In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of December 6 – December 10

A Look Into the Markets

This past week, we watched mortgage-backed securities (MBSs) bounce higher off 2021 price lows, helping home loan rates modestly improve from their worst levels of the year. Let’s talk about three things moving the markets and what to look for in the weeks ahead.

1. Fed Chair Throws Towel in On Inflation

I think it’s probably a good time to retire that word (transitory) and try to explain more clearly what we mean,” Fed Chair Powell 11/30/21.

On Tuesday, Fed Chair Jerome Powell and Treasury Secretary Janet Yellen, were on Capitol Hill providing the Senate and House their semi-annual testimony on the state of the economy and monetary policy.

In this setting, politicians push with tough questions, and it was here where Fed Chair Powell “folded” and seemed to have completely flip-flopped on the outlook for inflation. For months, Mr. Powell was steadfast saying that the increases in prices were “transitory” or short-lived in nature and that supply chain bottlenecks would likely be relieved sometime mid-2022.

This “retiring” of transitory is a big change for the Fed and it means a few things. One, the Fed has finally acknowledged that the increase in prices we are seeing is not going to be temporary and cool down in mid-2022. It also means the Fed must change its position as it relates to inflation because its mandate is to maintain price stability.

The surprising inflation outlook change and hawkish tone shook the financial markets, with stocks dropping to the benefit of bonds/rates.

2. When the Fed Becomes Hawkish

“At this point, the economy is very strong and inflationary pressures are higher, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner” – Fed Chair Jerome Powell – 11/30/21.

In another surprise move, one week after being renominated, Fed Chair Powell told the world that at the December Fed meeting, they may likely announce quickening the pace of the bond taper to end sometime in the Spring of 2022.

The main reason for this new hawkish tone and to speed up the taper is to make way for a Fed Rate Hike, which the markets expect to happen by July 2022.

It’s probably a good time to remember that Fed rate hikes have no direct impact on home loan rates. Fed rate hikes impact short-term rates like auto loans, credit cards, and home equity lines of credit. However, if you look at why the Fed is hiking rates, it is to help lower inflation and cool off economic growth. Both of those help long-term bonds like mortgage-backed securities.

The hawkish Fed action of stopping bond-buying and hiking rates, also strengthens the US Dollar versus other currencies, thereby lowering import prices and commodity prices like oil, etc. All of which are disinflationary and helpful to long-term rates.

3. Omicron Uncertainty

A new Covid variant, Omicron, emerged with its first case in the US. Initially, the stock market tanked, and interest rates improved on the rumors, chaos, and uncertainty surrounding the new variant.

It will take a couple of weeks before we have more data and insights, but at first glance, it appears the cases are mild, which if proven true, would be very good news as we head into winter. Remember stocks like good news, bonds/rates hate good news.

In the weeks ahead, we will also have to see the response by the Federal government and States. More restrictions and mandates create uncertainty and negatively impact economic activity, all of which hurt stocks and help rates.

Bottom line: The Fed just completely shifted its position from dovish to hawkish. The speeding up of the taper and growing likelihood of rate hikes, means we are likely to experience more volatility in the weeks and months ahead. If you have clients considering a purchase or refinance, now is the time to secure a home loan before we return to pre-pandemic mortgage rates.

Looking Ahead

In addition to the Fed and Omicron, the big story over the next couple of weeks is the debt ceiling and Build Back Better debates. The government wants to spend money – “a whole lotta spending money”. How these negotiations go will have an impact on the economy and financial markets.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The bond bounced off 2021 lows, helping rates modestly improve. If prices remain above those recent lows, mortgage rates will remain at or slightly better than current levels. But a drop beneath those lows will quickly usher in pre-pandemic mortgage rates.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, December 3, 2021)

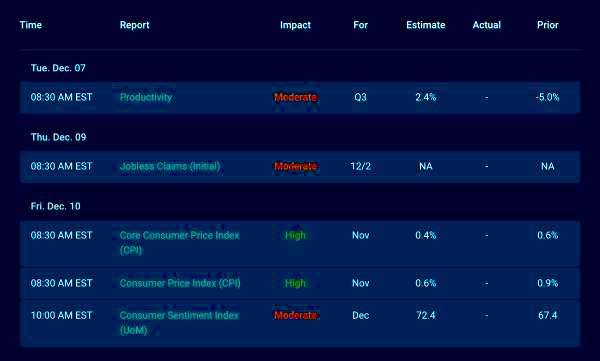

Economic Calendar for the Week of December 6 – December 10

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.