In This Issue…

Last Week in Review: The Good News Flow Continues

Forecast for the Week: Markets to Focus on Fundamentals

The Mortgage Market Guide View: The Importance of an Outdoor Sign

Last Week in Review:

The Good News Flow Continues

This past week, we watched home loan rates tick modestly higher and retreat from three-year lows.

Why?

There are three main reasons:

- U.S and Iran. On Wednesday, the de-escalation of tensions between the U.S. and Iran brought an immediate sense of calm to the financial markets. As a result, Stocks traded to all-time highs at the expense of Bonds and home loan rates.

- Jobs, jobs, jobs. Both the ADP and Jobs Report showed continued health in the labor market. The positive data is good news for the economy and good news for housing. Bonds hate good news, so rates ticked up.

- Improvement in Europe. Germany reported surprisingly stronger economic data, suggesting their economy is on the mend. In response to the good news, German rates ticked higher this week while putting upward pressure on our rates.

Bottom line: home loan rates are within a whisker of the best in three years and near the lowest in the history of our country. Coupled with a strong consumer and housing backdrop, this makes it an incredible time to either purchase or refinance a home.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Markets to Focus on Fundamentals

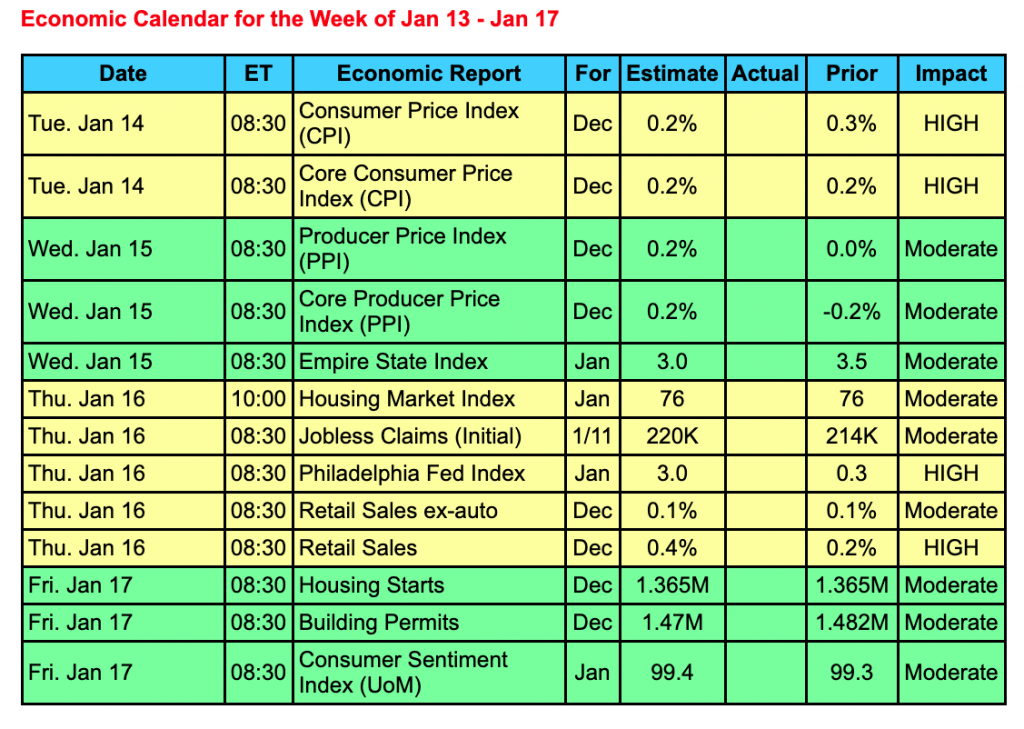

After the past week’s primary focus on the Middle East tensions that quickly faded, the markets in the upcoming week will try to get back to the basics of what’s been fueling the expansion in the U.S. economy… positive economic data, a strong job market, along with solid consumer confidence and spending.

The markets will receive data from the housing sector, consumer spending, manufacturing, and inflation from the consumer and wholesale level.

The phase one trade deal between the U.S. and China is expected to be signed on Wednesday.

Reports to watch:

- Inflation data will be reported from the Consumer Price Index on Tuesday followed by the Producer Price Index on Wednesday.

- From the manufacturing sector, the Empire State Index will be delivered on Wednesday with the Philadelphia Fed Index on Thursday.

- The NAHB Housing Market Index is scheduled for Thursday with Housing Starts and Building Permits on Friday. Consumer Sentiment will also be reported on Friday.

The Mortgage Market Guide View…

The Importance of an Outdoor Sign

Your Outdoor Sign Is Important For a Brick and Mortar Business

If you have a brick and mortar business, having a high-quality sign is as important to your business as a website is to an online business. Having a sign is a valuable part of your advertising and brand marketing strategy. Here are a few tips to help you with your signage.

- Use concise wording. Clearly state the name of your business and what you’re offering. List the hours the business is open, and add any tagline or slogan used throughout all of your advertising. You can add a touch of humor, just don’t go overboard, and avoid political comments.

- Select the correct location. Your sign is a way to visually communicate with people who, what, and where you are. Make sure the sign is where people can see it.

- Follow local laws. Check with the local laws about where you can place your sign, size and color restrictions, and any other local rules or regulations you must follow.

- Make it the right size. A sign that’s too small won’t be seen and may get overlooked, and one that is too big may appear gaudy. In addition, make sure the text balances with the dimensions of the sign.

- Consider a digital sign. Digital advertising is on the rise and you can add this style of advertising by having a digital sign for your business. Check with local laws first.

Work with a respected sign maker who can show you examples of past work, and remember, if you aren’t happy with the sign, change it, as the sign is part of your branding and advertising.

Source: Businestown

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.