In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of October 18 – October 22

A Look Into the Markets

Interest rates ticked up just slightly week over week. However, we might have seen a near-term peak in rates. Let’s break down what happened and talk about what to watch for next week.

“The Tide is High, but I’m Holding On” … Tide is High by Blondie

1. Inflation Remains High

The Consumer Price Index (CPI) for September showed prices are remaining persistently high and challenging the Fed’s notion it will be “transitory”.

CPI showed prices climbed 5.4% year over year, matching the hottest pace in 30 years. The more closely watched Core CPI, which strips out food and energy costs, rose 4.0% year over year. The Federal Reserve has the mandate to maintain price stability (inflation). The Fed’s inflation target is to have core consumer prices run at 2 to 2.5% over the long run, so seeing prices running at nearly double that level is a concern if it is not transitory.

Inflation can increase when people “expect” to pay more. At the moment, both 5-yr and 10-yr inflation expectations are matching the highest levels of 2021. If those inflation expectations rise further, it will put upward pressure on rates. The opposite is true.

2. Fed Minutes Reveal the Taper Plan

Last Wednesday, the Minutes from the previous Fed meeting were released. This is where we get to read the dialogue amongst Fed members and their thoughts on the economy and monetary policy.

The most important takeaway was Fed Members agreeing to a timetable and plan to taper or scale back bond purchases. Here’s what the Fed said back in September:

“The illustrative tapering path was designed to be simple to communicate and entailed a gradual reduction in the pace of net asset purchases that, if begun later this year, would lead the Federal Reserve to end purchases around the middle of next year. The path featured monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities (MBS)”. This is a very gradual scaling back of purchases. It is also important to remember that the Fed will continue to buy bonds daily during and after the taper, with proceeds from their existing portfolio, so this truly is a “scaling” back and not an end to bond buying.

“Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.” It’s clear the Fed will likely start buying fewer bonds this year.

3. The Cure for Higher Rates is Higher Rates

There were some signs that mortgage-backed securities (MBS), Treasuries, and even bonds abroad hit rate peaks – highlighting that at some point, higher yields attract investors.

For instance, Tuesday, there was a big 10-year Note auction that showed very high buyer demand. MBSs, on Wednesday, hit the lowest levels since March, but then bounced sharply higher…more on this subject below.

Lastly, the German 10-yr Bund touched – 0.08% on Wednesday, which matched the highest yield in over 2 years. Since that time, the Bund yield continued to decline and is currently at – 0.18%. As yields decline abroad, it puts downward pressure on our yields.

Bottom line: We are watching to see if rates might have peaked in the near term, despite persistently higher inflation and the likelihood of the Fed tapering this year. If you are considering a home loan, now is the time because if inflation does march higher and longer than expected, rates will be pressured above current levels.

Looking Ahead

Next week is a bit lighter on data with just housing reports being in the spotlight. The ongoing debt-ceiling and spending debates will continue to create market ripples for the next several weeks.

The bond market remains in price discovery mode as yields try to stabilize and price in where inflation and the economy are headed. This means we should expect continued volatility in the weeks and months ahead.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The bond bounced off support at $99.50, the price lows of 2021. If this support continues to hold, we may see bonds and rates modestly improve. However, should the bond fall beneath this important floor, we will likely revisit pre-pandemic rates.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, October 15, 2021)

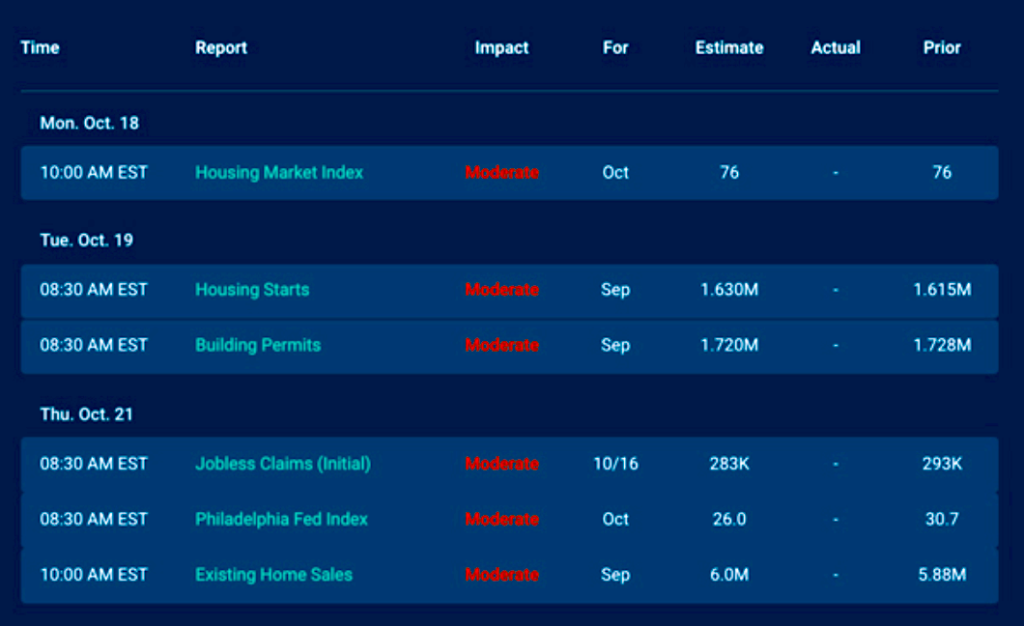

Economic Calendar for the Week of October 18 – 22

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.