In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of June 27, 2022

A Look Into the Markets

This past week Federal Reserve Chair Jerome Powell delivered his semi-annual testimony to Congress on Capitol Hill. Let’s walk through what the Chair said and how the financial markets reacted as well.

“At the Fed, we understand the hardship high inflation is causing. We are strongly committed to bringing inflation back down, and we are moving expeditiously to do so. We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses,” said Fed Chair Powell.

Last Wednesday, Fed Chair Jerome Powell was on Capitol Hill as part of the Federal Reserve Act, where the Federal Reserve Board is to submit written reports on “the conduct of monetary policy and economic developments and prospects for the future.”

Aside from the prepared testimony, the question-and-answer session from Congress always provides sound bites that move the market.

After last week’s 0.75% rate hike, the Fed Chair was grilled on the state of the economy, inflation, and the rising threat of recession.

“It’s certainly a possibility, it’s not our intended outcome, but it’s certainly a possibility.” Federal Reserve Chair Jerome Powell on whether Fed rate hikes will tip the economy into a recession.

Hearing of a possible recession, slow consumer demand and lower inflation were not comforting words to the financial markets. So, it was not a surprise to see rates improve in response to these words.

The two-year Treasury yield, which moves in advance of Fed moves, has declined from 3.50% at the recent Fed Meeting to under 3.00%, suggesting the Treasury market doesn’t see the Fed hiking rates as much as they said for fears of a recession.

“There’s really not anything that we can do about oil prices. Inflation was high certainly before the war in Ukraine broke out.” Fed Chair Powell.

This line got a lot of press and is a reminder that the Fed can’t fix headline or energy-based inflation. The two outcomes that can affect oil prices are either more supply or less demand. Oil has declined from a closing high of $124 to $104 per barrel as we head into the weekend. Why? The threat of slower demand caused by rising recession fears. Falling oil prices brings lower headline inflation, which is also good for bonds and rates.

“Overall, it’s a slowing in the housing market, the increase in housing prices to slow pretty significantly.” Fed Chair Powell.

The Fed has said they wanted to remove some of the “froth” out of housing and it’s clear that this has happened. Home price growth had been running at nearly 20% year over year coming into spring but, the recent rise in mortgage rates has slowed that pace of appreciation. We should expect more normal growth rates going forward and possibly some price declines in the near-term. We may also see a continued increase in housing supply as “would be” sellers jump in for the fear of missing out. All of this would be healthy and welcome to the housing market.

Bottom line: Long-term rates might have peaked at the recent Fed Meeting just like they did back in 1994 when the Fed last hiked rates by .75%. With additional homes coming to the market and rates having crested, now is a wonderful time to explore owning real estate.

Looking Ahead: Next week is full of economic reports, with the main event being the Fed’s favored gauge of consumer inflation – The Core Personal Consumption Expenditure (PCE). This report uses a different methodology to gauge inflation as it takes into consideration consumer buying changes. For example, if beef is expensive, the consumer might purchase chicken instead which is reflected in PCE. If this report comes in soft on a month over month basis, like it did last month, it would further help cement a rate peak and may even prompt the Fed to talk less about more rate hikes.

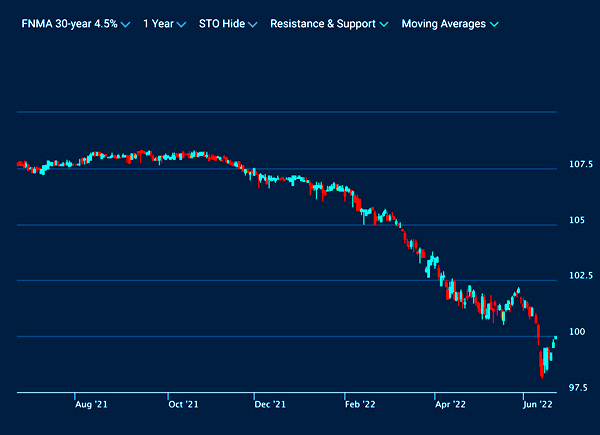

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 4.5% coupon, where currently closed loans are being packaged. As prices move higher, rates move lower and vice versa.

You can see on the right side of the chart, prices fell to fresh 2022 price lows – meaning 2022 rate highs but bounced sharply higher after the big Fed rate hike two weeks ago. Time will tell whether we just witnessed the MBS price bottom and mortgage rate peak for 2022.

Chart: Fannie Mae 30-Year 4.5% Coupon (Friday, June 24, 2022)

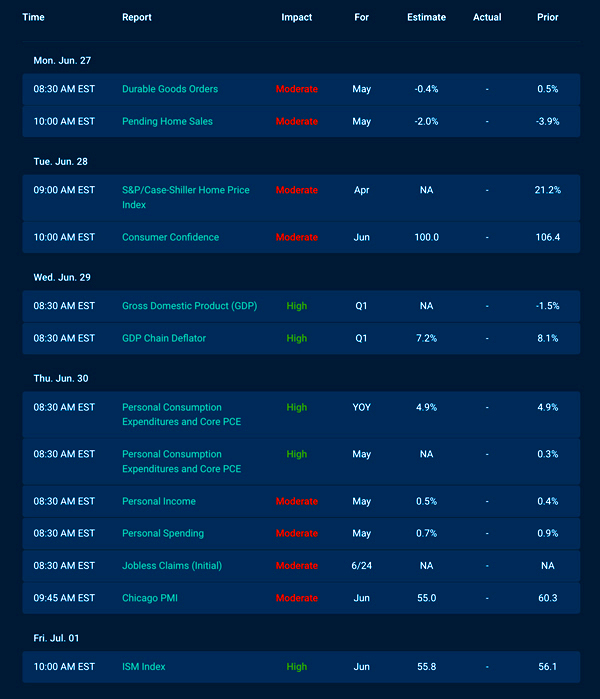

Economic Calendar for the Week of June 27 – July 1

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.