In this Issue…

A Look Into the Markets

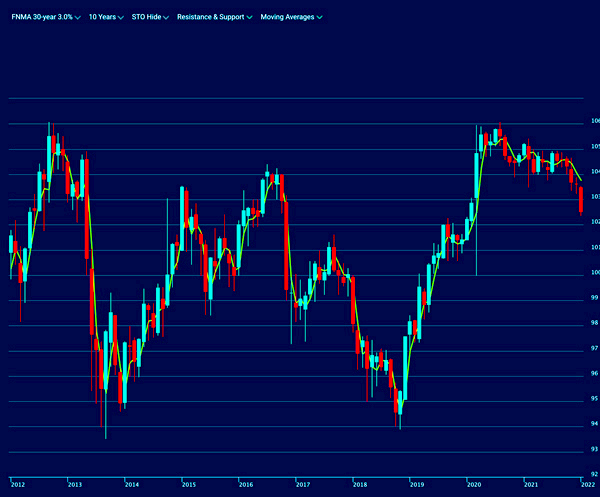

Mortgage Market Guide Candlestick Chart

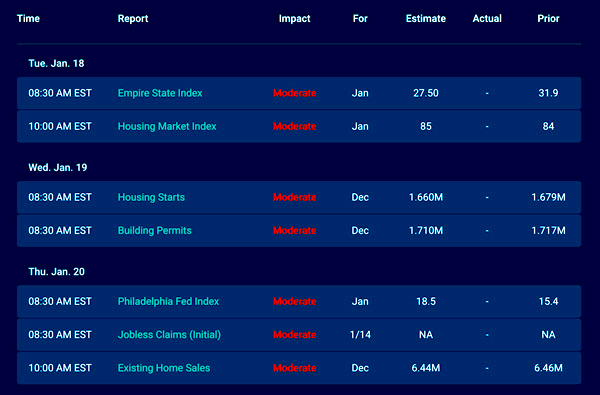

Economic Calendar for the Week of January 17, 2022

A Look Into the Markets

This past week, rates crept to two-year highs, while stocks were able to bounce higher after their recent selloff. Let’s discuss what’s happened this past week and what to watch in the weeks ahead.

Prices are Soaring

“Inflation is at the highest level since the 1980s and is having an overwhelming impact on owners’ ability to manage their businesses.” – NFIB Chief Economist, Bill Dunkelberg

Inflation is the archenemy of bonds and rates. When inflation is low, rates can remain low. The opposite is true. On Wednesday, the Consumer Price Index (CPI), a reading on consumer inflation, showed prices surged 7% year over year in December. The last time inflation rose that high, Michael Jackson released his “Thriller” album, back in 1982!!!

To make matters worse, the Producer Price Index, (a reading on what price increases producers or wholesalers pay) also rose at a scorching 9.7% year over year in December.

What is of concern is these reports are from December or backward-looking. The sharp rise in Omicron cases since mid-December has put millions of people temporarily out of work, causing further supply chain and production issues. Bottom line, we should expect further price increases in the months ahead.

“If we see inflation persisting at high levels longer than expected, then if we have to raise interest more over time, we will, we will use our tools to get inflation back.” Federal Reserve Chairman Jerome Powell.

The Federal Reserve has a mandate, to maintain price stability. Currently, prices are not stable, but are rising and causing problems. The Fed has become “hawkish” and forecasts call for multiple rate hikes once they stop purchasing bonds come mid-March.

It is important to remember that Fed rate hikes do not have a direct effect on mortgage rates, but on short-term loans like credit cards and autos. However, if the Fed can raise rates a couple of times and the economy can comfortably absorb those hikes without a big economic disruption like a slowdown in economic activity, then you should expect long-term rates like mortgages to creep higher.

2022 is looking like 2018 where the Fed was eager to raise rates multiple times and shrink their balance sheet. Back in 2018, mortgage rates increased from 4 to 5%. Upon hitting 5%, home loan activity slowed materially. One would think the Fed learned those lessons back in 2018 and will not allow long-term rates to go too high.

Bottom line: The sentiment in the financial markets has shifted very quickly. The Fed went from a tailwind to a headwind as it relates to rates. If you are considering a mortgage, rates are still suppressed thanks to the Fed bond-buying program which will end in March. Don’t delay.

Looking Ahead

Next week brings a bunch of different reads on housing. 2022 is set to be another banner for housing. The demand for housing remains strong and the labor market continues to grow. Remember that jobs buy homes, not rates. At the same time, we should also expect home loan rates to remain relatively low, further fueling the housing market.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is a 10-yr view of the Fannie Mae 30-year 3.0% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

2022 has a similar backdrop to 2018, where a hawkish Fed raised rates four times and normalized or shrunk its balance sheets of bonds/notes. Back in 2018, mortgage rates crept higher every month from January to November. If the same move plays out this year, now is a great time to lock.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, January 14, 2022)

Economic Calendar for the Week of January 17 – 21

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.