In This Issue…

Last Week in Review: Bullard Wants More

Forecast for the Week: Jobs Report on Tap

View: How to Stop Phone Call Spoofing

Last Week in Review:

Bullard Wants More

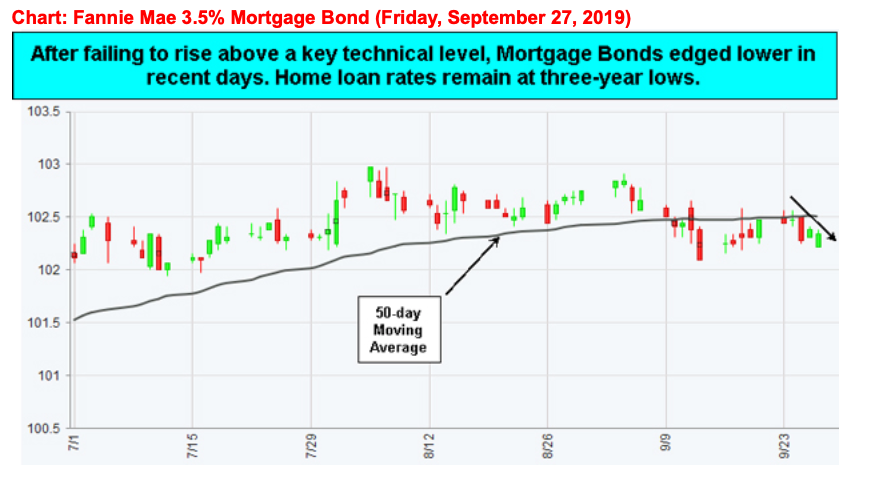

This past week was a classic example of how good news means bad news for Bonds and home loan rates.

A little trade deal with Japan, solid housing numbers, and hopeful news on the U.S./China trade dispute was enough to erase the previous week’s modest improvement in rates.

And on top of it all, Fed President James Bullard was out saying the Fed has to cut rates further, despite the U.S. economy doing well. At the moment there is over a 70% chance the Fed will cut the overnight Fed Funds Rate by .25% by years end.

What homebuyers and those looking to refinance must understand is that Fed rate cuts do not equal lower home loan rates. Fed rate cuts are designed to keep the U.S. economic expansion alive while promoting inflation, and if the Fed is successful in that endeavor, there is a limit to how low home loan rates can go.

On the other hand, if the Fed is unsuccessful and our economy slows further, and our inflation rate cools further, then we will see lower home loan rates in the future. Think bad news is good for home loan rates.

Bottom line: home loan rates have essentially moved sideways to slightly higher in the past few weeks, but still remain just above three-year lows making it a great opportunity to refinance or purchase a home.

If you or someone you know has questions about home loans, give me a call. I’d be happy to help.

Forecast for the Week:

Jobs Report on Tap

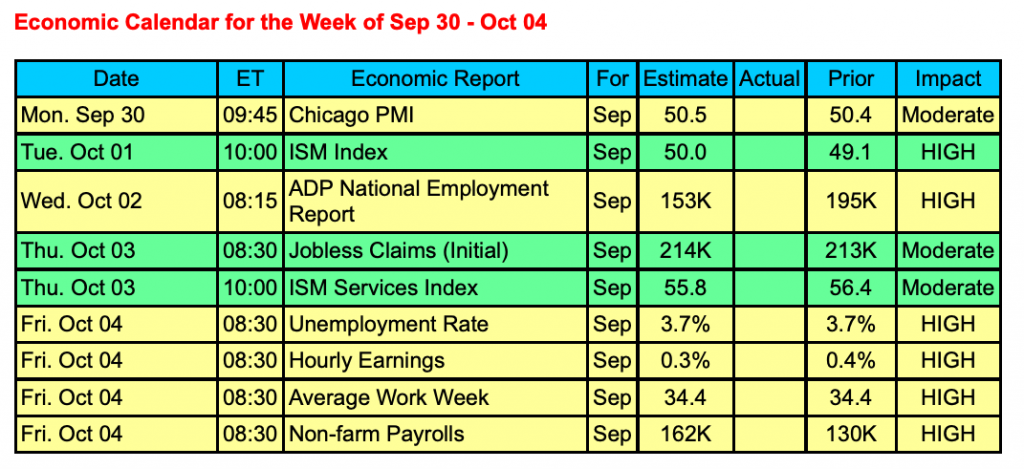

The markets will continue to be impacted by the most important news story to follow, the U.S./China trade negotiations, which have been positive of late. The circus that is Washington, D.C. will also be in focus, while key economic reports may round out what could be a volatile week.

The big report will come on Friday with the government’s Jobs Report for September. How this report goes could impact what the Fed does with interest rates for the rest of 2019.

Several key manufacturing reports will be released as the sector slows under the weight of the tariff issues.

Reports to watch:

Manufacturing data will come from the regional Chicago PMI on Monday followed by the ISM National Manufacturing Index on Tuesday. The ISM Service Index will be released Thursday.

On Wednesday, the first of two labor market reports will be delivered from the ADP Private Payrolls Report.

On Friday, the government’s Jobs Report will be released that covers Non-Farm Payrolls, the Unemployment Rate, and Hourly Earnings.

The Mortgage Market Guide View…

How to Stop Phone Call Spoofing

Telemarketers and scammers have taken advantage of the fact that the FCC is doing little to stop their activities and spoofing business phone numbers as part of their illegal activities. That means it’s up to business owners to take action against the scammers, even though it’s like a game of whack-a-mole. The following are tips to help get relief from phone call spoofing.

First, save an outgoing voicemail that tells callers that they’ve reached your business and explain that the phone number is being used by scammers. Take the opportunity to tell the caller that your business doesn’t engage in illegal activities and encourage the caller to report the call to the FCC even though it won’t do much good.

Now, chances are good that you’re getting these calls on your cellphones. This is annoying and disruptive. Telling the scammer off won’t achieve anything, so take action and block the phone number from calling you. The chances of losing a legitimate customer by blocking their number is very small. Go ahead and block away.

Obviously, legitimate telemarketers have to abide by the national Do Not Call Registry. While this won’t stop a scammer from calling you or using your phone number for spoofing, you can at least get some relief from unwanted telemarketing calls.

Not a whole lot can be done about phone numbers being spoofed as industry leaders and government officials are not taking action. Be empowered and do what you can to block spoofing attempts.

Sources: Better Business Bureau, Turbo Future, FCC

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose. Feature photo by Lora Ohanessian.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.