In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of July 5, 2022

A Look Into the Markets

The Fourth of July, Independence Day or July 4th was first recognized as a federal holiday in June of 1870, but the tradition of the 4th celebrations dates back to the 18th century and the American Revolution. On July 2nd, 1776, the Continental Congress voted in favor of independence, and two days later on the 4th of July, delegates from the 13 colonies adopted the Declaration of Independence, a historic document drafted by Thomas Jefferson. From 1776 to the present day, July 4th has been celebrated as the birth of American independence, with festivities ranging from fireworks, parades, and concerts to the good old-fashioned backyard barbecues.

This past week, some weak economic signals sparked increasing fears of a recession. Let’s walk through what happened and look ahead to next week.

“While the Present Situation Index was relatively unchanged, the Expectations Index continued its recent downward trajectory – falling to its lowest point in nearly a decade. Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by year end.” The Conference Board’s Consumer Confidence Report.

This reading is important because if pessimism begins to negatively affect consumer spending, the chance of a recession will rise sharply as consumer spending makes up two-thirds of our economic growth.

On Tuesday, the third and final reading of 1st Quarter GDP showed the economy shrank by 1.6%, worse than expectations of -1.5%. A recession is defined by two quarters of negative growth. The 2nd quarter is forecasted to barely grow, which means we will be in or close to a recession in the 1st half of 2022.

The silver lining about all this recession talk? It will put a limit to how high rates go. We are two weeks past the 3.49% peak in rates which ironically happened when the Fed raised the Fed Funds rate by .75%.

Bottom line: Long-term rates have stabilized but we should not expect much more improvement until inflation moderates further. With that said, if you are interested in purchasing a home, it remains a great time with rates beneath the rate of inflation.

Looking Ahead

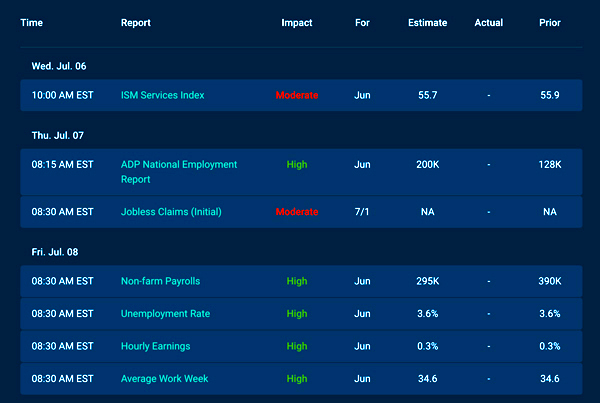

Next week we will receive important employment readings by way of the ADP Report and Jobs Report. The Fed wants to slow down the labor market and we have already seen layoff announcements in corporate America, so we will see if that is reflected in this week’s figures.

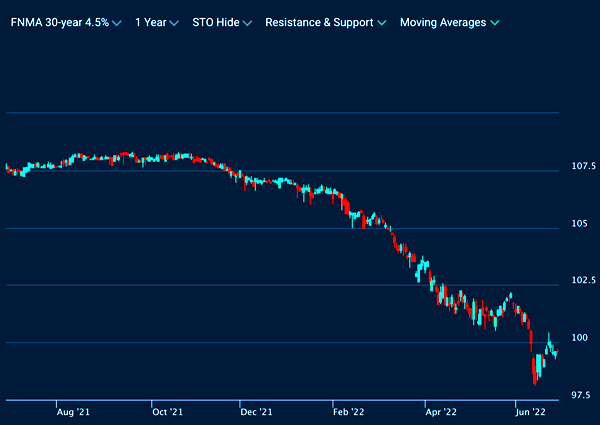

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 4.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

You can see the right side of the chart; prices fell to new 2022 price lows, meaning 2022 rate highs but bounced sharply higher after the big Fed rate hike two weeks ago. Time will tell whether we just witnessed the MBS price bottom and mortgage rate peak for 2022.

Chart: Fannie Mae 30-Year 4.5% Coupon (Friday, July 1, 2022)

Economic Calendar for the Week of July 4 – 8

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.