In this Issue…

A Look Into the Markets

Mortgage Market Guide Candlestick Chart

Economic Calendar for the Week of October 4 – October 9

A Look Into the Markets

Interest rates have ticked up the past 10 or so days after the Federal Reserve told the financial markets there is broad support to scale back bond purchases and finish those purchases by mid-2022. Let’s talk about three “other” things moving the market between now and the next big Fed Meeting on November 3rd.

1. Debt Ceiling Debate

“We now estimate that the Treasury is likely to exhaust its extraordinary measures if Congress has not acted to raise or suspend the debt limit by October 18” – Treasury Secretary, Janet Yellen.

It’s that time again. Our country needs to borrow more money to help offset the enormous amount of federal spending now and into the near future. To pave the way, Congress must raise the debt ceiling. This measure is nothing new. We have raised the debt ceiling over 15 times in this century alone.

Like most things in Congress, it’s never a pretty process to watch and the past has shown some messy debt ceiling debates which did turn into some crises…but the limit was always raised.

In this politically charged environment, we should expect a lot of chaos and uncertainty as this process moves forward. Normally, chaos and uncertainty would help bonds, but they have not yet as the anticipation of the Fed tapering bond purchases remains an upward pressure on rates.

Note – Congress came to agreement on a stop-gap measure which will fund the government until December 3rd.

2. Infrastructure Spending Debate

On top of the debt ceiling debate, Congress is trying to push through $5T worth of spending through two different bills. It is not clear if and what will get passed. The plans do have an impact on rates and future Fed Reserve policy.

If any of the plans come to pass, the Treasury Department will have to issue new bonds to pay for the plans. Meaning, investors in the bond market must buy even more Treasuries each month than what is available today. This additional bond issuance can weigh on bond prices and cause an uptick in rates.

Should the entire $5T or so get passed, the Federal Reserve, which has been buying $120B in bonds every month to help keep rates low, may be forced to do more buying in the future. Otherwise, how can the US afford an uptick in rates with $29T in debt and growing? Someone must buy our debt.

3. Home Prices Record Rise

The Case Shiller Index showed home price rose 19.7% in July, a fourth consecutive record of home price gains. This kind of rapid growth is unsustainable and this “froth” in the housing market is the very reason why the Fed is being pressured to taper bond purchases, especially the purchases on the mortgage-backed security side.

An increase in rates would likely slow the price appreciation in homes. What is not clear is how it would affect affordability and overall demand over time.

Bottom line: We are now just a few weeks away from the next Fed Meeting and, at the moment, their policy response is the main driver of long-term rates. Should the Fed announce taper, rates may rise further. The opposite is true. Now is the time for folks to lock in long-term rates as a real threat of higher rates exists.

Looking Ahead

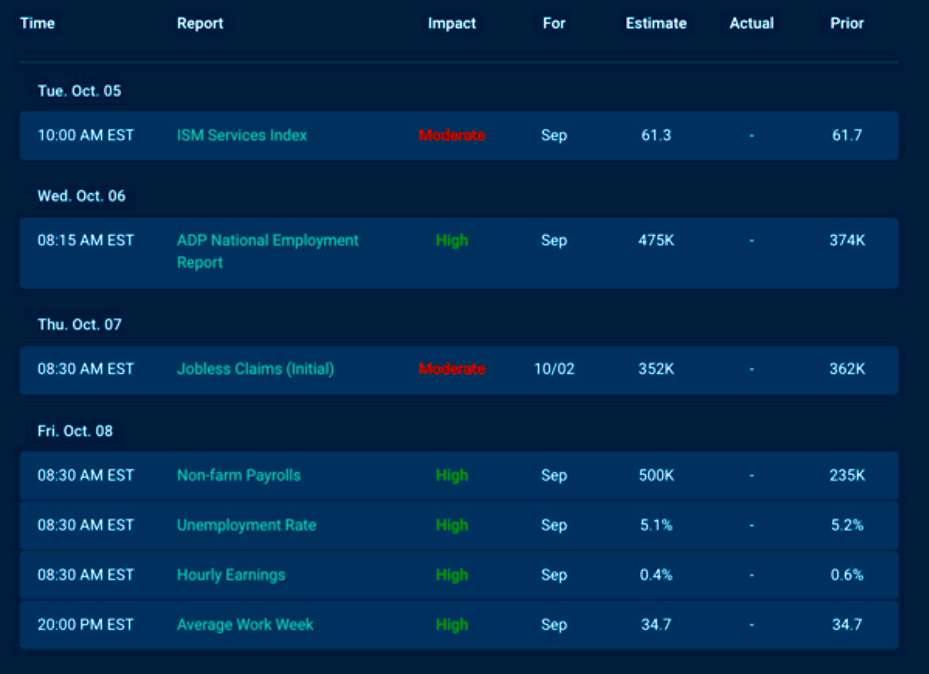

Next week is Jobs Week and is likely the final piece of the puzzle for the Fed to announce tapering or not. If Wednesday’s ADP and Friday’s Jobs Report show solid progress in job creation, the Fed will likely announce they will start scaling back bond purchases. On Nov 3rd, they were clear about this at the Fed Meeting less than 2 weeks ago. BUT – if job creations come in light, the Fed may hold off for another day.

Mortgage Market Guide Candlestick Chart

Mortgage-Backed security (MBS) prices are what determine home loan rates. The chart below is the Fannie Mae 30-year 2% coupon, where current closed loans are being packaged. As prices go higher, rates move lower and vice versa.

Bonds are trying to hold onto support at $100. If they hold, we may see bond prices and rates improve modestly. But, should bonds fall beneath this floor, we will likely revisit the highest rates of 2021 and threaten to move higher still.

Chart: Fannie Mae 30-Year 2% Coupon (Friday, October 1, 2021)

Economic Calendar for the Week of October 4 – 8

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services, and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors. As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you. Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features, or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

We are ready to help you find the best possible mortgage solution for your situation. Contact Sheila Siegel at Synergy Financial Group today.