In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of November 15 – November 20

A Look Into the Markets

This past week, we watched mortgage-backed securities (MBSs) touch their highest level since late September, meaning the lowest home loan rates. But the good vibes and rate improvement were quickly halted as prices hit key technical barriers. Let’s break down what happened, take a look at an important chart and the week ahead.

1. Global Yields Decline

The bond market is global. Meaning there are investors all over the planet in search of yield. So, when these investors look around the globe and see negative-yielding rates throughout many bond markets, it makes our anemic 10-yr Note yield, presently at 1.48%, look attractive. Our low, but outperforming yield, will always attract capital from around the globe and is a major reason why we haven’t seen or likely will see a material increase in rates.

This past week rates around the globe moved lower, which pulled our 10-yr Note lower, which in turn helps MBS prices move higher and home loan rates lower. In Germany, their 10-yr Bund moved from – 0.10% to – 0.30% on the notion the European Central Bank will not be hiking rates anytime soon.

There is about a 165bp spread between the German Bund and our 10yr Note which at times narrows and widens but is a reliable figure over the long term. So, when there are problems in Europe and the Bund declines, we often see a similar decline in our yields. The opposite is true.

2. High Inflation Persists, Bonds Don’t Care…for now

Inflation is the archenemy of bonds, or so we are taught in economics. Generally, as inflation rises, interest rates must rise to compensate investors for the additional cost of inflation. Today, investors are not being compensated for the negative effects of inflation when purchasing a long-term bond like the 10-yr Note.

The Consumer Price Index (CPI) was delivered on Wednesday. It showed overall consumer prices, which included energy and food, were up a whopping 6.2% year over year, the fastest pace in 31 years.

Inflation this high makes the 10-yr Note, yielding 1.48%, a horrible investment. Who would buy such a bad investment? For one, foreign investors, who are familiar with negative yields. Our Federal Reserve is also a big buyer of our Treasuries every month.

There is a big debate whether high inflation will be transitory. One thing to watch closely is whether inflation expectations are rising. If inflation expectations rise, meaning – if people think or feel prices will rise, they will.

Right now, inflation expectations for the next 10 years are running at 2.63%, the highest in decades. If this number goes higher, it will put pressure on the Fed to speed up their bond tapering program and ultimately hike rates.

3. Technicals Matter

After a sharp decline in rates over the past couple of weeks, many ask, where is the bottom? This is where the charts and technicals can be incredibly important. The 10yr Note and the German 10-yr Bund rate decline stopped right at its 200-day Moving Average.

For rates to move beneath this important moving average, it may take bad news which bonds like. At the moment, with inflation rising to the highest level in 31 years, it may be difficult for rates to improve much, if at all from here.

Bottom line: Home loan rates have made a marked improvement over the past couple of weeks. But tough technical levels and another hot inflation reading may limit further rate improvement. If you are considering a home loan, now is an incredible time to capture the lowest rates in the next couple of months.

Looking Ahead

The big themes to follow over the next few weeks will be the debt ceiling and Build Back Better Framework debates. We are going to see Retail Sales and Housing numbers next week as well.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

Bonds made an impressive price bounce off the lows of 2021, helping mortgage rates improve. The improvement ended as prices neared their 200-day Moving Average. To see further home loan rate improvement, the Bond will have to break above this tough ceiling. Higher inflation expectations may prevent this from happening.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, November 12, 2021)

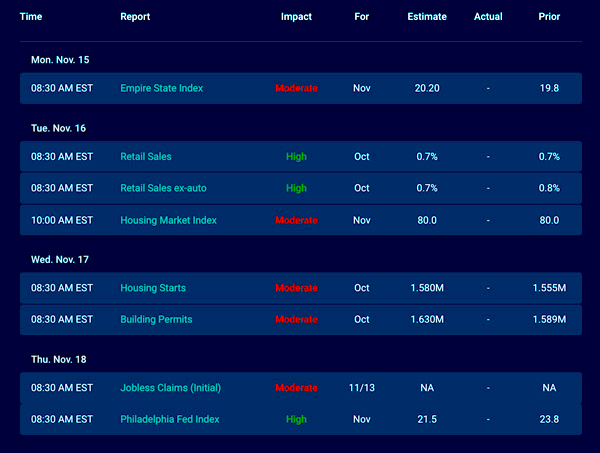

Economic Calendar for the Week of November 15 – 19

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.