In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

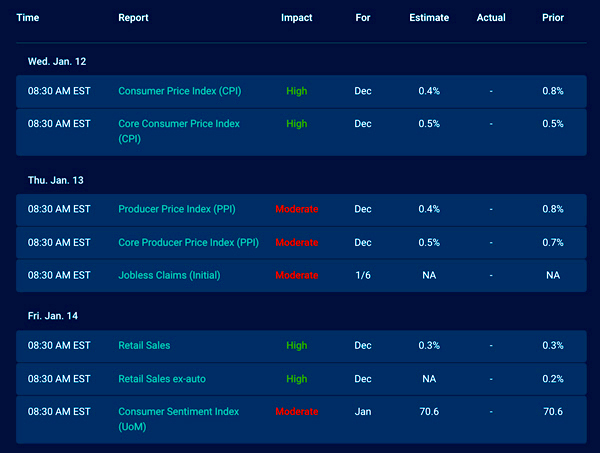

Economic Calendar for the Week of January 10, 2022

A Look Into the Markets

We are only a few days into the new year and are already seeing incredible volatility in the financial markets. The Minutes to the December FOMC meeting were released and stock, bonds, and rates didn’t like what they heard. Let’s discuss what’s happened in this first trading week of 2022 and what to watch for in the days and weeks ahead.

Back to 2018

“Some observed that, as a result, depending on the size of any caps put on the pace of runoff, the balance sheet could potentially shrink faster than last time if the Committee followed its previous approach in phasing out the reinvestment of maturing Treasury securities and principal payments on agency MBS.” FOMC Meeting Dec 2021.

Bonds and stocks hated this note within the Minutes – here’s why. In response to the pandemic, the Fed started purchasing $120B worth of Treasuries and Mortgage-backed securities (MBS) to stabilize the financial markets and help the economy grow. This bond-buying program is currently scheduled to end in March. When this program is over, the Fed will have roughly $9,000,000,000,000 in Treasury Notes/Bonds and MBS on their balance sheet. Yes, the twelve zeros represent $9T – a whopping amount of bonds.

This quote from the Minutes suggests that not only will the Fed no longer be buying bonds to help keep rates low, but they are looking to become a “seller” of bonds as they look to “shrink” their balance sheet. As one could imagine, if the Fed becomes a seller rather than a buyer of bonds, rates will tick higher. The bond market reacted sharply to this idea as MBSs fell to the lowest levels since Feb 2020, before the pandemic and the 10-yr Note yield spiked to 1.75%, the highest in two years.

“The median respondent’s projected timing for the first increase in the target range for the federal funds rate also moved earlier from the first quarter of 2023 to June 2022.”

This line within the Minutes further highlights the Fed’s hawkish tone and it lifted the probability of multiple rate hikes in 2022. The incoming data on inflation and employment will determine if and how much the Fed can hike rates. Remember, Fed rate hikes do not directly affect home loan rates. They affect short-term loans like credit cards, autos, and home equity lines of credit.

However, if the economy continues to be strong and can absorb Fed rate hikes, we should expect long-term rates like home loans to tick up as well. How high could mortgage rates climb?

The current environment looks much like 2018. In that year, the hawkish Fed hiked rates four times and it was the only time the Fed was able to shrink its balance sheet, which they suggested in the recent Minutes. As a result, MBS fell 600 basis points, which led to 1.5% in mortgage rates.

The main difference this time around is that business and consumer sentiment has declined sharply. So, while inflation remains high, and the labor market is tight, people don’t feel as optimistic about the future. This could lead to less economic activity and thwart the Fed’s ability to be as aggressive as they are suggesting.

The current Omicron rise and effect on economies and supply-chains could disrupt Fed policy.

Bottom line: The sentiment in the financial markets has shifted very quickly. The Fed went from a tailwind to a headwind as it relates to rates. If you are considering a mortgage, rates are still suppressed thanks to the Fed bond-buying program which will end in March. Don’t delay.

Looking Ahead

The tone is set. The Fed wants rates higher to stave off inflation threats that are no longer “transitory”. This makes the economic reports very important and next week we will see readings on inflation and consumer spending by way of retail sales. Expect continued volatility. Watch 1.75% on the 10-year Note, which is like the “levee”. If the yield “breaks” above 1.75%, we are likely to see a 2.00% yield quickly.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBSs just fell beneath 2021 price lows and are at the lowest levels in 2 years.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, January 7, 2022)

Economic Calendar for the Week of January 10 – 14

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.