In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of December 27 – December 31

A Look Into the Markets

The financial markets are entering the 2021 Holiday season in a volatile fashion in response to Omicron, Build Back Better fallout, and the threat of Fed rate hikes in the coming year. Let’s discuss what’s happening and look at what to expect in the final week of the year.

1). Fallout from Rapid Omicron Variant Spread

This week Omicron surprised the financial markets by exploding across the US. Despite the uncertainty, stocks attempted to stabilize and shrug off last week’s losses at the expense of bonds.

The financial markets are looking beyond the rapid rise in cases as it appears, for now, most cases are somewhat mild. The markets will continue to watch the response for more restrictions, mandates, and potential shutdowns that will impact economic activity.

“As we look through these cases, literally ripping through the country right now – putting aside the rest of the world, I think we’re finding ourselves where we knew we were going to get to for the past several months and that is that this virus will not be eradicated and we’re going to have to learn to live with it”. NBA Commissioner, Adam Silver.

This quote from NBA Commissioner Adam Silver about why the NBA is not likely to postpone the basketball season sums up what the financial markets are sensing.

2). Build Back Better off the Table, for Now

President Biden’s Build Back Better (BBB) bill is no longer being debated as Sen. Joe Manchin said he is a “no” and will not vote for the legislature. We shall see what happens in 2022 and if a leaner bill comes to pass. If BBB doesn’t pass or is watered down, it does help interest rates in three ways:

- Less bond issuance: The Treasury will not be tasked to issue new bonds to help pay for the plan.

- Less inflationary fears.

- Less economic stimulus.

Some big financial institutions are already out saying that if BBB doesn’t pass, our Gross Domestic Product (GDP) will come in .50% lower. With that said, any further economic slowdown will remove the likelihood of three Fed rate hikes in 2022.

Bottom line: The rise of Omicron has introduced uncertainty, which may soon pass. If you have clients considering a purchase or refinance, now is the time to secure a home loan before we return to pre-pandemic mortgage rates.

Looking Ahead

We will continue to watch the Omicron story develop as well as chatter surrounding BBB and the Federal Reserve’s comments on current conditions. The Fed is set to stop its pandemic-induced bond-buying program by mid-March and potentially raise rates three times. This can change.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The bond bounced off 2021 lows, helping rates modestly improve. If prices remain above those recent lows, mortgage rates will remain at or slightly better than current levels. But a drop beneath those lows will quickly usher in pre-pandemic mortgage rates.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, December 24, 2021)

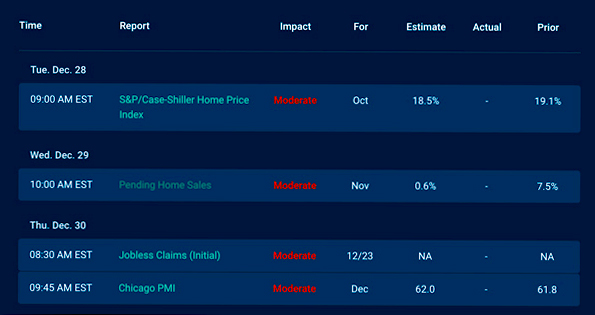

Economic Calendar for the Week of December 27 – 31