In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar

A Look Into the Markets

This past week interest rates improved slightly from concerns of an economic slowdown. Let’s discuss what happened and look into the important news items next week.

Labor Market

“We do not seek or welcome further cooling in the labor market. We do not seek or welcome further cooling in the labor market” – Fed Chair Powell.

This past Wednesday, the JOLTs Report was released, confirming that the labor market is cooling. The headline number, which shows the number of jobs available, declined more than expectations and fell to the lowest level since January 2020, before the pandemic.

Seeing less help wanted signs is the first step to elevated unemployment. If you think about how the labor market cycle works, first you stop hiring, then you may trim hours for some of your employees and if conditions persist then you start reducing headcount. We are moving through this cycle rapidly right now as the unemployment rate has ticked up sharply over the last year.

Adding to the headwind for the labor market are both hires and quits, which are also both at pre-pandemic levels. On the quit side, people are not readily quitting because it’s tougher to find a job. This highlights the softening conditions in the labor market.

Manufacturing Recession

Another sign of economic conditions slowing was our manufacturing index which continues to show contraction. This news would normally be bond-friendly as bonds like bad economic news – but this was offset by a higher price paid component, which is inflationary and bonds don’t like.

2/10 Yield Curve

In the middle of last week and in response to all the bond friendly news, the 2-year Note yield disinverted or moved beneath the 10-year Note yield for the first time since 2022. If this disinversion or positive yield curve remains, there is a rising fear of recession ahead. Currently there seems to be no recession but things can change quickly as we have seen in the labor market.

September Stocks

September has been historically a bad month for stocks, and they are off on the wrong foot again this year as prices crumbled when we returned from the Labor Day holiday on Tuesday. Again, this is from fears of a softening labor market and the reality that the Fed is cutting rates because economic conditions are warranted. It seems that bad news is finally bad news.

It is also important to remember that each of the last two Septembers were also rough ones for the bond markets and interest rates. So, while things are looking pretty good right now, stay in touch with your mortgage professional as this can change quickly.

Bottom line: The trend is our friend as rates are at the lowest levels of 2024 and are threatening to touch the best levels since early 2023. Moreover, the Fed is going to cut rates in a couple weeks and will likely do so again in November and December, if the labor market continues to soften.

Looking Ahead

Next week is the Blackout or Quiet Period for the Fed. This means there are no speeches or comments on monetary policy. That is a good thing. We do have the Consumer Price Index (CPI) inflation reading which has been the biggest market mover for interest rates over the past couple of years. Markets are expecting CPI to come in at 2.6% year-over-year, the lowest since March 2021. We are also going to have another round of Treasury auctions that can move rates sharply.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices are near the best levels of the year and are close to touching the best levels since early 2023.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, September 6, 2024)

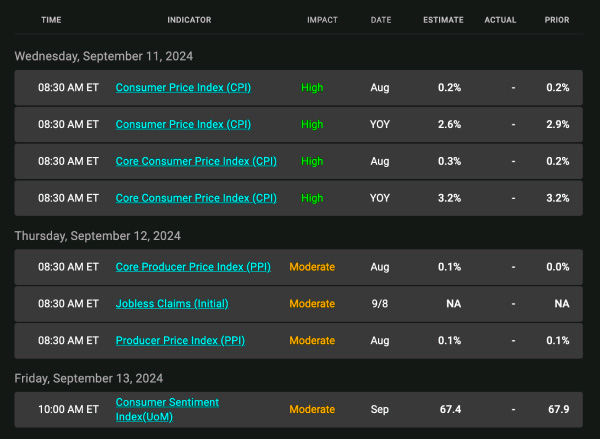

Economic Calendar for the Week of September 9 – 13

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the Newsletter because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.