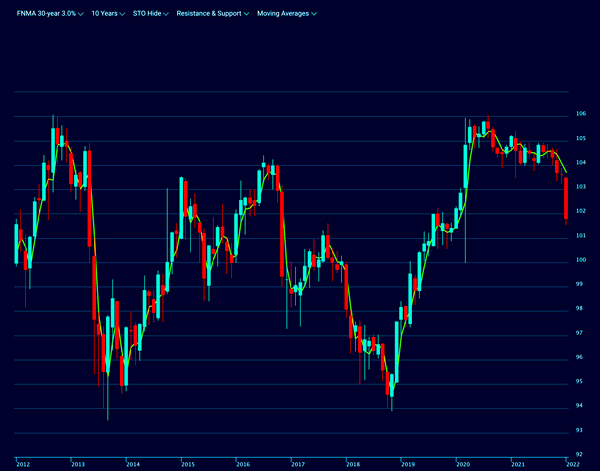

Mortgage Market Guide Candlestick Chart

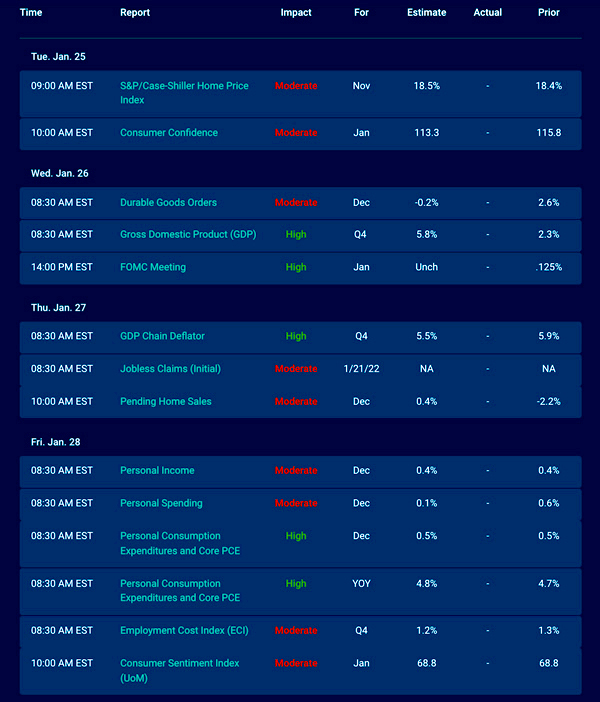

Economic Calendar for the Week of January 24, 2022

A Look Into the Markets

Home loan rates ticked up this week to the highest levels in two years. Let’s discuss what’s happened this past week and what to watch in the weeks ahead.

“Up, Up, Up – Can only go up from here” …Up by Shania Twain

Interest Rates Rising Globally

The U.S. bond market took the long weekend to ponder Federal Reserve Monetary Policy and what they will do at next week’s Fed meeting and beyond.

Once the bond market reopened on Tuesday, it came to the realization that rates “can only go up from here.”

Much like 2018, the Fed is hawkish and they want to raise rates multiple times and possibly “shrink” their balance sheet (sell bonds).

The Treasury market saw the 2-year note yield, an instrument that responds to the notion of Fed rate hikes, spike above 1.00% for the first time in two years. The 10-year yield, which many look to as a rate that ebbs and flows with mortgage rates, ticked up above 1.85%, also the highest in two years.

Mortgage-backed securities (MBS), where home loan rates are derived, dropped sharply again, pushing rates to the highest mark in two years.

The spike here caused ripples abroad, where the German 10-year bund yield crept up to 0.0% for the first time in years. Germany and most of Europe have had negative rates for years and 2022 may be the year that changes.

Oil Prices Spiking

Just when you thought it was safe to fill up your tank, oil has gushed to $86 … a seven-year high. This spike is untimely as we are already dealing with 7% consumer inflation and a market fearing multiple Fed rate hikes to fight inflation. In the absence of oil prices receding, it will lead to more inflation and expectations of even more. On the latter, this is the fear of the Fed, that consumers will get comfortable and expect higher prices in the future. Inflation expectations are self-fulfilling, meaning if we expect higher prices, we get them. The opposite is true.

It’s All About the Fed, Folks

There is no lack of opinions on what the Fed will do this year as it relates to interest rates and their balance sheet. And it is this uncertainty that has caused incredible volatility in the stock and bond markets. The markets are fearing the Fed will hike rates four times or more this year.

Back in 2018, the Fed hiked rates four times and ultimately stocks declined sharply and housing was disrupted. Subsequently, the Fed spent 2019 reversing all the hawkishness and cut rates in July 2019.

Listening to the Fed is very important as the financial markets and housing are tethered to interest rates, which they control … to some degree. Let’s see what they say and do next week.

Bottom line: The sentiment in the financial markets has shifted very quickly. The Fed went from a tailwind to a headwind as it relates to rates. If you are considering a mortgage, rates are still suppressed thanks to the Fed bond-buying program which will end in March. Don’t delay.

Looking Ahead

As we shared, it’s all about the Fed. And next Wednesday at 2:00 p.m. ET, we shall see what they do and say. And if this big event weren’t enough, the Fed’s favored gauge of inflation, the Core PCE, will be released next week. The most recent reading showed inflation running at 40-year highs. If inflation creeps higher still, the Fed will continue its hawkish tone. Should we see some moderation, it could give the Fed some wiggle room to be less hawkish and adopt some wait-and-see attitude towards multiple rate hikes this year.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is a 10-year view of the Fannie Mae 30-year 3.0% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa. Much like January 2018, MBS prices have declined 190+ basis points this month causing a sharp spike in home loan rates. Be careful. Back in 2019, with a similar Fed backdrop, rates crept higher every month as the Fed hikes rates multiple times.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, January 21, 2022)

Economic Calendar for the Week of January 24 – 28

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.