In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of October 11 – October 16

A Look Into the Markets

Interest rates ticked up last week as the financial markets continue to endure a tug of war between Fed tapering bond purchases, uncertainty behind the debt ceiling and $5 trillion in new spending bills. Let’s talk about what is happening and what to watch for in the weeks ahead.

“Babe I’m leaving, I must be on my way” – Babe by Styx

1. Employment Situation Improves Enough for the Fed

“I don’t personally need to see a very strong employment report, but I like to see a decent employment report”… Jerome Powell’s Fed Meeting Press Conference Sept 22, 2021.

At the last Fed Meeting, Chair Jerome Powell led the markets to believe that further improvement in the labor market would be enough for the Fed to announce they would taper bond purchases at the next Fed meeting on November 3rd.

This past week, the incoming data showed a “decent” employment situation with the ADP report coming in higher than expectations and the unemployment rate declining to 4.8%.

This news may be enough for the Fed to taper or scale back bond purchases and go from $120 billion a month to zero by mid-2022.

It’s not fully clear how this will impact interest rates longer-term but, seeing a big buyer of Treasuries and mortgage-backed securities stop buying may cause a continued uptick and volatility in rates in the near term.

2. Kick the Can on the Debt Ceiling

Congress appears to have agreed on a measure to allow the government to meet its current debt obligations until December 3rd. This doesn’t fix the bigger negotiation of raising the debt limit, but it does give Congress a few more weeks to figure things out.

Bond-rating firms are watching the debt ceiling negotiations and discussions on new spending. There is a threat that our debt could be downgraded, like it was back in Aug 2011 during a similar ugly debt ceiling debate. Should that event come to pass, it would be disruptive to the financial markets.

The debt ceiling debates are not over, rather just beginning. But if history is any gauge, we should expect a deal to be made. It will just be ugly to watch and likely happen at the 11th hour.

3. Spending Bill Debate

In addition to lifting our debt ceiling, Congress is in the midst of another heated debate – two monster spending bills totaling nearly $5 trillion. The House has set a date of October 31st as a deadline to vote on this new spending bill, as they attempt to gather the votes required for passage.

The financial markets get a sense that the $5 trillion spending bill will get brought down in negotiations and a smaller plan might very well be good for the bond market and interest rates. Here are four positive effects for bond/rates with less spending:

Less bond issuance

Less economic stimulus

Less inflationary pressures

Less downward pressure on the U.S. Dollar

Bottom line: What were tailwinds for the bond market – covid uncertainty, Fed bond-buying, and more – have now become headwinds … meaning it is likely to put continued upward pressure on rates in the near term. If you or someone you know is considering a mortgage, now is the time.

Looking Ahead

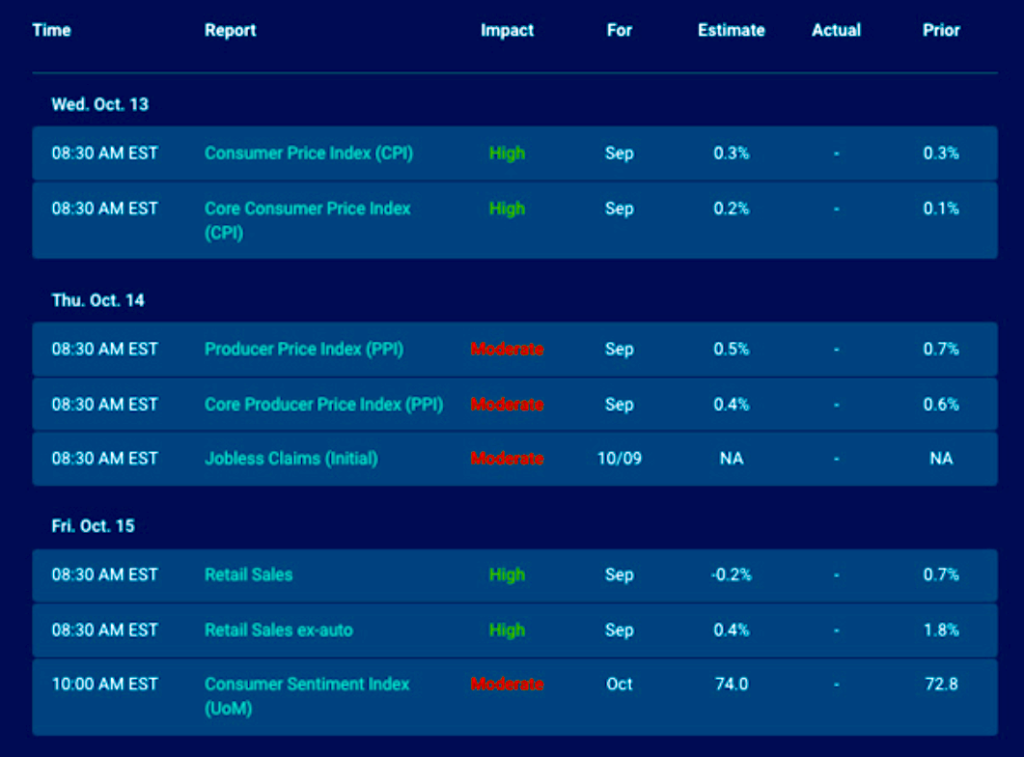

Next week is a short week with Monday closed for Columbus Day. Then things heat up with important inflation readings by way of the Consumer and Producer Price Index. Retail Sales will provide a gauge on consumer spending, which makes up two-thirds of our Gross Domestic Product (GDP). Lastly, the Treasury will sell a boatload of new Treasuries with the bellwether 10-year Note being the highlight. The market will be focused on the buying appetite of the 10-year Note, now that it is clear the Fed will be buying fewer bonds in the near future.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

The bond is trying to hold onto support at $100. If that holds, we may see prices, bonds and rates modestly improve. However, should the bond fall beneath this floor, we will likely revisit the highest rates of 2021 and threaten to move higher still.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, October 8, 2021)

Economic Calendar for the Week of October 11 -15

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.