In This Issue…

Last Week in Review: Stocks and Mortgage Rates Rise

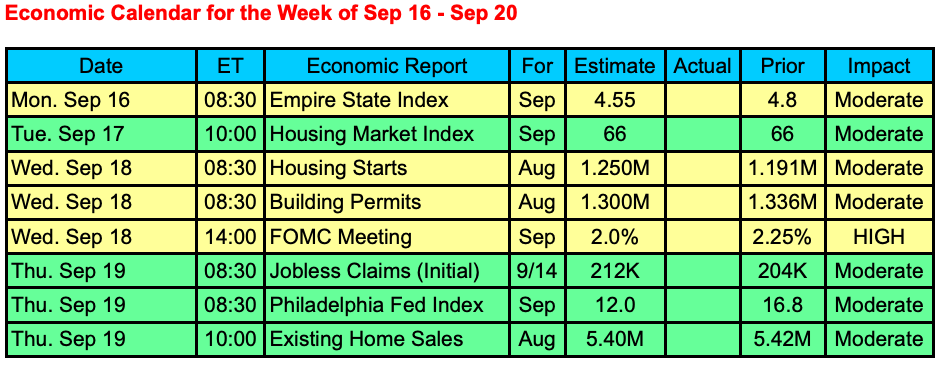

Forecast for the Week: It’s Fed Week

View: How to Avoid Conflicts With Your Co-Workers

Last Week in Review

Stocks and Mortgage Rates Rise

This past week home loan rates ticked up sharply from the previous week leaving many wondering – have rates bottomed?

For would-be homebuyers, real estate agents, and folks working in the housing industry, here are three things affecting home loan rates today and stories to follow in coming weeks and months. Which way these things go will determine the next directional move for home loan rates:

- U.S./China Trade Dispute: In recent weeks both sides have played “nice” with tariffs being delayed by the U.S. and China opening markets. How this story goes, so will global economies, financial markets, and home loan rates. At the moment, there is no bigger story to track.

- Tug of War: The push/pull action between slowing global economies and world central banks is at play. With economies slowing, central banks are cutting rates and introducing new financial stimulus to keep the economic expansion growing. If central banks are successful and economic growth reaccelerates, home loan rates will suffer further. The opposite is also true.

- The “Technical Picture”: It has turned against home loan rates for now. Back on August 5, Mortgage Bonds hit a 2019 price high and have been unable to break above that price, and subsequently slipped lower creating a tough “ceiling of resistance” that Bonds will have to pierce in order for home loan rates to further improve.

Bottom line: The recent uptick in rates could simply be a blip on the radar and we may see home loan rates hit all-time lows in the months ahead. As mentioned, the bullets above will determine what happens next. With rates remaining near three-year lows, would-be buyers and folks looking to refinance should capture the opportunity while at hand because there could be a high cost and risk to waiting for rates to go even lower.

If you or someone you know has questions about home loans, contact Shelia at Synergy Financial Group. We’d be happy to help.

Forecast for the Week

It’s all about the Fed!

Fed members will kick off their scheduled two-day Federal Open Market Committee meeting on Tuesday with the monetary policy statement being delivered on Wednesday afternoon at 2:00 p.m. ET.

The statement will be associated with a Summary of Economic Projections with Fed Chair Powell holding a press conference immediately following the statement release at 2:30 p.m. ET.

It is expected that the Fed Funds Rate will decrease by 0.25% to bring the rate to 2.0%. What is said within the policy statement and what Fed Chair Powell says can potentially impact Stock and Bond prices, yields, and mortgage rates.

Economic data will be abundant in the upcoming week with housing data in the spotlight, but the reports will take a backseat to the Fed meeting and the ongoing headlines out of the U.S./China trade issues.

Throw in the aforementioned tug of war, and we could see more volatility during the week.

Reports to watch:

- Housing data dominates the economic landscape this week with the NAHB Housing Market Index on Tuesday, Housing Starts and Building Permits on Wednesday, and Existing Home Sales on Thursday.

- Regional manufacturing will be seen from the Empire State Index on Monday and the Philadelphia Fed Index will be released on Friday.

The Mortgage Market Guide View…

How to Avoid Conflicts With Your Co-Workers

Work in itself can be stressful. When you mix this stress with conflicts among your co-workers, you’ll notice reduced levels of productivity. You may also hinder your chances of getting a promotion. All workplaces should have open lines of communication where employees feel free to express themselves, but its important that this freedom to share ideas, thoughts, and opinions doesn’t lead to tension. Following certain standards and policies can go a long way in helping you avoid workplace conflict. Here’s a look at two of those ways.

It’s always best to address workplace conflicts sooner rather than later. The longer the conflict stirs up tension among co-workers, the more twisted the whole situation usually becomes because of gossip. Many conflicts start out very small and can easily be resolved before getting out of control, but only if they are addressed as soon as possible.

If you can schedule a face-to-face meeting to resolve the conflict, this will usually work in your favor. Resolving conflicts via email and text often leads to misunderstandings that can possibly make the problem worse. Speaking face-to-face with the person you have a conflict with allows both of you to more accurately assess one another’s feelings due to the ability to decipher both tone of voice and facial expressions.

Use the tips above to keep workplace stress and conflict to a minimum. These tips not only help you maintain high levels of productivity, but they can also be the difference between landing that next big promotion and missing the opportunity.

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.