In this Issue…

A Look Into the Markets

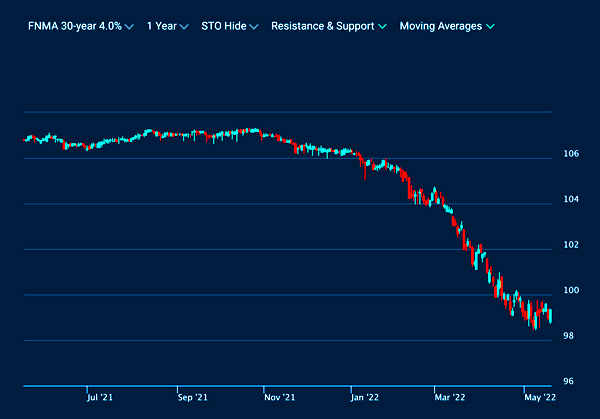

Mortgage Market Guide Candlestick Chart

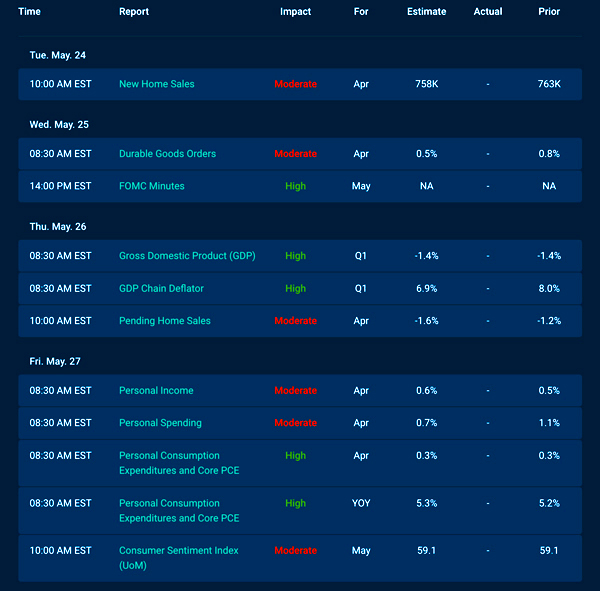

Economic Calendar for the Week of May 23, 2022

A Look Into the Markets

This past week, home loan rates improved slightly in response to growing fears of a recession. Let’s walk through what happened and discuss what to look for in the week ahead.

“What we need to see is inflation coming down in a clear and convincing way, and we’re going to keep pushing until we see that.” Fed Chair Jerome Powell May 17, 2022.

The Consumer is Still Spending

On Monday, Retail Sales for April came in better than expectations, showing the consumer remains a bright spot in the U.S. economy. Despite soaring energy prices, consumers spent on automobiles, restaurants, and travel.

Consumer spending makes up nearly 70% of our Gross Domestic Product (GDP), so we need to see the consumer continue to spend if we want our economy to expand. A tight labor market should help the consumer continue to drive economic growth for now.

Single-Family Housing Starts are Stalling

The National Association of Home Builders reported new single-family house construction stalled in April in response to “weaker confidence in the single-family market, as rising mortgage rates and building material construction costs are driving more potential buyers out of the market,” per Jerry Konter, chairman of the National Association of Home Builders (NAHB).

Overall Housing Starts for April remain steady, thanks to a surge in multi-family dwellings. It’s clear that demand for housing remains strong and the current tight labor market should continue to drive this demand, despite the uptick in rates.

Target Misses Target

“We faced unexpectedly high costs, driven by a number of factors, resulting in profitability that came in well below our expectations, and well below where we expect to operate over time,” said Target CEO Brian Cornell.

Soaring diesel costs and lingering supply chain issues were the main drivers cutting their profit margins. Cornell also shared that Target shoppers are concerned about ‘the high and persistent inflation they’ve been experiencing, particularly in food and energy.’

Shoppers continued to buy daily essentials, but as prices increase, consumers aren’t splurging on bigger-ticket items. This reflects how inflation works, if consumers are paying too much on energy and food, they will not spend money on other items.

In Comes Recession Fears

As mentioned earlier, if consumer spending slows, GDP will decline and if we endure back-to-back negative growth quarters of GDP…that would meet the textbook definition of a recession.

Stocks did not like the reports from Target and other retailers like Best Buy and Walmart and sold off sharply. Also pushing stocks lower is the idea the Fed will hike rates too much and push the economy into a recession, in order to lower inflation pressures.

The selling pressure on stocks came to the benefit of rates as the 10-year yield moved from 3.00% to 2.78% between Wednesday and Thursday.

Bottom line: Home loan rates are showing signs of peaking with rates hovering near current levels over the last month. Uncertainty and volatility around inflation, the Fed, and economic growth will continue to push rates and stocks around. If you are considering a purchase transaction, now is a great time to lock.

Looking Ahead

Next week’s economic calendar brings the Fed’s favored gauge of inflation, the Core Personal Consumption Expenditure (PCE) Index. This will be a very important reading as it is the last PCE report before the Fed’s next meeting on June 15th, where it is widely expected they raise the Fed Fund Rate by .50% to a range of 1.25 to 1.50%. Speaking of the Fed, we will see the Fed Minutes from the May 4th Fed Meeting. History has shown the Fed Minutes could be a market mover.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is a five-year view of the Fannie Mae 30-year 4.00% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

You can see on the right side of the chart, that MBS fell beneath support at price lows last seen in 2018, thereby making a fresh 11-year price low.

With the 10-year yield pulling back from 2018 highs, MBS improving from the May lows, and the aforementioned long-term 10-year trend in place, we may very well be nearing the peak in rates.

Chart: Fannie Mae 30-Year 4.0% Coupon (Friday, May 20, 2022)

Economic Calendar for the Week of May 23 – 27

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.