In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

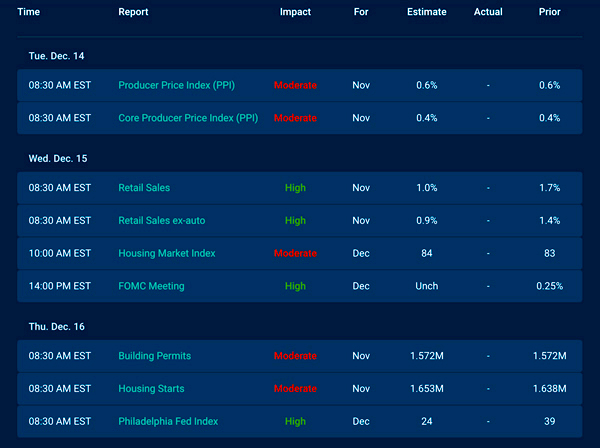

Economic Calendar for the Week of December 13 – December 18

A Look Into the Markets

This past week, mortgage-backed securities (MBSs) moved lower and are trading near 2021 price lows, pushing mortgage rates up near the worst levels of the year. Let’s talk about three things moving the markets and what to look for in the weeks ahead.

1. Omicron Safe Haven Trade Unwinds

The financial markets had panicked in response to the initial Omicron news on fears of rising hospitalizations, deaths, and more shutdowns/restrictions. Stocks fell sharply and bond yields improved, with the 10-yr Note touching 1.34%.

We are awaiting more data, but the initial feedback suggests those who are affected by the Omicron variant are not requiring medical attention or hospitalization. We also learned that Pfizer’s vaccine may also help keep symptoms mild.

In response to this good news, stocks soared higher, erasing all the previous week’s losses and bond yield ticked higher with the 10-yr moving back up to 1.50%.

In addition to looking past Omicron, it appears the financial markets may be looking past COVID on the realization we will continue to see new variants that may produce mild symptoms and not require us to shut down parts of the economy.

2. Quiet Before the Storm

It was a “quiet” week, literally on the Fed front, as no Federal Reserve officials spoke this week in what is the “quiet period” before next Wednesday’s Fed Statement release.

Come next Wednesday at 2 pm ET, things will be far from quiet. When the Federal Reserve delivers its Monetary Policy Statement, we will hear the Fed’s outlook on inflation, the labor market, and the economy.

Most importantly, we will hear whether the Fed will speed up the “tapering” of bond purchases, meaning will they buy even less every month.

Recently renominated Fed Chair Powell was on Capitol Hill and spoke far more hawkishly, where he said it’s probably time to speed up the tapering, so we expect that announcement next week. This move would pave the way for the pandemic-induced bond-buying program to likely end sometime in Spring 2022, rather than June 2022.

This is an important move by the Fed because it also paves the way for a potential rate hike earlier in 2022. The recent hawkish tone by the Fed was another big reason for stocks to sell-off recently. We shall soon see what the Fed says and does next week and how the financial markets react.

It is worth reminding here that Fed rate hikes do not affect mortgage rates. Once the Fed does hike rates, it impacts short-term rates like credit cards, auto loans, and home equity lines of credit.

3. Mixed Labor Market Picture

“Promoting maximum employment” is part of the Fed’s dual mandate. The labor market has been giving us mixed signals of late. Our unemployment rate has fallen to 4.2% which is the lowest since the pandemic began, but our Labor Force Participation Rate (LFPR) remains stubbornly low and at levels last seen in the 1970s.

The LFPR is an important figure as it tells us how many people over the age of 16 and not in the military are either working or actively looking for a job.

The Fed recently said they want to see “maximum participation” before hiking rates. At the moment, we are not seeing any meaningful improvement in LFPR, so it will be interesting to see what the Fed says next week and if they touch on “participation”.

The unemployment line is certainly short…Initial Jobless Claims, people who first file for unemployment, came in at 185K. This is a low number and highlights how easy it is to get a job.

How easy is it? We have 6.5M people unemployed and over 11M jobs available. Anyone looking for a job can easily find one and likely command higher pays, hence the reason we are seeing a record amount of job quitters.

Bottom line: The improving labor market will continue to support housing into 2022 and beyond. At the same time, rates are ticking up as the Fed threatens to buy fewer bonds. Now is a wonderful time to lock in a home loan before we see pre-pandemic rates.

Looking Ahead

There is nothing more important than next week’s Fed Meeting. In addition to the Fed Statement at 2 pm ET Wednesday, Fed Chair Powell will host a press conference at 2:30 pm ET. You never know what the Fed Chair will say or how the markets will react, but we should expect high volatility in stocks, bonds/rates.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The bond bounced off 2021 lows, helping rates modestly improve. If prices remain above those recent lows, mortgage rates will remain at or slightly better than current levels. But a drop beneath those lows will quickly usher in pre-pandemic mortgage rates.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, December 10, 2021)

Economic Calendar for the Week of December 13 – 17

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.